Realty Income (O) has tiptoed along a wobbly tightrope for more than half a century, blundering and stumbling, yet its grand collection of whimsical properties-each as peculiar as a child’s favorite toy-has made it quite the curious investments tale. Alas, despite its enchanting growth, like a forlorn creature desiring escape from a glass jar, the stock languishes far beneath its pre-pandemic heights, as if shackled by invisible chains made by mysterious market forces.

But hark! A peculiar event is on the horizon, a veritable fairy tale in the autumn air, promising to sprinkle magic dust upon Realty Income’s stock and liberate it from its gloomy dungeon. If the fabled interest rate cut arises this September, our longsuffering protagonist may finally awaken from its snoozing slumber.

The Curious Factor that Might Just Save the Day

Yearning for redemption, Realty Income appears poised to receive a benevolent fairy godmother in the form of the mysterious interest rate cut, whispered about in hushed tones among speculative wizards and traders alike.

According to the amusingly named CME Group, rates futures traders, shrouded in their crystal balls, have conjured a 95% certainty of a much-anticipated rate cut in September. The buzz intensified after the U.S. Bureau of Labor Statistics released a surprisingly tame Consumer Price Index (CPI) report, as dainty as a rabbit’s thump, showing a mere 0.2% for July, while inflation tiptoes along a 2.7% tightrope.

Even fanciful Treasury Secretary Scott Bessent has tossed in his two cents, suggesting that a 0.5% slice of the rate cake could be on the menu, much to the shock of analysts who were cautiously nibbling on predictions of a 0.25% cut. Bessent isn’t shy, believing that these meddlesome rates ought to drop by 150 basis points or more-a veritable feast for those anxiously awaiting lower rates!

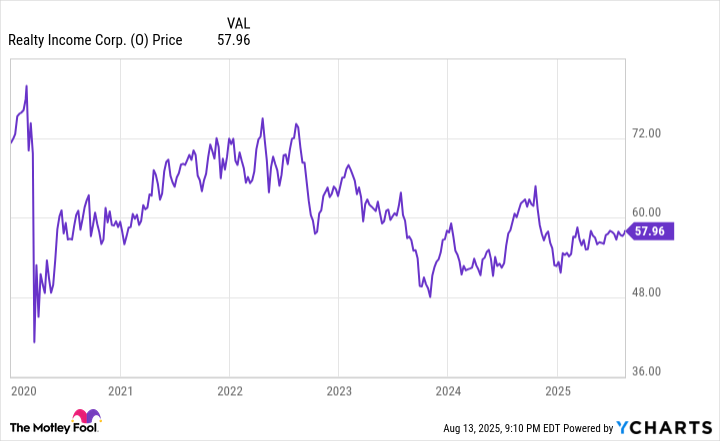

Oh, dear reader, how critical these rates are to our beleaguered Realty Income, which is nearly as dependent on capital as a kitten is on its comforting clutches. Once, the stock soared to great heights in February 2020, perched on its lofty summit, but it now teeters precariously 30% below that peak, like a wobbly jelly on a plate.

Yet, an amusing twist to this tale lies in the stark contrast between Realty Income’s business and its unfortunate stock performance. As of the ebbing second quarter of 2025, the company boasts over 15,600 properties-an impressive surge from the paltry 6,500 it had when it gallantly peaked in 2020 through cunning acquisitions and clever concoctions of development.

Moreover, in a fit of financial bravado, it raised its monthly dividends with delightful frequency, even during the pandemic-but what is this?! Their annual dividend has mushroomed to nearly $3.23 per share, yielding a princely 5.5%, standing tall as a giant amidst the S&P 500’s diminutive 1.2% average.

The Brave Opportunity Lurking Ahead

Interestingly enough, the present interest rate maelstrom has yet to squelch Realty Income’s growth. In the shimmering first half of 2025, the company’s revenue swelled to $2.8 billion, blossoming 7% compared to the previous year’s muddle.

Now, while expenses crept up by 6%, the second-largest expenses turned out to be those dastardly interest payments, ballooning by a hefty 13%. Investors now wear expressions of understandable concern, hoping for relief if Realty Income can enchantingly refinance debt or charm lenders into offering lower rates.

Miraculously, they still managed to woo $447 million in net income attributable to common shareholders during the first two quarters of 2025-up 16% from the year prior! Remarkable, isn’t it, how profits can flourish amidst the dark clouds of high interest rates?

And what of lower interest rates? What magic they could muster to persuade investors to take a second glance at Realty Income’s valuation! Its P/E ratio of 56 teeters just above the average of 54 over the last five years, prompting the curious to scratch their heads.

But wait! Realty Income twirls its wand to remind us it is indeed a real estate investment trust (REIT), meaning funds from operations (FFO) are far more vital than mere net income. For the past 12 months, its FFO sat proudly at over $3.65 billion, leading to a price-to-FFO ratio of just under 15-a figure that could send Realty Income soaring to spectacular heights if the winds of interest rates shift.

The Soothsayer’s Glimpse of Realty Income One Year On

With whispers of interest rate cuts swirling like leaves in the autumn breeze, the long-awaited recovery of Realty Income stock could ignite with fervor in the coming year, perhaps even turning heads with market-beating returns!

While the stock has languished like a forgotten tale in a dusty book, one mustn’t be fooled; it still expanded its portfolio and nurtured its dividend blossoms during this lengthy slumber.

Should the fabled interest rate cut manifest, Realty Income may find its chains of debt loosened, granting it the power to chasse after new properties or conjure remarkable buildings, subsequently enhancing its profits. With the delightful 5.5% dividend yield fluttering like a flag in the wind and an enticing price-to-FFO ratio of 15, this beleaguered stock may finally have its day in the sun, gleefully leaping into a prosperous new chapter.

🏰

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-17 11:54