All Petersburg—nay, the whole world of crypto—hums, buzzes, and spins, like a clerk who just learned that his Bitcoin wallet is now worth twelve kopecks. So, what is this mysterious creature fluttering about: the AI trading agent? Imagine, dear reader, a most diligent official, but one who drinks neither vodka nor coffee, devouring reams of market metrics at breakneck speed, scrawling down the price of Solana faster than your mother-in-law can utter, “What in blazes is a blockchain?”

Maybe you’re an enterprising developer, a numbers fancier, or some idle fellow convinced Dogecoin is the new gold standard. The fog of ambition billows, and yet, you ask: how do I conjure such a magic assistant? Settle in. I will lead you by the nose through this labyrinth of wires and empty promises. You want to build an AI crypto bot? Well, why not! After all, madness has its own rewards.

Key Takeaways:

- AI crypto agents learn—and unlike your Uncle Boris, they do eventually adapt to changing circumstances 🧠

- If you don’t clutch your purse tightly and keep your model up to date, you’ll be left with memories, not money!

- With enough data (price, gossip, blockchain oddities), your bot can become the Sherlock Holmes of crypto trading.

What is an AI Trading Agent?

What is this AI trading agent, you ask? Merely a creation so sophisticated it would sit smugly in any Petersburg Registry, sifting data, making trades, and—miracle of miracles—not asking for a state pension. Machine learning, deep dreaming, or perhaps some reinforcement—a fancy way of saying it learns by getting whacked by the invisible hand of the market. All this, while you nap soundly (perhaps because you no longer have any skin in the game).

Such agents crawl through history (theirs, not yours), sniffing for patterns, not in your grandmother’s borscht recipe, but in those inscrutable price graphs, order books, social sentiment, and the moods of the market as fickle as Gogol’s Akaky Akakievich contemplating a new overcoat.

Unlike those robotic minions with their ironclad rules (“Buy if moving average rises!”), an AI runs simulated adventures, adjusts accordingly, and emerges battered but wiser. The crypto markets are a masquerade ball of volatility, and AI agents are the only ones not wearing their boots on the wrong feet.

How AI Enhances the Agent?

Let us compare the average trading bot (stiff, unblinking, making the same trade until doomsday) to the AI agent—who, for better or worse, changes his coat with each new tweet from Elon Musk. The AI learns, refines, and sometimes even dreams (if neural networks do dream of electric rubles, who can say?).

