For two decades now, the realm of technological enterprise has expanded, not as a blossoming garden, but as a vast, uneven terrain. To attempt individual cultivation of each promising shoot—each company—is a labor of Sisyphus. A more… pragmatic approach, if one may call it that, lies in the aggregation of these endeavors, a collective representation. This is the promise – and the peril – of the exchange-traded fund.

To seek a single vessel for such a portfolio is not to embrace optimism, but to acknowledge the sheer impossibility of informed omniscience. The Invesco Nasdaq 100 ETF (QQQM 1.19%) presents itself as such a vessel. It is not a panacea, but a distillation—a concentrated essence of the prevailing currents. It offers, if nothing else, a degree of insulation against the inevitable failings of individual enterprises – a small hedge against the relentless entropy of the market.

The Architecture of Dominance

QQQM mirrors the composition of the Nasdaq-100, an index charting the course of approximately one hundred of the largest non-financial entities listed on that exchange. It is a landscape deliberately sculpted, excluding the traditional bastions of finance – the banks, the insurers, the purveyors of mortgaged futures. What remains is a concentration of power, a testament to the ascendancy of those who manipulate information, facilitate connection, and increasingly, define the very contours of modern existence.

The technological sector constitutes over sixty-three percent of QQQM’s holdings. Nine of its top ten positions are occupied by entities engaged in the relentless pursuit of innovation – or, more accurately, the refinement of existing paradigms. The exceptions are telling:

- Nvidia: 8.63% of the ETF

- Apple: 7.19%

- Microsoft: 6.65%

- Amazon: 4.85%

- Meta: 3.76%

- Alphabet (Class A): 3.69%

- Tesla: 3.67%

- Alphabet (Class C): 3.43%

- Walmart: 3.02%

- Broadcom: 2.92%

To concentrate nearly forty-eight percent of a 104-stock fund within ten holdings is not, strictly speaking, diversification. It is, rather, a declaration of faith—a belief in the enduring power of a select few. These are the architects of our digital age: the purveyors of software, the manufacturers of desire, the masters of data, the shapers of the future. They represent not merely industries, but ecosystems – complex, interdependent webs of influence.

The absence of complete technological saturation—the inclusion of consumer discretionary, healthcare, and industrial entities—offers a degree of palliative care. It is a recognition that even the most formidable empires are vulnerable to external shocks, to shifts in consumer sentiment, to the unpredictable currents of the broader economy. It is a small, belated acknowledgement of the interconnectedness of all things.

The Illusion of Progress

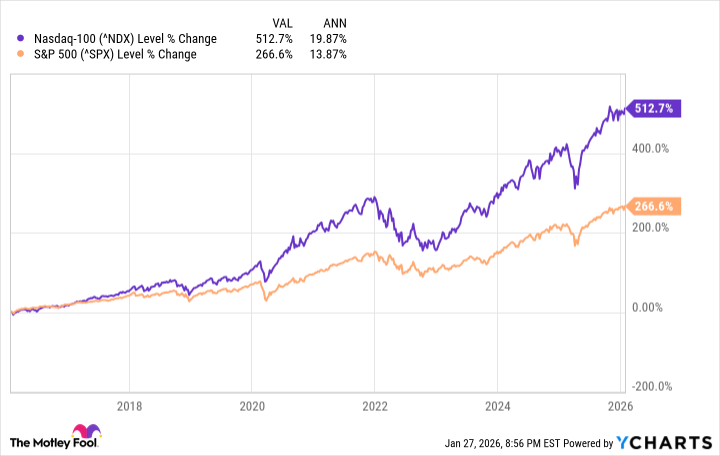

Over the past decade, the Nasdaq-100 has yielded an average annual return exceeding nineteen percent. A modest investment of two thousand units of currency a decade ago would now be worth approximately twelve thousand two hundred and fifty. QQQM, a more recent arrival, has averaged fifteen and a half percent since its inception in October 2020. To expect such returns to persist indefinitely is, of course, a folly. The market is not a benevolent benefactor; it is a capricious mistress.

Even a “modest” ten percent annual return would, theoretically, double your investment every seven and a half years. Such calculations are seductive, but they conceal a fundamental truth: nothing is guaranteed. The past is not a predictor of the future; it is merely a record of what has already been lost. The companies driving QQQM’s performance are, undoubtedly, formidable. But even the most robust enterprises are susceptible to the ravages of time, the whims of fashion, the inevitable consequences of hubris.

The Weight of Fractions

The resemblance of QQQM to its predecessor, the Invesco QQQ Trust ETF (QQQ 1.20%), is not accidental. They are, for all intents and purposes, identical—mirror images of the same underlying index. The distinction lies in a seemingly insignificant fraction: the expense ratio. QQQM’s is 0.15 percent, compared to QQQ’s 0.18 percent.

The difference appears negligible on paper. But over time, these fractions accumulate, compounding into a substantial sum. Consider a monthly investment of five hundred units of currency, averaged at a ten percent annual return:

| Years Invested | Investment Value Without Fees | Fees Paid With QQQM | Fees Paid With QQQ |

|---|---|---|---|

| 10 | $95,920 | $990 | $1,120 |

| 15 | $190,630 | $2,250 | $2,700 |

| 20 | $343,650 | $5,800 | $6,950 |

| 25 | $590,080 | $13,150 | $15,740 |

| 30 | $986,960 | $27,600 | $33,020 |

To invest in the same underlying index while simultaneously reducing costs is a small victory—a momentary reprieve from the relentless erosion of wealth. QQQM is not a panacea, but it is, perhaps, a marginally more efficient vessel for navigating the turbulent waters of the modern market.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

2026-02-01 18:04