As a seasoned crypto investor with a knack for technical analysis and a portfolio that’s seen more than its fair share of market swings, I can’t help but feel a familiar sense of unease when observing Ethereum’s current trajectory. The MACD death cross and the rising Aroon Down Line are signals that have often preceded significant downturns in the past.

Right now, Ethereum (ETH) is undergoing a noticeable drop, causing its value to decrease approximately 3% in the last day. If this downward momentum continues, it might force Ethereum’s price to fall below the crucial $3,000 mark.

This analysis examines the factors contributing to this likelihood.

Ethereum Sellers Re-Emerge

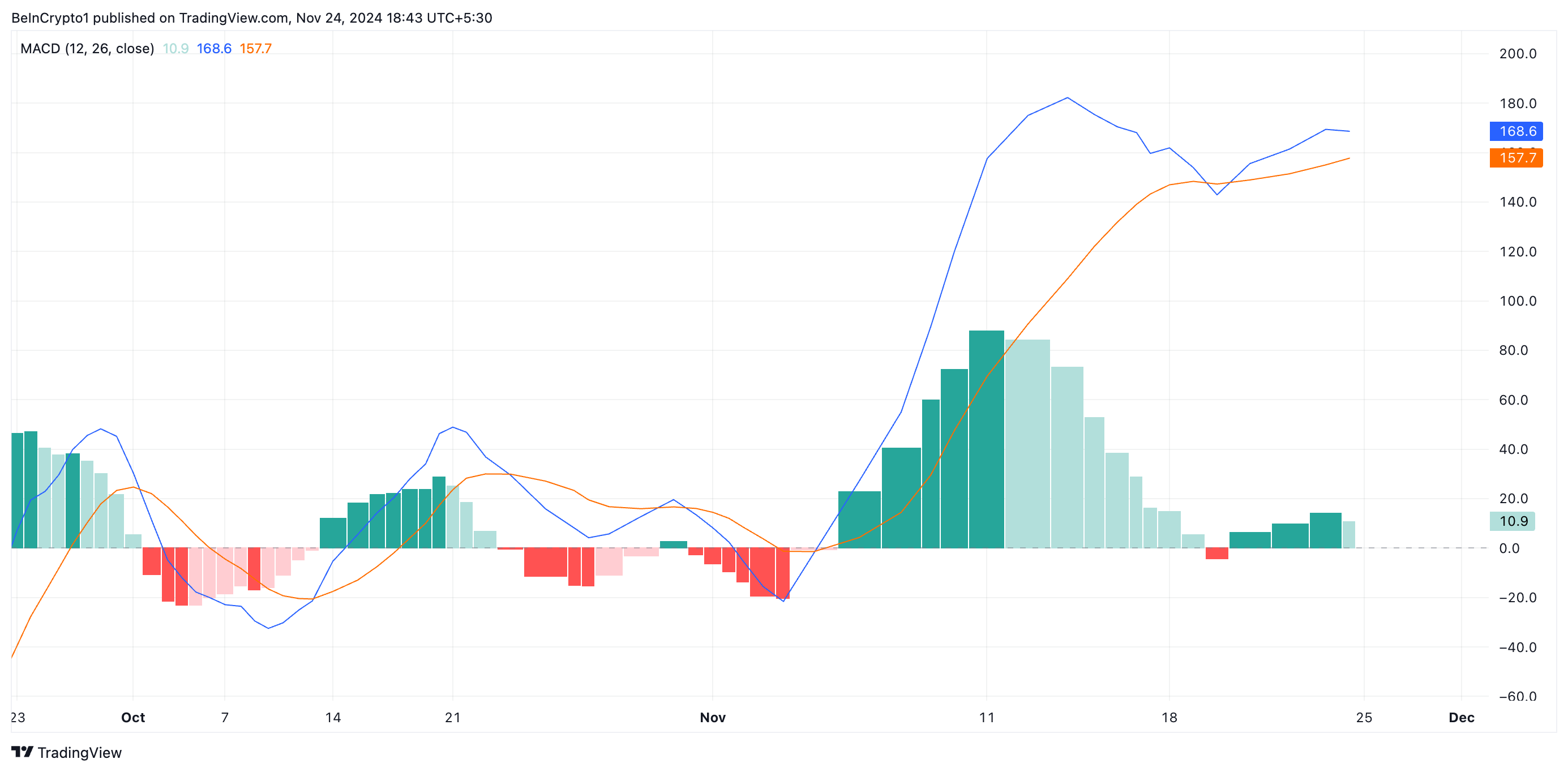

Examining the ETH/USD daily chart, it appears that the Moving Average Convergence Divergence (MACD) may be indicating a possible death cross. Currently, the MACD line (represented in blue) seems to be trying to drop below the signal line (orange).

This tool assesses the fluctuations and momentum of an investment’s value, offering buy or sell tips based on its trends. When the MACD line (which represents the shorter-term average) falls below the signal line (the longer-term average), it signals a bearish trend or shift in momentum. This warning sign suggests that there is growing selling pressure, implying the asset’s price may continue to drop.