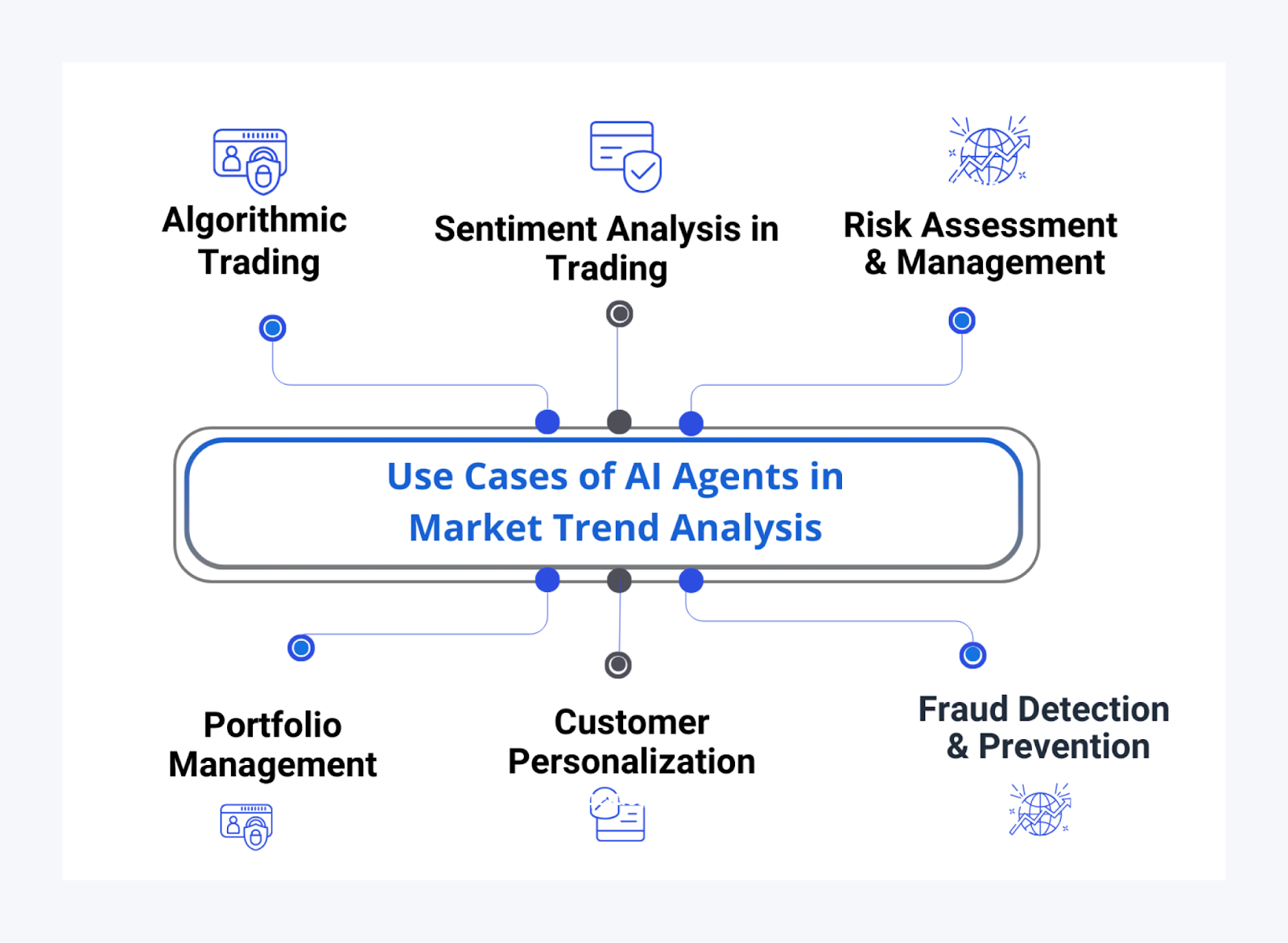

Pattern Recognition and Prediction

The crypto market is chaos with a top hat. AI, particularly LSTMs, gobble up candlestick data and attempt to guess tomorrow’s drama. These little neural clerks can—at least sometimes—predict when a dreary Wednesday will turn into a market bull run (or just another disastrous Thursday).

Adaptive Learning and Strategy Evolution

The beauty of AI is its dogged refusal to repeat your cousin’s trading mistakes. Through a relentless gauntlet of rewards and punishments, it learns to dodge potholes and refine its wits, unlike your friend Pavel, who still thinks ICO means “Instantly Create Orphans” (of your savings, that is).

Multi-Factor Decision-Making

Foolish bots listen only to one tune—the RSI. AI agents, however, devour everything: price charts, Twitter lamentations, on-chain shenanigans, and more. Natural Language Processing means your bot now cares deeply about what some anonymous troll yells about Ethereum at 3 am.

Risk Management and Optimisation

Why leap into the icy Neva without a scarf? AI tries not to. Instead, it calculates volatility, recommends position size adjustments, and ensures you don’t accidentally mortgage your apartment for three Polkadot tokens.

Using portfolios, AI can juggle risk like a St. Petersburg bureaucrat passing reports—nobody knows where it will land, but the treasury stays (mostly) intact.

Anomaly Detection and Market Awareness

The crypto market is like Nevsky Prospect—always another oddball lurking. AI models wielding autoencoders spot weirdness, gasp at suspicious wallet moves, and might even halt trading before the next disaster strikes. If only they could warn you before you bought NFTs of dancing cabbages!

Automation at Scale

AI does not sleep. It flits from Binance to Coinbase to the dregs of some obscure exchange, trading like a caffeinated auditor. Maybe today it’s bullish on Bitcoin, tomorrow—a nervous wreck with small-cap altcoins. It’s everywhere, always, and never asks for tea breaks.

How to Develop AI Agent for Crypto Trading?

