Stanley Druckenmiller, a man who has stared into the abyss of markets for decades and found, more often than not, a reflection of our own anxieties, once held Nvidia. He divested, of course. It was a logical, if perhaps regretful, severing. The fever pitch of valuation… it became unbearable, a grotesque distortion of underlying reality. He spoke of a possible return, a wistful contemplation, but only if the price were to descend from its precarious heights. A man of prudence, he is, and the market… the market rarely rewards such virtues.

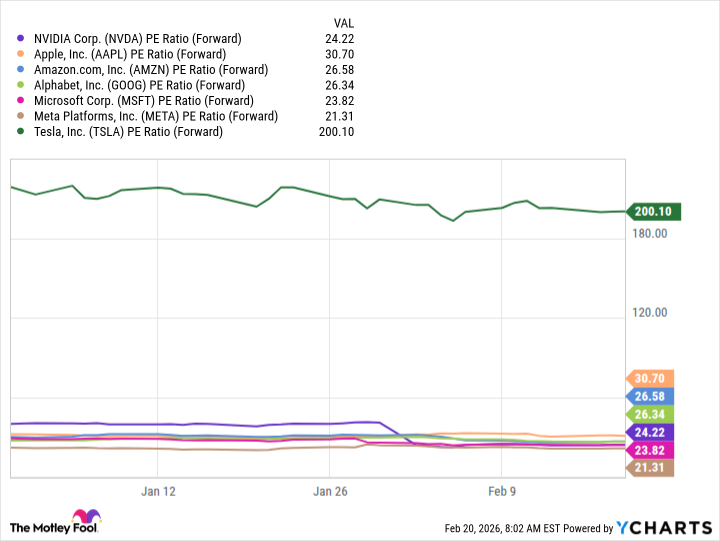

And descend it has, somewhat. Though “somewhat” feels a cruel jest when measured against the initial ascent. Nvidia now trades at a multiple that, while still demanding, no longer threatens to induce a moral panic. Yet, Druckenmiller remains unenthusiastic. He does not rush back into the fold. No, he is not a creature of impulse, of herd mentality. He seeks… something more substantial. A value, perhaps, that whispers of enduring strength, not fleeting hype.

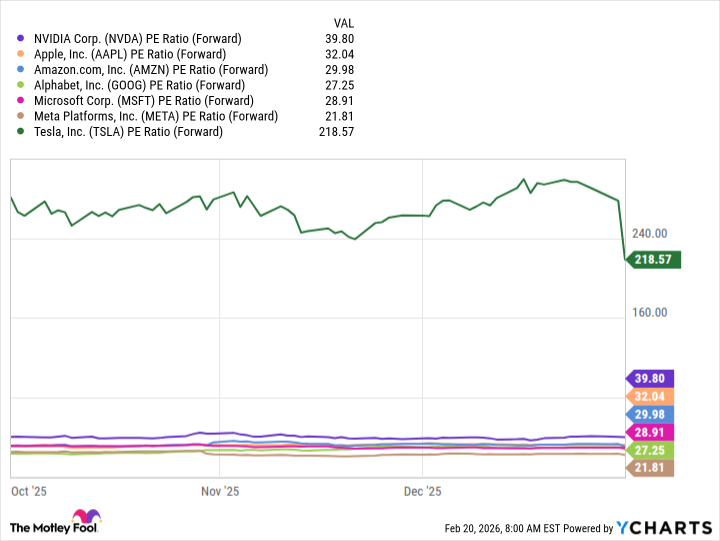

He has instead turned his attention to Alphabet. A quiet, almost understated move. It is not the flashiest of plays, not the one that will dominate headlines. But then, Druckenmiller has never been one for theatrics. He prefers the subtle shift, the carefully calculated position. Alphabet, at the time, represented a relative bargain amongst the so-called “Magnificent Seven” – a rather grandiose title, if you ask me, for a group of companies still subject to the whims of fate. He increased his stake by an astonishing 276%, a bold declaration in the language of capital. A man does not wager so heavily without a conviction, a belief that something… fundamental… is at play.

The allure of Alphabet, of course, lies in its burgeoning AI capabilities. It is not merely a search engine anymore, but a laboratory of artificial minds. And Google Cloud, that nebulous entity, is showing signs of genuine growth, fueled by the insatiable demand for AI infrastructure. But is it enough? Is any of it truly enough to justify the valuations we are seeing? That, my friends, is the question that haunts every rational investor. The market, in its infinite folly, often pretends otherwise.

We cannot know Druckenmiller’s precise reasoning. Perhaps he saw a confluence of factors – a favorable price, a strong underlying business, a strategic positioning for the future. Or perhaps, he simply felt a… resonance. A sense that Alphabet, despite its imperfections, offered a degree of stability in a world teetering on the brink of technological upheaval. A man of his experience learns to trust his instincts. They are often more reliable than any analyst’s report.

Should you follow his lead? That, ultimately, is a matter of temperament and risk tolerance. The market is a cruel mistress, and she favors the bold, but she often punishes the reckless. Nvidia, for all its potential, remains a volatile beast. Alphabet, while less exhilarating, offers a degree of comfort. Amazon, too, is a worthy contender, a behemoth that has weathered countless storms. But remember this: there are no guarantees. The future is shrouded in uncertainty, and even the most astute investor can be caught off guard. The only certainty is change, and the inevitability of loss. And perhaps, in the grand scheme of things, that is a truth worth contemplating.

So, observe Druckenmiller’s moves, yes, but do not blindly imitate them. Think for yourself. Question everything. And remember that the pursuit of wealth is a hollow endeavor if it comes at the expense of your soul.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2026-02-22 20:22