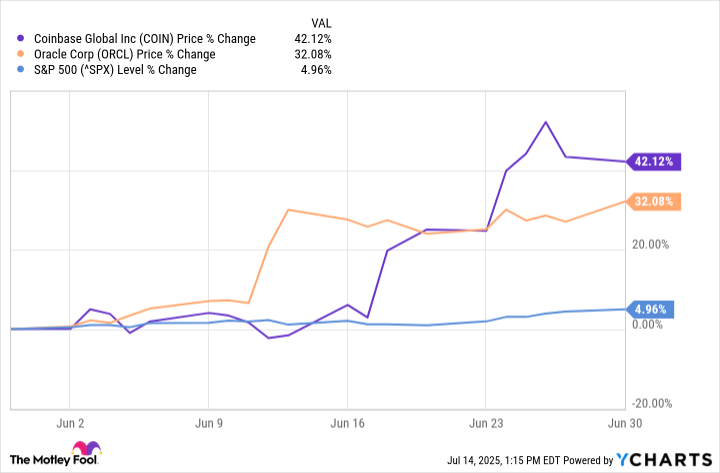

June proved to be an exceptional month for the S&P 500 index, with a closing increase of 4.96%. This was its second strongest performance of the year, surpassed only by the 6.15% growth in May. As a result, the index’s year-to-date (YTD) advance now stands at 5.50%, as we move into July.

Despite the S&P 500 posting strong advances in June, certain individual stocks within the index surpassed these gains significantly. The top two performers for the month were Coinbase Global (COIN +3.21%) and Oracle (ORCL +3.35%), with respective increases of 42.12% and 32.08%.

Let’s see why.

It was an unexpected twist that Coinbase topped the S&P 500’s performance, given it was just its initial full month as part of the index. For three consecutive months, Coinbase has recorded positive monthly returns – a feat not seen since Q4 of 2023 for them. With a revenue-sharing deal with fintech firm Circle in place, Coinbase may be poised to introduce a potentially lucrative new business sector.

Oracle’s impressive month can be traced back to positive developments in its cloud sector. In the final quarter of fiscal year 2025 (ending May 31), its cloud infrastructure revenue increased by 52% compared to the previous year, reaching $3 billion. Moreover, its total cloud revenue rose by 27% year over year to $6.7 billion. With a fresh cloud contract anticipated to generate approximately $30 billion annually starting in a few years, investors are optimistic about Oracle’s future trajectory.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Banks & Shadows: A 2026 Outlook

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-07-18 00:35