Nvidia, Microsoft, and Apple. Together, these tech giants boast a staggering market capitalization of approximately $11 trillion.

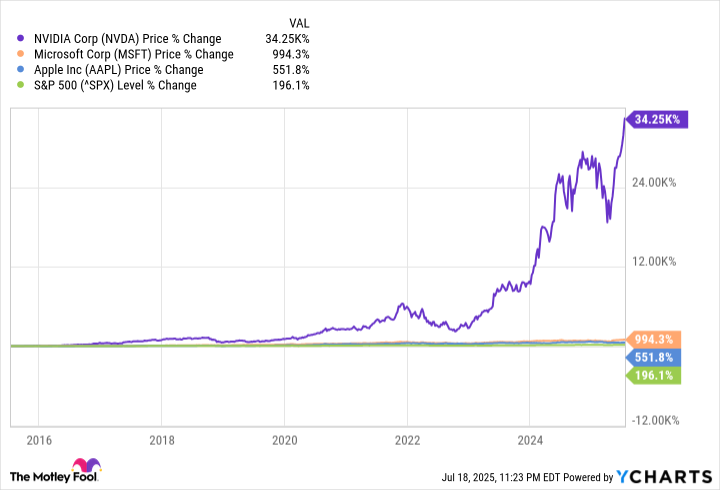

They have each obliterated the return of the S&P 500 over the past decade:

Investors who don’t own the top three tech giants might find their portfolios lagging behind the overall market. Yet, it’s important to note that these aren’t the only successful stocks within the Information Technology sector, and a straightforward method exists for purchasing multiple high-flyers in this category.

The Vanguard Information Technology ETF, referred to as VGT, is a type of investment fund called an exchange-traded fund (ETF) that focuses solely on investing in stocks from the technology sector. Since its launch in 2004, it has consistently outperformed the S&P 500 annually on average, and it’s predicted to do so again by 2025.

The world’s most dominant tech stocks packed into one low-cost ETF

The Vanguard ETF doesn’t just focus on information technology stocks within the S&P 500; rather, it invests broadly across the entire sector, encompassing a diverse range of 319 stocks from 12 different sub-categories such as semiconductors, systems software, and application software.

The semiconductor sector holds the largest share at approximately 30.4%, a fact that’s not unexpected given the crucial role of data center hardware in the current surge of artificial intelligence (AI). Companies like Nvidia have seen their market value soar to over $4.2 trillion due to the high demand for their data center chips, and even Broadcom has joined the league of trillion-dollar corporations by capitalizing on sales of AI hardware.

AI plays a significant role across the entire tech industry, and it’s evident in the Vanguard ETF as well. In fact, the top 10 holdings within this ETF (which make up 58.8% of its total value) are all actively involved in the artificial intelligence race.

| Stock | Vanguard ETF Portfolio Weighting |

|---|---|

| 1. Nvidia | 16.74% |

| 2. Microsoft | 14.89% |

| 3. Apple | 13.03% |

| 4. Broadcom | 4.57% |

| 5. Oracle | 2.05% |

| 6. Palantir Technologies | 1.64% |

| 7. Cisco Systems | 1.58% |

| 8. International Business Machines | 1.56% |

| 9. Salesforce | 1.47% |

| 10. Advanced Micro Devices | 1.31% |

Among Nvidia’s major clients are Microsoft and Oracle, who manage an expanding network of data centers equipped with numerous AI processors. They lease out their computational power to various businesses and developers for financial gain. It is worth noting that Microsoft has also emerged as a significant player in AI software development, largely due to its Copilot virtual assistant, which is incorporated into popular products such as Windows, Office 365 (Word, Excel, and PowerPoint).

Apart from being a significant player in the AI software industry, Palantir functions through three primary platforms: Gotham and Foundry assist businesses and governments in deriving useful information from their data, while AIP facilitates the seamless incorporation of AI within routine tasks. Noted tech analyst Dan Ives from Wedbush Securities posits that Palantir’s value might surge by an impressive 177% to reach a staggering $1 trillion in the next three years, as companies compete fiercely to transform their data into financial gains.

Beyond its leading 10 investments, the Vanguard ETF also features several other notable AI-related software stocks. These include cybersecurity titans like Palo Alto Networks and CrowdStrike, in addition to Adobe and Snowflake, among others.

One appealing aspect of the Vanguard ETF could be its exceptionally low cost, which is reflected in its expense ratio of only 0.09%. This means that for every $10,000 invested, you’d pay an annual fee amounting to just $9. In contrast, other funds in the industry typically charge an average of 0.93%, making Vanguard a staggering 10 times less costly to own.

On course to beat the S&P 500 again in 2025

Since its launch in 2004, the Vanguard Information Technology ETF has consistently outperformed, delivering an annual compound growth rate of 13.7%. This is significantly higher than the S&P 500’s average return of 10.1% per year during the same timeframe.

2025 seems poised to see that trend persist, as the ETF ended July 18 with a year-to-date increase of 10.3%, surpassing the S&P’s gain of 7.3%. The tech sector is once again outperforming this year, largely due to advancements in AI. Microsoft, Nvidia, and Palantir have all experienced significant growth, with their shares rising by 21%, 24%, and an impressive 104% respectively.

To avoid potential losses from market fluctuations, it’s wise not to invest everything in a single sector, such as AI or technology stocks. If the growth of AI experiences downturns, those high-flying tech shares could experience significant declines, causing temporary underperformance compared to other sectors. To minimize risk, consider incorporating this Vanguard ETF into a well-diversified portfolio.

If the chosen strategy pans out favorably, it has the potential to generate substantial profits. For instance, an investor who put $20,000 into the S&P 500 in 2004 would now have approximately $167,000. However, if this same investor had divided their initial investment of $20,000 and invested $10,000 each in the S&P 500 and a Vanguard ETF, they would currently have around $264,800. This significant difference could mean a transformative financial boost for many individuals.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- The Best Single-Player Games Released in 2025

- Brent Oil Forecast

- Michael Burry’s Market Caution and the Perils of Passive Investing

2025-07-23 12:35