The year 2026 looms, not as a mere date on the calendar, but as a precipice. A point beyond which the relentless march of artificial intelligence will irrevocably alter the landscape of commerce, of existence itself. The hyperscalers – these modern titans – perceive this with a chilling clarity. To hesitate, to be overtaken, is to invite obsolescence, a fate they seem to regard with a peculiar, almost existential dread. And so, they pour forth capital, a veritable deluge of investment into data centers and the arcane machinery within, driven not by simple profit, but by a deeper, more unsettling impulse – the fear of being left behind in the darkness.

One might ask, is this merely a rational economic calculation? Or is there something more… primal at play? A desperate attempt to impose order upon the chaos of innovation? To build a digital fortress against the uncertainties of the future? I submit to you that it is both, and neither. It is the very essence of human striving, writ large upon the silicon canvas of the 21st century. And within this grand drama, three companies stand as particularly compelling figures: Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing. They are not merely benefiting from this surge; they are the surge, the very conduits through which this digital current flows.

These entities are, at present, reaping substantial rewards. But to view them solely through the lens of immediate profit is to miss the larger, more disturbing truth. The current spending is but a prelude, a mere foreshadowing of the immense capital outlays to come. Amazon, Alphabet, Meta – they speak of hundreds of billions. A staggering sum, yes, but it is not the magnitude that truly unnerves, but the implication. They are building not just infrastructure, but a new reality, a digital dominion where the boundaries of possibility are constantly shifting. And the cost? Nearly half of that immense expenditure is funneled directly into the acquisition of chips – the very brains of this new order.

Nvidia and Broadcom, then, stand at the epicenter of this transformation. But even they are not entirely independent actors. They rely, crucially, on the quiet, indispensable labor of Taiwan Semiconductor. It is a complex web of dependence, a delicate balance of power. One cannot thrive without the others. A chilling reminder that even in the age of digital disruption, the laws of interdependence remain immutable.

The projections are, frankly, audacious. Nvidia speaks of trillions – trillions – in global data center capex by 2030. A figure so vast it almost defies comprehension. But is it merely optimistic speculation? Or is it a glimpse into a future that is already unfolding, a future where the digital realm has become inextricably intertwined with the very fabric of our lives? The question haunts me, and I suspect it should haunt you as well.

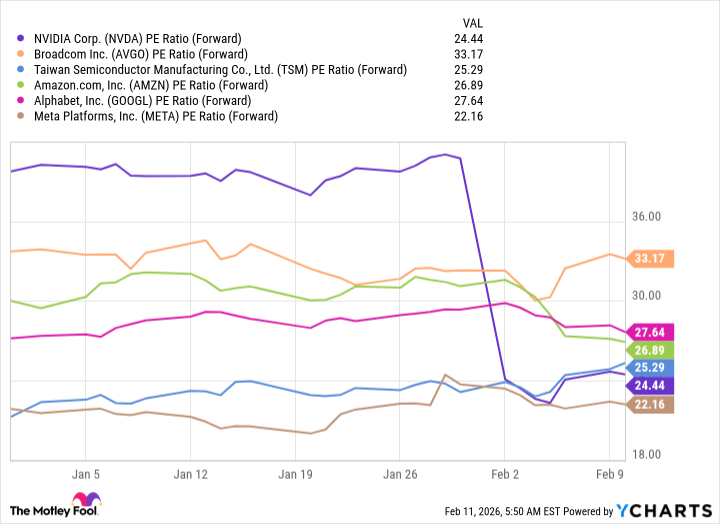

And yet, despite this potential for exponential growth, the market has not yet fully recognized the true value of these companies. They trade at reasonable multiples, a fact that strikes me as… peculiar. One might expect a frenzied rush to acquire their shares, a desperate scramble to capitalize on the impending boom. But the market, it seems, is often guided by forces that are far more opaque, more irrational. Perhaps it is a collective skepticism, a lingering doubt that this AI revolution will truly deliver on its promises. Or perhaps it is simply the inherent unpredictability of human behavior, the tendency to underestimate the power of transformative technologies.

Wall Street analysts predict impressive growth rates – 64% for Nvidia, 51% for Broadcom, 34% for Taiwan Semiconductor. But these are merely numbers, sterile abstractions that fail to capture the full scope of the opportunity. These companies are not simply poised to grow; they are poised to reshape the world. And in a world undergoing such profound transformation, a premium valuation is not merely justified; it is inevitable.

Therefore, I submit to you that these three stocks represent not merely a sound investment, but a necessary one. A way to participate in the unfolding drama, to align oneself with the forces that are shaping the future. The AI buildout will intensify, the demand for chips will surge, and these companies will be there to power the new digital age. But be warned: this is not a journey for the faint of heart. It is a descent into the unknown, a confrontation with the very essence of progress. And in the darkness, one can only hope that the light of innovation will be sufficient to guide us forward.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-02-16 23:12