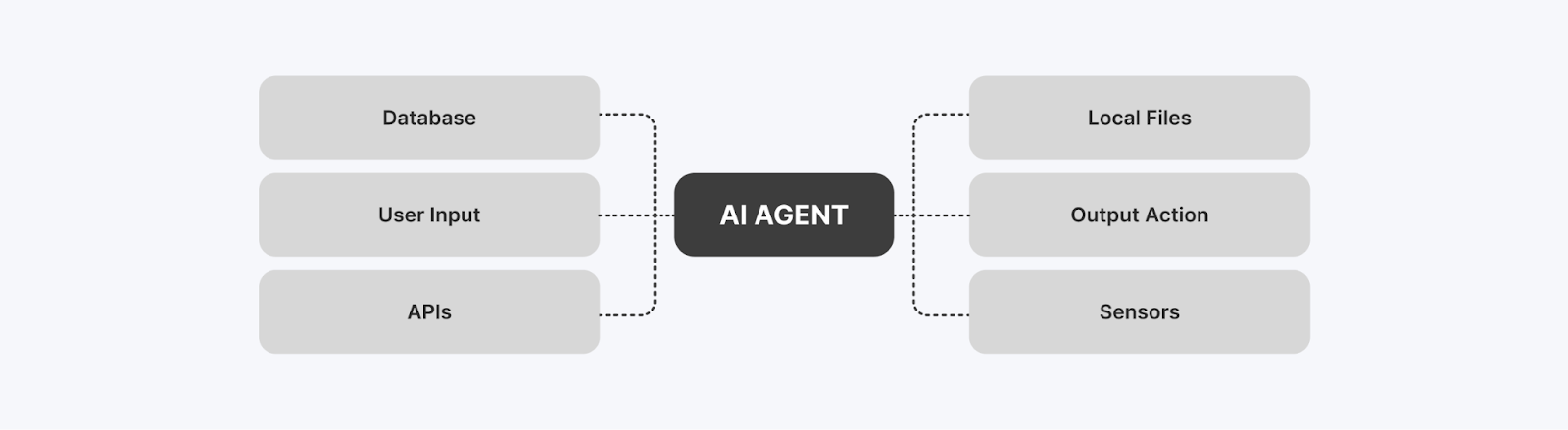

What is an AI agent, really? Think less “one big brain” and more “a collection of squabbling appendages,” each arguing about which data is most delicious. Here’s the anatomy of this noble beast:

Data Ingestion Module

First, you must build yourself a trusted attendant—one that tirelessly drags in data: price feeds, Twitter rants, the order book equivalent of Dostoyevsky’s novels. It must, like any decent bureaucrat, handle endless interruptions (API rate limits) with shrugs and retries.

Data Preprocessing and Feature Engineering

If you feed your models rotten potatoes (noisy data), you should expect nothing but the finest, freshest nonsense in return. Clean the data, patch up the holes, invent technical indicators, and transform tweets into something approaching meaning. Raw data is like unwashed beets—no one wants that for dinner.

AI/ML Prediction Engine

This is the beating heart (albeit with arrhythmia). Here, algorithms fight for supremacy: LSTMs, CNNs, rebels from the reinforcement learning camp. Sometimes they join forces (ensemble methods)—think of a committee, only occasionally functional.

Strategy Logic and Signal Filter

The AI’s raw predictions would drive you to bankruptcy without some adult in the room. Enter the logic layer, filtering out wild impulses and enforcing a little bit of sanity (for once). “Don’t buy because the model is excited—wait until RSI is low and the omens are favorable!”

Trade Execution Engine

An AI decision is but a whisper unless acted upon. The execution engine is your sturdy carriage driver—dispatching trades, minding slippage, retrying after network hiccups, and mumbling curses at exchange APIs like a true Russian soul.

Risk Management System

A worthy agent feareth ruin above all. This stern overseer polices stop-losses, position sizes, daily drawdowns, and all manner of hazards—because who wants to end up like the protagonist of “The Overcoat,” robbed in the night?

Portfolio and Capital Allocation Module

Sometimes your AI becomes a master of ceremonies, juggling coins, favoring one, then another, based on arcane signals and recent performance. Diversification—because trusting your entire future to $PEPE is a game for madmen.

Monitoring, Logging, and Analytics Dashboard

The city must have its gossip column! This module records every success, failure, and embarrassing mishap in excruciating detail for generations of analysts to laugh or weep over. Beautiful dashboards show you whether your AI is hero or fool.

Model Training and Update Pipeline

Alas, models grow senile, as do men. A wise creator arranges for regular retraining—lest the agent babble about 2017 like a relic, while the market skips ahead to 2030.

Security and Infrastructure Layer

No Petersburg tale is complete without a plot twist involving stolen wallets or vanishing funds. Your AI must guard keys in vaults, lock its doors, and practice healthy paranoia—containerization and all. One wrong step and your fortune joins the ghosts of lost rubles.

Conclusion

And so, the fateful union of AI and crypto spawns a trading entity capable of learning, adapting, and (with luck) out-witting other market players. The journey is not for the faint-hearted, and the rewards, like Petersburg snow, can be fleeting. But oh, what a spectacle! Now you have the recipe, stir the pot—or build an AI and let it stew in the chaos for you. 🍲🤖

FAQ:

What is an AI crypto bot?

An AI crypto bot is a machine that trades faster than your cousin Sasha can misplace private keys. It uses clever algorithms to buy, sell, and sometimes, weep in the corner.

Do I need coding skills to build a crypto trading bot?

Da, comrade! Without Python, you’re as lost as a sheep on Nevsky Prospect during a New Year’s blizzard.

What’s the best AI model for crypto trading?

“Best” is for poets and philosophers. Try LSTM for timelines or PPO for wild adventures—then argue about it on Reddit.

Can I make passive income with an AI trading agent?

In theory, yes, but passive income usually passively leaves your pocket, too. Tinker, monitor, and hope your agent is less clumsy than a drunken Cossack. Cheers!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-05-14 20:47