Artificial intelligence (AI) has, in recent years, heralded a new era for investors. A few, colossal stocks-fittingly referred to as the “Magnificent Seven”-have basked in its glow. Yet, as always, the smallest and most overlooked among them often reap the greatest rewards. In this hallowed company, an old name has made its mark once again: International Business Machines (IBM). But what is the true story behind this once-forgotten titan’s comeback, and what does it reveal about the cruel indifference of market forces?

The Silent Return of a Giant

One might be inclined to forgive the casual investor for having written off IBM. While other tech stocks bloomed and flourished in the sunlit fields of innovation, IBM, a relic of an earlier age, fell into shadow. The very mention of “legacy tech” seemed to carry the scent of obsolescence, as if the company’s destiny was sealed: an immovable and outdated monolith, fated to fade into irrelevance.

Yet, in 2019, when few were looking, the winds of change began to stir. Under the unassuming yet steady leadership of Arvind Krishna, IBM made a $34 billion acquisition of Red Hat. In that moment, it seemed the company might at last be reclaiming its soul. The acquisition allowed IBM to stake a claim in the world of cloud computing, the very foundation upon which AI would thrive. This was no mere pivot. It was a resurrection.

From the ashes of its old self, IBM began to rise, not just in terms of technology, but in dignity. Hybrid cloud technologies became the bridge that connected AI aspirations with practical, worldly results. By the time Krishna was appointed CEO the following year, it was clear that IBM was positioning itself not just as a participant, but a leader in the new AI landscape-chiefly through its work with watsonx, a tool enabling the training, validation, and global deployment of AI models.

But here lies the deeper irony: the true weight of this resurgence lies not merely in the clouds, but in the earth beneath. It is quantum computing-the very frontier of human innovation-that stands to elevate IBM further. Unlike the binary confines of traditional computing, quantum machines can manipulate values in ways that defy even the most imaginative minds. And IBM? It commands the world’s largest fleet of quantum computers, positioning itself to launch the first “fault-tolerant” machine by 2029. Such a feat, in a world that spins ever faster in its technological race, is a quiet triumph, one that may yet give the company an unassailable lead.

The Cold Mathematics of Progress

It is no exaggeration to say that the company’s numbers tell a story of resilience. Despite its spinoff of Kyndryl in 2021, which allowed it to shed the dead weight of a legacy business, IBM has witnessed steady, if slow, growth. The first half of 2025 saw revenue climb to nearly $32 billion, a 4% increase over the same period in 2024. But more than that, it was an 8% leap in the second quarter alone-a testament to the creeping but undeniable forces of change at play within the company.

Yet, this progress comes with its own ironies. Operating income increased by 14% year over year, while the company’s profits of $3.2 billion, though substantial, marked a 5% decline. This setback was not one of poor performance, but of taxation-an all-too-common affliction that seems to sap the vigor from even the most promising enterprises.

Still, the forward-looking promise remains, as IBM forecasts a free cash flow of $13.5 billion for the year, a notable increase over the previous year’s $12.7 billion. This projection, far above the expected dividend cost of $6.2 billion, suggests that IBM’s storied commitment to dividends-a tradition uninterrupted for 30 years-will continue. The dividend now stands at $6.72 per share annually, yielding 2.4%, which is nearly double the S&P 500’s average. For those who seek the solace of regular, dependable returns, this dividend remains a beacon of stability in an ever-changing world.

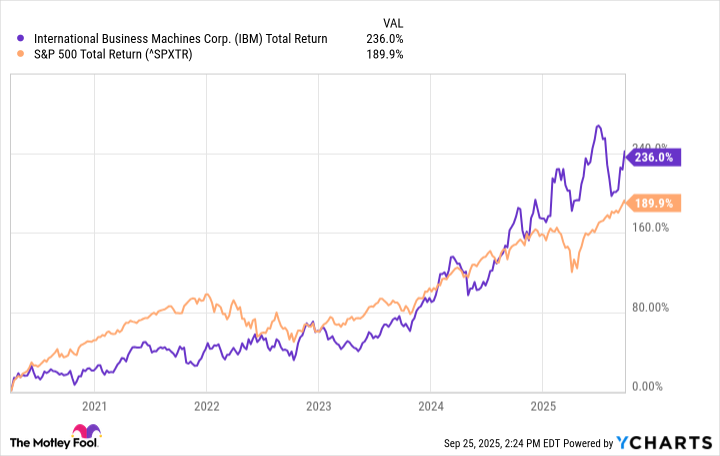

Since Krishna’s ascension to the helm in 2020, the stock has posted total returns that have bested those of the S&P 500, with the stock recently achieving record highs. But even as the price rises, the specter of valuation looms. At present, IBM’s P/E ratio sits at a lofty 45-far removed from the more humble 10 P/E at the time Krishna assumed leadership. Yet, even with this surge in price, the forward P/E ratio of 25 speaks of untapped potential, a quiet promise of growth that few may yet fully appreciate.

The Silent Triumph of IBM

It is in the stillness of this quiet victory that we find IBM’s true strength. After years of struggle and self-doubt, this once-mighty corporation has not only survived but thrived. The acquisition of Red Hat, the foray into quantum computing, and a resurgence in AI-all of these actions represent more than just the execution of a business strategy. They are acts of defiance against the inevitability of decline. And for the patient investor, the quiet dividend yields of IBM serve as a reminder that even in the most tumultuous times, stability can emerge from the most unexpected places.

Indeed, the market, in its ceaseless churn, may forget the quiet heroes. But for those who seek not just growth but dignity-who value the enduring strength of steady dividends amid the volatility of the stock market-IBM’s return offers a glimmer of hope. And, as we know all too well, hope is a currency far rarer than any stock.

💰

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2025-09-28 15:53