It’s a funny old world, isn’t it? Stocks popping up like fresh mushrooms after rain, promising endless growth and sparkling sales. But when you look closer, ah, there’s a trickster in the shadows. You see, only a tiny handful of these jolly little stocks actually manage to make any proper money, without resorting to all sorts of tricky schemes-like diluting their shareholders or playing the *”give us more money, please!”* game. Dutch Bros, though, now there’s a beast with a bit more substance. It’s a young pup, but it’s got claws-and a lot more cash in its pockets than it did before. Take a gander, folks, this might just be your next best friend on the stock market.

And would you believe it? The share price of Dutch Bros has dropped 30% just in the past month. Why? Well, let’s take a closer look at what makes this chain so irresistible to those looking for something new and exciting to sink their financial teeth into. Dutch Bros is a place that serves up iced, blended drinks with flair-a mix of coffee, energy drinks, smoothies, and shakes-and it’s quickly become the darling of the drive-thru crowd. With fancy “escape lanes” to keep things speedy, it’s not your ordinary quick fix.

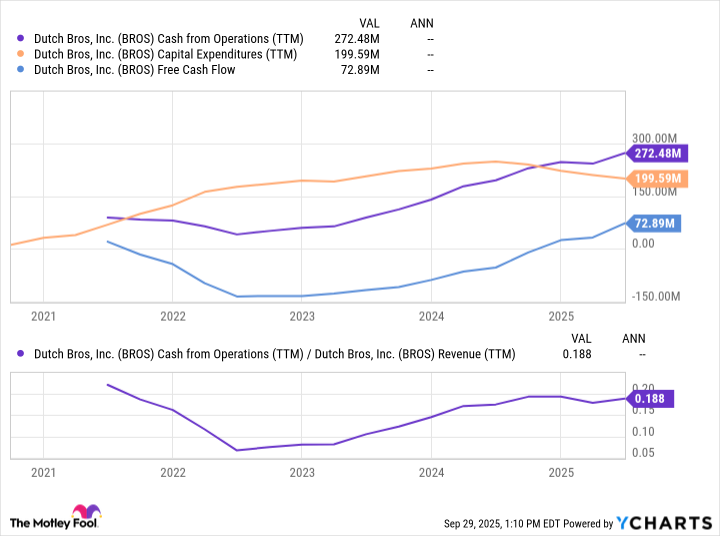

The Cash Concoction: Dutch Bros’ Brewed-Up Growth in One Glorious Chart

Now, here’s the fun part. The chain has grown like a feverish wildfire, doubling its store count to over 1,000 locations between 2021 and today. A quick glance and you’d say, “Blimey! That’s a lot of caffeine!” But hold your horses-here’s the rub. While all that growth looks glittery, their share count has *nearly tripled*. That’s right-triple! The management, keen as a ferret in a hen house, raised heaps of cash by offering up shares, expanding their empire but diluting the value for those who’d already invested. It was all rather unsightly, like a cake that looks delicious from the outside but is all soggy and misshapen inside.

Back in my darker days of analysis, I’d written off Dutch Bros as another flash-in-the-pan. But then-oh, THEN-something quite extraordinary happened. In 2024, a truly thrilling event occurred. They did something no one thought possible: the company started *earning* more money from its daily operations than it was spending on the opening of new stores. Oh yes, no more relying on share offerings to fill the coffers. This, my friends, was the turning point. They had managed to pull themselves up by the bootstraps and fund their future with their own hard-earned cash. It was a moment of rare, almost mythical, financial magic.

Do you see that tipping point? That, my dear reader, is when Dutch Bros stopped looking like a house of cards and started resembling something more solid. The company has now reached a stage where its expansion plans are being funded *internally*, without begging the markets for more. How delightful! They’ve still managed to spend $200 million on capital expenditure, opening 131 new stores, but-wait for it-they brought in $272 million in cash from operations. After all that, they had $73 million in free cash flow to strut around with.

But here’s the real kicker. Dutch Bros plans to double its store count by 2029, with a grand vision of 2,029 locations. And get this: the potential market could see as many as 7,000 stores! It’s a mighty impressive vision, if you ask me. And at a modest 35 times CFO, Dutch Bros is certainly an intriguing proposition for anyone looking to get in on a growing business that knows how to balance growth and cash flow, without the usual run-of-the-mill stock market shenanigans.

So, is Dutch Bros a clever brew or just another frothy concoction full of bubbles? Well, it might just be time to grab your cup, take a sip, and decide for yourself. ☕

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-10-01 17:18