Johnson & Johnson (JNJ) is like that reliable friend who shows up to brunch every Sunday but also has a tendency to overshare about their recent court battles. With an enviable streak of 62 consecutive years of dividend increases, it’s no wonder this pharma giant has earned the title of Dividend King. But hold on, because here comes the plot twist: It’s not just smooth sailing, my friends; this company has faced a fair amount of legal and regulatory drama that would make even the most riveting soap opera blush.

So, can we trust that this single stock will magically transform our nests into golden eggs? Spoiler: Counting on one investment to bless you with millionaire status tends to be as risky as ordering the mystery special at a sketchy diner. Let’s dive into the depths of Johnson & Johnson’s potential. Buckle up!

Opportunities for growth

One of the charming traits of Johnson & Johnson is its uncanny ability to keep its products in demand, like that trendy avocado toast everyone keeps raving about. For instance, the world’s geriatric population-yes, that’s what we call it-will balloon to 22% by 2050, compared to a measly 12% in 2015. Translation: The need for pharmaceuticals and medical tech is about to skyrocket.

Now, while we’re all for industry growth, there’s a tiny catch. Just because healthcare is on the up and up doesn’t mean that J&J gets a free ride. Still, I have three compelling reasons why this stalwart might just fare well amid the chaos.

First, let’s applaud Johnson & Johnson for their track record of innovation. They’ve been around for over a century, clever little pioneers! Yet they manage to keep evolving, fending off competitors, patent cliffs, recessions, and even pandemics-all with the finesse of a tightrope walker. The past doesn’t guarantee the future, sure, but hey, it’s nice to have a history of success in your corner, isn’t it?

Second, the current landscape of J&J’s offerings is something to be marveled at. With a portfolio boasting over 20 brands and a handful of blockbuster hits in its arsenal, they’re like the ultimate cocktail party guest-diverse and entertaining! They’re diving into everything from oncology to neuroscience, and guess what? They’ve got over 100 active programs in the pipeline. Talk about a rich buffet!

Third, let’s chat about their fancy new toy-an innovative robotic surgery device called Ottava. Yes, I know, it sounds like a villain from a cheesy sci-fi flick. But in reality, the robotic-assisted surgery market is like that new kid at school-underexplored and brimming with potential. With the aging population clamoring for easier surgical options, if the Ottava gets its enabling clearance in a few years (and fingers crossed it does), it could very well become J&J’s prized stallion in the growth race.

Can Johnson & Johnson overcome its headwinds?

Ah, the drama thickens! J&J currently finds itself buried in a heap of lawsuits from upset customers claiming their talcum products were a health con job. The company has “tried” to settle these matters, but let’s be honest, it’s been about as successful as a cat in a dog park.

On top of that, new U.S. regulations are throwing a wrench into the works, giving the government more authority to haggle down drug prices. Just like those times you got cornered into negotiating your way out of a bad Tinder date-awkward but necessary. Some J&J products are already on the chopping block for negotiations, and who knows what lies ahead?

But let’s not get carried away with worry here. If these lawsuits were as dire as a Shakespearean tragedy, J&J wouldn’t still have a higher credit rating than, you know, the U.S. government. That strength is the reason why judges have rolled their eyes and shot down the company’s wish to settle by declaring bankruptcy through a subsidiary.

Regarding price negotiations, we’ve already discussed J&J’s robust portfolio. With a buffet of different products and a pipeline overflowing, they should have more than enough creativity and cash flow to navigate these choppy seas. It’s like being in a bloated federal bureaucracy, but with profitability-that’s a win!

So don’t fret. Johnson & Johnson is likely to emerge relatively unscathed.

Hedge your bets

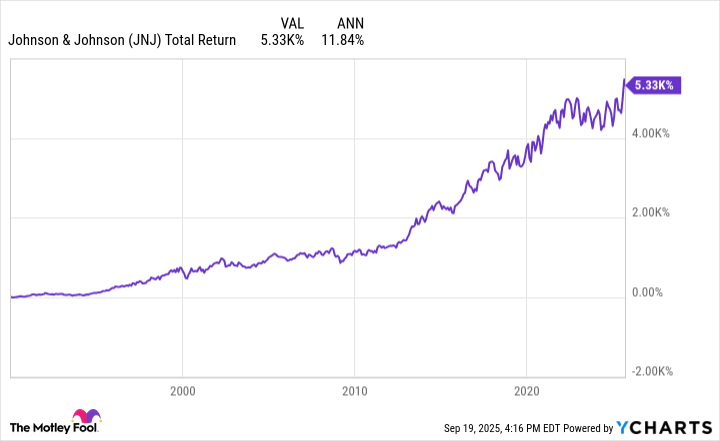

Now, imagine you start with a sweet $100,000. To rise to the elusive million-dollar mountain in 20 years, you’d need to achieve a compound annual growth rate (CAGR) of 12.2%. That’s above and beyond even what J&J has managed historically, even with dividends’ help. And yes, let’s not sugarcoat it: That’s a tall order!

In my admittedly pessimistic opinion, the pharmaceutical titan might struggle to pull this off. Does that make it a bad stock to own? Not at all! With very few stocks hitting that 12% CAGR over two decades, putting all your hopes in J&J is more like hoping for the best outcome from a blind date than a guaranteed jackpot. It’s a decent choice for a solid, well-rounded portfolio to help you flirt with millionaire status, but don’t bank on it entirely.

💸

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2025-09-26 14:58