In the vast, unrelenting terrain of Wall Street, where the winds of fortune shift like desert sands, a new breed of colossus has risen. They are called the Magnificent Seven-seven titans who have carved their names into the bedrock of the technology age. Their combined worth, $19.7 trillion, is a monument to human ingenuity and corporate ambition. Yet their true power lies not in numbers alone, but in the quiet revolution they stir beneath the surface.

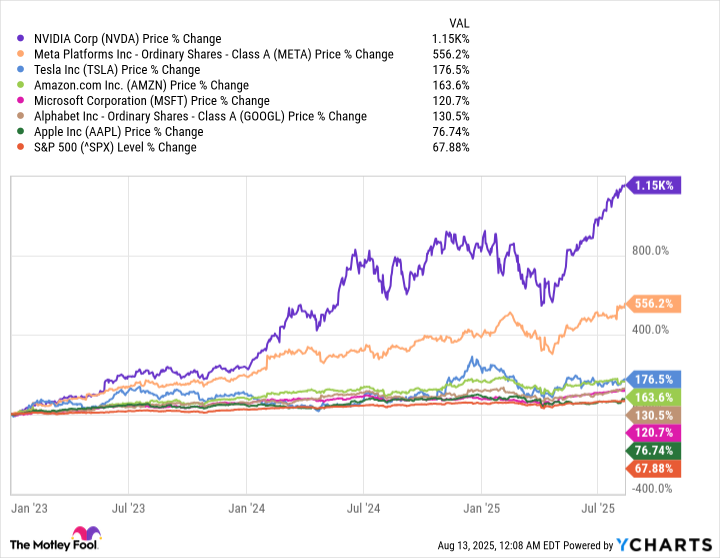

Since the dawn of the artificial intelligence era in 2023, these seven have marched forward with the resolve of pioneers. Their median return of 163% has outpaced the S&P 500’s 67%, a chasm that leaves many small investors gazing upward, their portfolios diminished by the shadow of these giants. The market’s fickle heart may turn cold, but for now, the Magnificent Seven reign.

Yet hope persists for the ordinary man and woman who dare to stake their claim. The Vanguard Mega Cap Growth ETF (MGK) offers a bridge-a way to stand beneath the canopy of these titans while still glimpsing the sky. It holds 69 stocks, 57.7% of which are the Magnificent Seven, their roots entwined with the future of AI. The rest, a scattering of old-world titans like Eli Lilly and Boeing, whisper of stability in a world that thrums with silicon.

The Seven and the Alchemy of AI

These seven companies are not mere corporations; they are alchemists, turning the leaden data of the present into the gold of tomorrow. Their laboratories are server farms and codebases, their wands the GPUs and algorithms that power AI:

- Nvidia forges the tools of the revolution-graphics processing units that hum with the energy of a thousand minds.

- Microsoft stitches AI into the fabric of daily life, from the flicker of a Copilot assistant to the vast Azure clouds where ideas take flight.

- Apple whispers intelligence into devices, its Intelligence software a quiet storm of automation in pockets and palms.

- Amazon weaves AI into the tapestry of commerce, from Rufus the shopping assistant to the invisible sentinels that guard its warehouses.

- Alphabet builds the bridges between human thought and machine, its Gemini models spanning the chasm with uncanny grace.

- Meta bends attention into algorithms, its Llama models a gift to the open-source faithful.

- Tesla charges ahead into the electric future, its Cybercab a promise of roads unburdened by human hands.

But the Vanguard ETF is no slavish servant to these giants. The remaining 42.3% of its holdings-Visa, Costco, McDonald’s-anchor it to the earth, a reminder that the world still runs on groceries, burgers, and the quiet pulse of credit cards.

A Portfolio’s Double-Edged Sword

Yet this ETF is not a talisman. Its concentration in AI and the Magnificent Seven is both its strength and its vulnerability. Should the alchemists falter, the ETF’s value would wither like a prairie in drought. But for those who temper its boldness with a broader portfolio, it becomes a plowshare-turning the soil of diversification to plant seeds of growth.

Since 2007, the ETF has yielded 13.5% annually, a full 3.4% more than the S&P 500. Imagine the tale of two $10,000 investments: one in the S&P alone, the other split. By now, the split would have grown to $154,222, while the S&P alone would hover at $113,032. The ETF’s volatility, like a storm over the plains, is softened by the shelter of a balanced portfolio.

Cathie Wood’s vision of a $13 trillion AI software industry by 2030 and Jensen Huang’s prophecy of $1 trillion in data center spending by 2028 are not mere numbers. They are the echoes of a new frontier, one where the Magnificent Seven stand as both pioneers and gatekeepers. For the small investor, the Vanguard ETF is not just a tool-it is a testament to the enduring human urge to stake a claim in the unknown.

The road ahead is long, and the market’s winds are fickle. But in the shadow of giants, even the humblest investor can plant a flag. 🌾

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-17 14:37