As a seasoned market analyst with over two decades of experience under my belt, I have seen countless bull and bear markets come and go. And while Ripple’s recent rally has been nothing short of impressive, it’s crucial to approach any investment with caution, especially when signs of weakening momentum start appearing.

Over the last week, the price of Ripple (XRP) has seen a substantial surge, increasing by 51.33%. Over the past month, this increase has been even more impressive at 109.09%. This powerful trend has pushed XRP into a bullish market, with technical signs like EMA lines reinforcing its upward trend.

As a crypto investor, I’ve noticed some signs that might require me to tread carefully with my XRP holdings. The Relative Strength Index (RSI) is decreasing, and the Chaikin Money Flow (CMF) is negative, which could be indicators of potential market reversal. Whether XRP will keep climbing or take a sharp downturn hinges on how the market responds to these changing trends. It’s essential to stay vigilant and adapt my strategy accordingly.

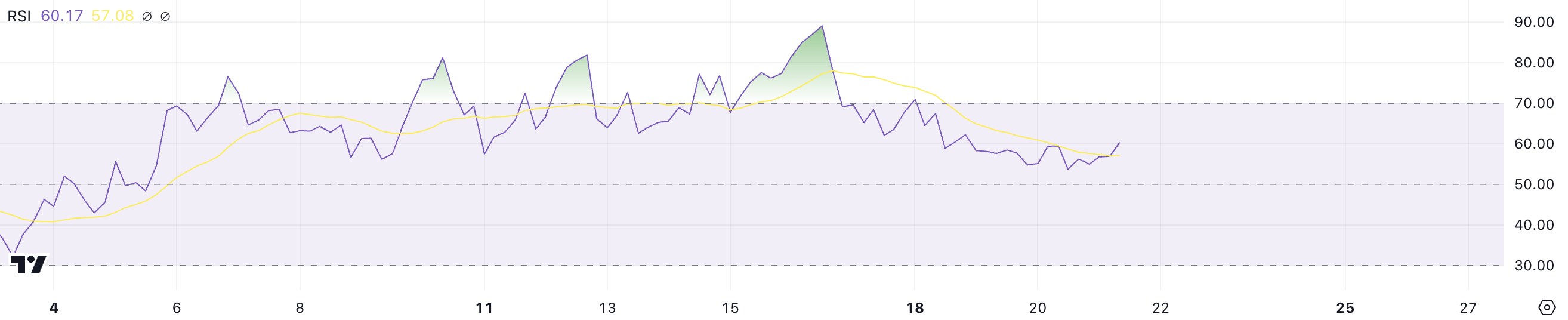

XRP RSI Is Below The Overbought Zone

The Relative Strength Index (RSI) of XRP has fallen to 60, having come close to reaching 90 on November 16, and maintaining levels above 70 from November 15 to November 17. In simpler terms, after almost touching a value of 90 on November 16 and staying above 70 for three days from November 15, the RSI of XRP has now dropped down to 60.

This decrease shows that Ripple has left the ‘overbought’ area, a place where significant buying pressure was pushing its value up. The fall hints at the market slowing down, as traders might be cashing out following the substantial increase in price.

The Relative Strength Index (RSI) gauges the rate and amplitude of price fluctuations, with figures exceeding 70 suggesting overbought status and numbers under 30 hinting at oversold conditions. At 60, XRP’s RSI suggests a continuing positive trend while displaying a more even-keeled sentiment compared to its earlier surge.

As long as the market is trending upwards, a lower Relative Strength Index (RSI) may suggest a more gradual increase in prices, potentially leading to a period of consolidation as the market settles. If buying interest resurfaces, the value of XRP could continue its upward trajectory; however, a continued drop in RSI might hint at a decreasing bullish momentum.

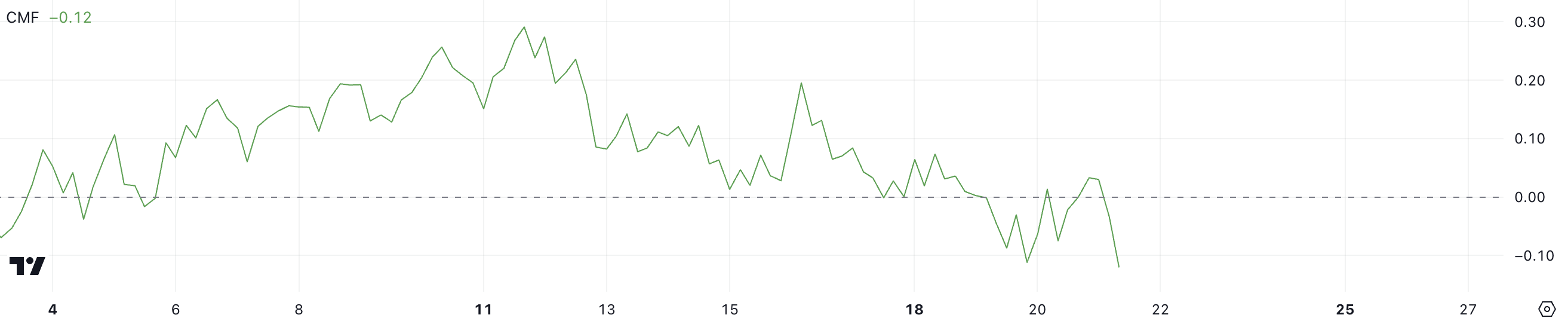

Ripple CMF Is Now Negative After Staying Positive For 14 Days

The XRP Chaikin Money Flow (CMF) stands at -0.12 right now, having displayed positive readings from November 5 to November 19. It’s important to note that this is the lowest CMF level since October 31. This downward shift suggests an increase in selling activity and possibly a drain of funds from the asset, indicating potential capital outflow.

Earlier this month, the shift towards non-positive CMF values suggests that the strength of the bullish trend is decreasing, with an increasing number of market players reducing their holdings of Ripple.

The Capital Movement Factor quantifies both the quantity and direction of funds entering or leaving an asset. A positive reading signifies a capital influx, which is generally bullish, while a negative value indicates a capital outflow, usually bearish.

The Comoving Moving Formula (CMF) for XRP at -0.12 indicates a growing bearish trend, which might exert downward influence on its current rising trajectory. If the CMF persists in being negative or worsens, it could signal persistent selling forces, making it difficult for Ripple to maintain its upward momentum.

Ripple Price Prediction: Biggest Price Since 2021?

The current setup for XRP’s Exponential Moving Averages (EMA) suggests a potentially optimistic outlook. Short-term averages are hovering above their long-term counterparts, and at this moment, the value is trading above every one of them, hinting at an upward trend.

On the other hand, the gap closing between the current price and certain trendlines might indicate a possible decrease in bullish energy. Such a development could hint at a declining uptrend, making XRP more susceptible to a change in market opinion.

Should a descending trend appear, signaled by the decreasing Relative Strength Index (RSI) and unfavorable Chaikin Money Flow (CMF), there’s a possibility that Ripple’s price may encounter considerable resistance, potentially causing it to dip towards its support level at $0.49. This potential drop represents a substantial 56% correction in value.

If the upward momentum of XRP continues to grow, it might surge towards the $1.27 mark and could even push beyond to reach $1.30. This would be a new peak for XRP since last year in May 2021.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-21 20:43