As a seasoned researcher with a knack for spotting market trends and patterns, I’ve witnessed my fair share of bull runs and bear markets. The current surge in HBAR, the native cryptocurrency of the Hedera Hashgraph network, is nothing short of impressive, reaching heights last seen in April 2024. However, with great gains come caution signs, and this rapid ascent has pushed the token’s price into overbought territory.

The digital currency known as HBAR, which operates on the Hedera Hashgraph platform, has experienced an astonishing surge of more than 180% over the past week. At the moment, it is being traded at $0.13, a price level not seen since April 2024.

On the other hand, this swift increase in value has taken the HBAR token’s price beyond the overbought range, hinting at an upcoming potential price adjustment or correction.

Hedera Traders Overextends Its Price

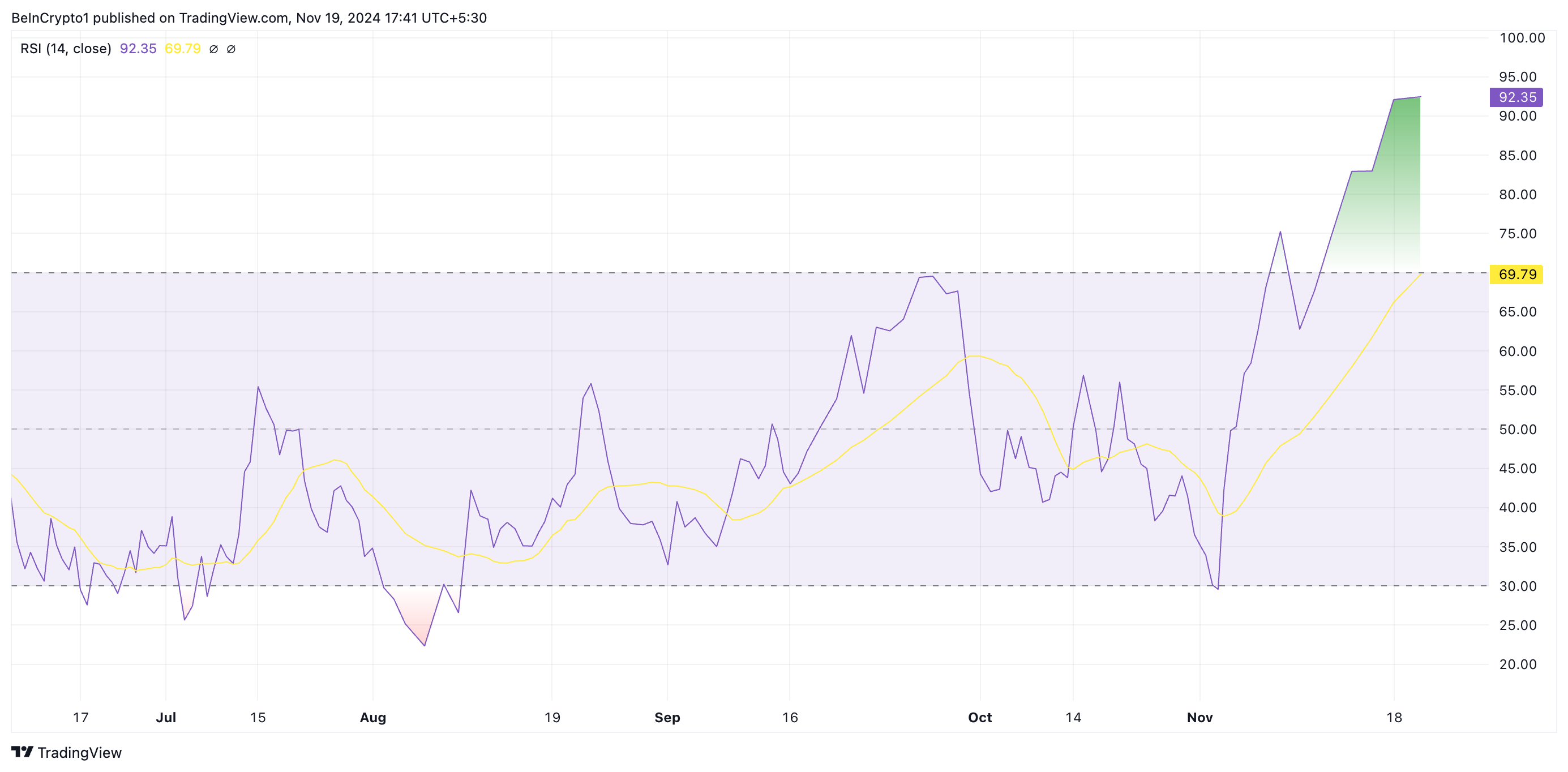

The data from HBAR’s Relative Strength Index (RSI), as currently observed, indicates a highly active market. At present, the RSI has reached an unprecedented level of 92.35.

The Relative Strength Index (RSI) determines if an asset’s market conditions are excessively bought or sold. This index falls between 0 and 100, where figures above 70 signal the asset is overbought, possibly indicating it’s due for a drop. On the other hand, values below 30 suggest the asset is oversold, potentially signifying an upcoming recovery.

The current Relative Strength Index (RSI) of HBAR stands at 92.35, signaling that it is in an extremely overbought state. This means that buyers have been aggressively purchasing HBAR, leading to an excessive price increase compared to the number of sellers. However, this imbalance may not be sustainable and could potentially lead to a decrease or correction in HBAR’s price in the near future. Although the asset’s price might continue to rise temporarily, it’s important to keep in mind that high RSI values often precede such market corrections.

Additionally, the cost of HBAR has broken through the upper limit of its Bollinger Bands chart, which suggests to investors that it’s currently in an overbought state within the market.

The Bollinger Bands indicator measures market volatility and identifies potential buy and sell signals. It consists of three main components: the middle band, the upper band, and the lower band.

As an analyst, I utilize a 20-day moving average, which functions as a foundation for the price trend’s trajectory. The upper boundary is established by adding two standard deviations to this baseline, taking into account any price fluctuations that exceed the moving average. Conversely, the lower boundary is determined by subtracting two standard deviations from the same baseline, reflecting price movements below the moving average.

If the cost exceeds the upper limit, it frequently implies the asset might be overbought since it’s risen substantially above its usual price level. This may hint at an upcoming price correction or retreat.

HBAR Price Prediction: A Pullback Is Imminent

If the demand for HBAR lessens and sellers take over, we might expect a decrease in its price. Right now, it’s trading above the support created at $0.12. When the buying enthusiasm wanes, it could test this price point. If it can’t maintain this level, the token’s value may drop sharply towards $0.11.

If the upward trend persists, the HBAR token could regain its previous cycle peak of $0.15 and even surpass it, contradicting the bearish prediction mentioned earlier. A convincing break above this level would pave the way for HBAR to reach its year-to-date high of $0.18.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

2024-11-19 21:16