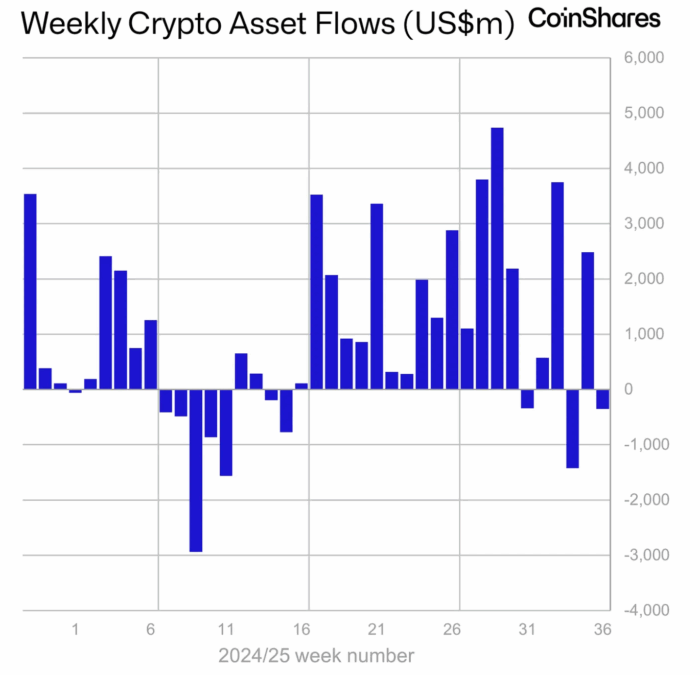

The perfidious ballet of digital asset markets stumbled last week, partners tripping on unseen wires of institutional withdrawal. James Butterfill of CoinShares, that Prometheus chained to his charts, declared a hemorrhage of $352 million from crypto’s gilded arteries. 💸

Observe, if you will, the graph’s waltz, gray and reluctant, as America’s payroll woes performed a faint pas de deux with optimism-surely September would rescue us with a rate-cutting flourish! Instead, trading volumes pirouetted offstage, minus 27%. Appetite for digital assets curled up like a bored housecat, utterly unimpressed. 🐱

But hope is an undying cockroach-year-to-date inflows burrow at $35.2 billion, 4.2% higher than last year’s sleepy $48.5 billion, dollars as persistent as a spouse’s passive-aggressive sighs.

Bitcoin’s Swagger & Ethereum’s Swan Song

America, always eager to take center stage, coughed up $440 million in outflows. 🇺🇸 Meanwhile, Hong Kong and Germany played stoic understudies, sneaking $8.1 million and $85.1 million into the coffers, with the genteel discretion of stashing wine bottles in the linen closet. Despite carnage, Bitcoin twirled heroically, posting $524 million in net inflows, a digital Don Quixote charging the windmills of market adversity.

Ethereum, that elegant, misunderstood sibling, endured seven sorrowful days of withdrawals-$912 million!-across investment products, as if conducting an extended funeral for optimism. Nevertheless, its year remains robust, total inflows sitting handsomely at $11.2 billion, refusing to die quietly.

Meanwhile, Solana and XRP, those insouciant youths, kept the party rolling: Solana, notching a relentless 21 weeks of inflows ($1.16 billion), and XRP, sipping its $1.22 billion like a cocktail at an overlong brunch. 🥂

Grayscale’s Skywriting and ETF’s Fever Dream

On X (née Twitter, Queen of Name-Changing), Zach Rynes heralded Grayscale’s S-1 submission to the SEC, intent on transmuting Grayscale Chainlink Trust ($GLNK, a modest $28 million AUM) into a properly starched ETF. Bitwise tossed its hat in the ring too, the ETF circus never lacking for clowns.

Bloomberg’s Eric Balchunas, breathless-or perhaps just caffeinated-remarked,

“ETFs crack $800b in YTD flows, a jaw-dropping $5b/day… tracking for $1.2T, a record likely to humble narcissistic gold bugs.” 🤡

ETF enthusiasm balloons even as crypto investors clutch their pearls at short-term outflows. Volatility: the great equalizer, as familiar and unwelcome as a tax audit.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-09-09 01:36