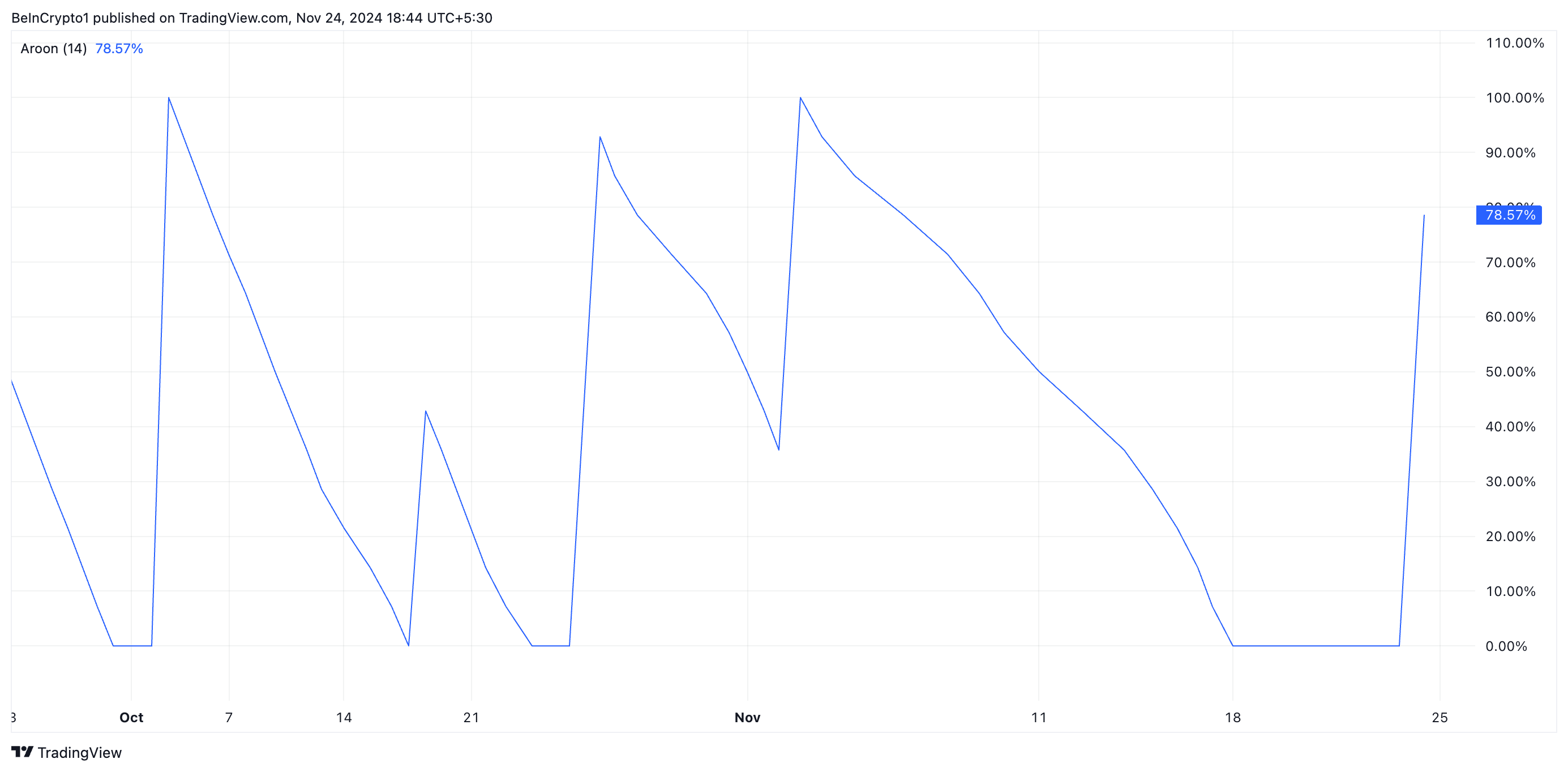

The increasing Aroon Down Line within ETH suggests a growing bearish influence, now at 78.57%. This indicates that the downward trend in ETH’s value is picking up speed.

The Aroon Indicator measures the power of an asset’s price movement using two elements: the Aroon Up line, which demonstrates the intensity of upward trends, and the Aroon Down line, which indicates the strength of downward trends. An increasing Aroon Down line suggests that lower prices are occurring more often recently, suggesting a rise in bearish pressure or the beginning of a downward trend.

ETH Price Prediction: Key Support Level To Watch

Right now, Ethereum is being traded at approximately $3,333, sitting comfortably above the support level of $3,203. This significant level matters because if Ethereum falls below it, we could see transactions happening under $3,000. Based on data from the Fibonacci Retracement tool, a drop in price might lead to Ethereum being valued at around $2,970.

Conversely, an increase in popularity for the top alternative coin would contradict this pessimistic viewpoint. In such a case, Ethereum could surge towards $3,500.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Zenless Zone Zero 2.0 – release date, events, features, and anniversary rewards

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2024-11-24 22:48