They are known, these seven. The leviathans of our age, their names echoing through the halls of commerce: Nvidia, Alphabet, Apple, Microsoft, Amazon, Meta Platforms, and Tesla. A cohort assembled not by design, but by the relentless forces of accumulation. For years, their ascent has been taken as immutable law, their valuations divorced from the earthly concerns of prudence. But even empires bear the weight of gravity. And within the current market landscape, a faint possibility emerges – a fleeting moment where value, however distorted, might be glimpsed amidst the prevailing exuberance.

- Nvidia

- Alphabet

- Apple

- Microsoft

- Amazon

- Meta Platforms

- Tesla

To speak of ‘cheapness’ in relation to these entities feels… discordant. A misnomer, perhaps. Yet, the valuations, once soaring into the stratosphere, have begun to… settle. Not to a level of genuine affordability, understand, but to a point where a dispassionate assessment, stripped of the prevailing narrative of endless growth, becomes… permissible. We must, therefore, undertake a meticulous examination, a sifting of the numbers, to discern whether a flicker of opportunity exists within this seemingly impenetrable fortress of capital.

The Illusion of Premium

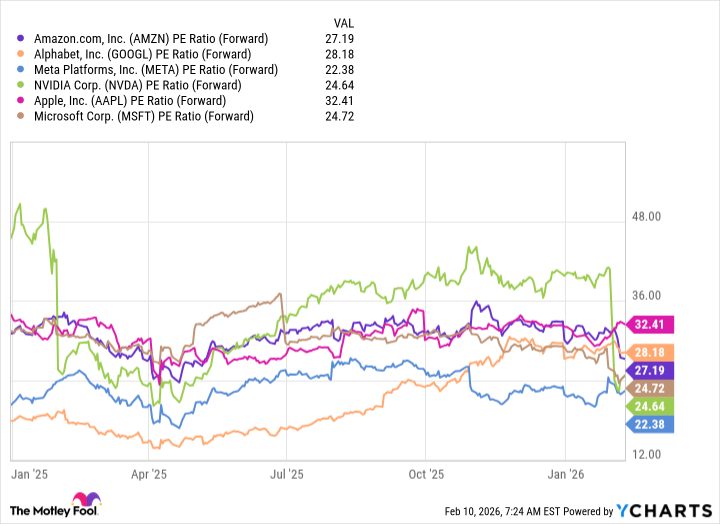

The tools of valuation are often crude instruments, blunt where nuance is required. Yet, they remain our only defense against the seductive allure of speculation. To assess these rapidly evolving entities solely on trailing earnings is to gaze into a rear-view mirror while hurtling towards an uncertain future. The recent surge in artificial intelligence, a phenomenon both promising and unsettling, has fundamentally altered the earnings landscape. To cling to the past twelve months as a measure of present worth is a dereliction of duty. Therefore, we turn to forward earnings – a projection, admittedly, fraught with peril, but a more honest attempt to capture the current trajectory.

The result is… revealing. A convergence, it seems, around a relatively narrow band of valuation. All trade at a premium, of course – these are not companies seeking humility. But the excess, the blatant disregard for fundamental principles, has… diminished. Tesla, however, remains an outlier – a creature unto itself, trading at a multiple that defies rational explanation. We shall exclude it from our consideration, not out of judgment, but out of a desire to focus on those entities where a semblance of value might, however faintly, be detected.

The range is roughly 22 to 30 times forward earnings. And within that range, three entities stand out: Nvidia, Microsoft, and Meta Platforms. These are not bargains in the traditional sense. But they are, relatively speaking, less… exorbitant. And when compared to the broader market – the S&P 500, trading at 21.8 times forward earnings – the disparity is… less pronounced. These companies are not merely reflecting the average; they are demonstrably exceeding it in terms of performance and potential. Yet, the market, in its collective wisdom (or lack thereof), seems… indifferent.

The Absence of Justification

Nvidia, for instance, has traded at this level on occasion during its ascent. There is no logical reason for the current discount. The fear of an artificial intelligence ‘bubble’ – a term bandied about with reckless abandon – is, I suspect, a convenient excuse. Amazon, Alphabet, and Meta Platforms have collectively committed to over $500 billion in capital expenditures by 2026, largely dedicated to the construction of data centers. This vast investment will inevitably flow towards Nvidia, fueling further growth. The projections from Wall Street analysts confirm this expectation, forecasting a 52% revenue increase for Nvidia in fiscal year 2027. To hesitate, to delay, would be an act of… imprudence.

Microsoft, meanwhile, suffered a minor setback following its recent earnings announcement. A curiously disproportionate reaction, given that the company outperformed expectations and Azure, its cloud computing platform, delivered a robust 39% year-over-year growth. The market, it seems, is quick to punish even the slightest imperfection. This temporary weakness should be viewed not as a cause for concern, but as an… opportunity.

Finally, Meta Platforms. At 22.2 times forward earnings, it is the most ‘affordable’ of the seven, trading at the same valuation as the broader market. One might expect, therefore, a growth rate of around 10% per year. One would be mistaken. Meta’s revenue rose 22% in the fourth quarter of 2025, and Wall Street expects a 25% increase this year, followed by 17% next year. These are not the figures of a company trading at a discount. Yet, the market remains… unmoved. And in that indifference, lies the… possibility.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-15 08:02