The year 2025 witnessed a flourishing in the markets, the broad index known as the S&P 500 ascending with a vigor not seen in many a season – a gain of 16.4%. Yet, even as fortunes swelled for some, a more discerning eye might have noted a different current. For those who, at the year’s commencement, had placed their trust not in the entirety of the market, but in the singular vessel of the Vanguard Information Technology ETF, a considerably greater reward awaited – a return of 21.2%. It is a difference, perhaps, not merely of percentage points, but of recognizing where the true engines of our age are located.

This fund, unlike others that cast a wide net, focuses its energies upon the realm of information technology – a sector increasingly interwoven with the very fabric of modern existence. Within it reside the artificers of artificial intelligence, those who, with each innovation, reshape the contours of possibility, and, inevitably, of profit. It is a curious thing, this relentless pursuit of novelty. Do we truly understand the consequences of our creations, or are we merely swept along by the tide of invention?

Since its inception in the year 2004, this Vanguard offering has, year after year, surpassed the performance of the broader market. This is not a matter of chance, but of a consistent alignment with the forces driving progress. One might even say it is a testament to the enduring power of focused vision. Yet, to attribute success solely to shrewd investment overlooks the deeper currents at play – the ambition, the risk, the sheer human endeavor that underpins every technological leap.

A Universe Contained Within One Fund

Within the Vanguard ETF reside no fewer than 320 distinct enterprises, each a microcosm of innovation, each contributing to the complex tapestry of the technology sector. The largest portion of this portfolio – a substantial 32.4% – is dedicated to the realm of semiconductors. This is hardly surprising, given the pivotal role these microscopic marvels play in the age of artificial intelligence. Consider the titans of this industry – Nvidia, Broadcom, Micron, Advanced Micro Devices – their combined worth exceeding seven trillion. Such sums are not merely figures on a ledger; they represent the concentrated power of human ingenuity, the potential for both great benefit and, perhaps, unforeseen disruption.

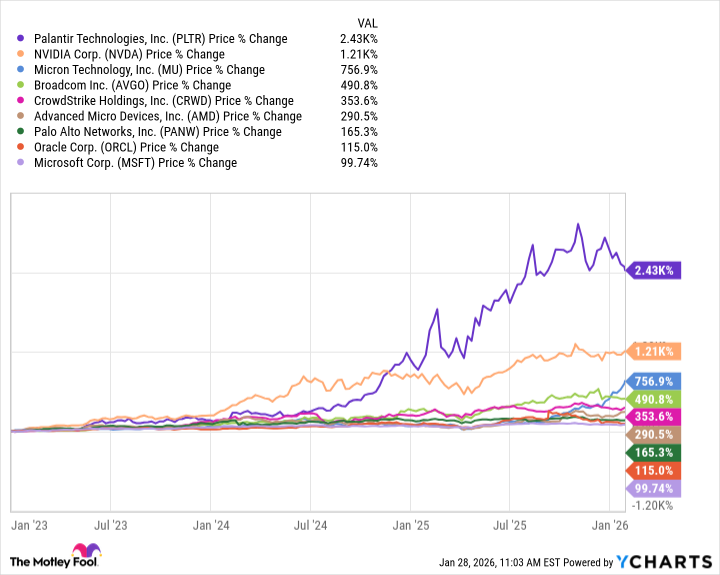

Following closely behind is systems software, comprising 17.7% of the fund’s holdings. Here, one finds companies like Microsoft and Palantir Technologies, purveyors of the intelligence that powers our digital world. Oracle, a hybrid of software and infrastructure, also occupies a prominent position, as do the cybersecurity fortresses of Palo Alto Networks and CrowdStrike. It is a landscape of constant vigilance, a perpetual arms race against those who would exploit the vulnerabilities of our interconnected systems. The irony, of course, is that security itself has become a commodity, a source of profit in a world increasingly defined by risk.

The Vanguard ETF, therefore, offers not merely exposure to a sector, but to an entire ecosystem. From the fabrication of chips to the development of applications, from the provision of internet services to the consulting that guides its implementation, every facet of the AI revolution is represented within its holdings. Indeed, since the dawn of this new era in 2023, these nine companies alone have, on average, experienced a return of 655%, a figure that dwarfs the 81% achieved by the broader S&P 500. It is a stark reminder that fortune favors those who recognize the currents of change and position themselves accordingly.

The Future, as Seen Through a Portfolio

Since its inception, the Vanguard Information Technology ETF has yielded a compound annual return of 14.1%, consistently outperforming the S&P 500’s average of 10.6%. This is not a fleeting phenomenon, but a testament to the enduring power of technological innovation. And as we look towards 2026, the signs suggest that this trend will continue. The recent reports from semiconductor fabricators and equipment suppliers – Taiwan Semiconductor Manufacturing, Texas Instruments, ASML Holding – all point to a surge in demand. This, in turn, fuels the growth of companies like Nvidia, AMD, Broadcom, and Micron, creating a virtuous cycle of innovation and profit.

But to focus solely on the immediate returns is to miss the larger narrative. Before artificial intelligence captured our collective imagination, this ETF drew its strength from other technological revolutions – the advent of the smartphone, the rise of cloud computing, the proliferation of enterprise software. And just as these technologies eventually yielded to the next wave of innovation, so too will artificial intelligence. Quantum computing, autonomous vehicles, robotics – these are the forces that will shape the future, and those who position themselves accordingly will reap the rewards.

The technology sector, therefore, is not merely a collection of companies, but a crucible of change, a testament to the boundless capacity of human ingenuity. The Vanguard Information Technology ETF, with its diversified holdings and consistent performance, offers a compelling opportunity for investors seeking to participate in this ongoing revolution. And while the future remains uncertain, one thing is clear: the weight of progress continues to shift, and those who understand its direction will be best positioned to navigate the currents of change.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

2026-02-01 20:22