In the year 2021, the social media giant Facebook rebranded itself as Meta Platforms Inc. (META), signaling a shift towards its long-term goals in the metaverse. Despite ongoing work on this project, over the past two years, Meta’s advancements in artificial intelligence (AI) have emerged as its top priority. This tech titan is taking bold steps, and if circumstances align favorably, these ventures could yield remarkable returns over the next five years and beyond. Let me explain why Meta Platforms might potentially double investors’ initial investments by the end of 2030.

Meta Platforms is sparing no expense

Meta Platforms is pouring substantial funds into its aspirations for artificial intelligence (AI). They’ve declared their intention to establish AI data centers, a project they estimate will require investments in the hundreds of billions. In addition, Meta Platforms has made strategic moves such as purchasing Play AI, a company specializing in creating realistic voices through AI technology. The specific financial aspects of these transactions remain undisclosed.

In other locations, Meta Platforms strengthened its collaboration with EssilorLuxottica, a company that owns brands like RayBan and Oakley, known for their eyewear products. For years, Meta Platforms and EssilorLuxottica have been working in tandem, but the latest investment, approximated at around $3.5 billion, elevates their partnership to unprecedented heights. Additionally, Meta Platforms has been actively recruiting top AI specialists from rival companies, such as OpenAI.

What potential benefits might Meta Platforms derive from its AI investments, given its vision for AI technology? Mark Zuckerberg, the CEO, anticipates that AI glasses could become a significant force in the industry within the next five to ten years. While his prediction may seem overly optimistic, it’s important to note that Meta’s collaborative AI glasses with EssilorLuxottica boast advanced capabilities. These smart glasses can be operated by voice commands, capture images and videos, and allow users to share their real-time views during WhatsApp video calls.

Unlike Llama, Meta’s advanced language model, Meta Platforms didn’t provide it for free. Developing Llama was not a cost-free endeavor for them either.

The company intends to entice skilled programmers to enhance and perfect their LLM project, with the goal of ultimately becoming the top choice on the market. As Llama plays a key role in powering several of the company’s AI projects, such as Meta AI and its virtual assistant, this approach could potentially bring about beneficial impacts across all these related endeavors over time.

Revenue and earnings could double by 2030

Meta Platforms’ AI initiatives are set to bolster their advertising sector, which accounts for most of their sales. The company aims to automate ad creation and launch, potentially driving up ad demand and subsequent income for Meta. With an expansive user base of approximately 3.43 billion daily active users at the end of Q1, Meta Platforms’ sites and apps continue to be highly sought-after advertising destinations by businesses aiming to reach a vast audience.

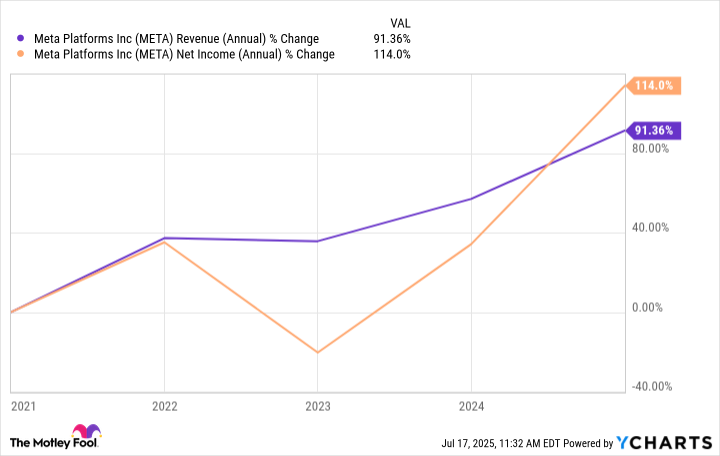

Additionally, Meta Platforms has boosted user interaction on its applications due to AI-enhanced suggestion systems. The firm’s operations have undergone a significant transformation because of AI, leading to increased efficiency and numerous profitable prospects throughout its business. Over the next five years, it is likely that Meta Platforms’ income and profits will double, as they came very close to achieving this growth in the previous five-year period.

Despite challenges posed by President Donald Trump’s trade policies, which have affected ad demand from certain Asian companies, Meta Platforms, Facebook’s parent company, can still achieve its objectives, given its keen focus on AI and numerous expansion opportunities. In the first quarter, Meta Platforms demonstrated robust results. Moreover, it now offers dividends to shareholders. By buying the stock today and enabling automatic dividend reinvestment, you could potentially see returns that would double your initial investment by the end of 2030.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-07-22 03:22