In the aftermath of a recent meeting of the Federal Open Market Committee (FOMC), the US Dollar Index (DXY) condescended to plummet, as if through some divine intervention, sparking fervent debate on its potential impact on Bitcoin (BTC) and the mercurial world of liquidity.

Ah, Bitcoin! The digital phoenix that has risen yet again to embrace the $85,000 range. But before we pop the champagne 🥂, let’s not get ahead of ourselves—future gains are still hanging in the balance, like a tightrope walker in a windstorm.

Fed’s Crystal Ball Comes Up Short Amid Economic Fears

Analysts—those diligent soothsayers of market fortunes—believe that a faltering dollar could very well forge a brighter path for Bitcoin’s recovery. This scintilla of optimism shines in stark contrast to the shadowy concerns softly lurking in the macroeconomic corners.

Our dear President Donald Trump has thrown a celebrity-esque fit, vociferously clamoring for the Fed to cut interest rates like a chef de-juicing a lemon.

“The Fed would be MUCH better off CUTTING RATES as US Tariffs start to transition (ease!) their way into the economy. Do the right thing,” Trump quipped on Truth Social, likely while standing under an umbrella of orange spray tan.

Such utterances reveal potential political spats looming over our emotional landscape of monetary policy—leaving risk assets teetering in uncertainty.

Unfortunately, the FOMC slapped down Trump’s wishes, opting not to entertain further interest rate cuts, while presenting an economic revision that felt like a cold splash of water to the face. Cheers to downward revisions for 2025!

The Fed decided to lower its GDP growth forecast from a hopeful 2.1% to a rather unexciting 1.7%. Meanwhile, the unemployment number is looming at 4.4%, like an unwanted house guest. Pair that with inflation whimsically underestimated with PCE inflation set at 2.7% and core PCE at 2.8%—both skyrocketing beyond previous expectations, and it’s a pretty dismal picture.

In stark contrast, the DXY took quite the nosedive right after this bombshell played out.

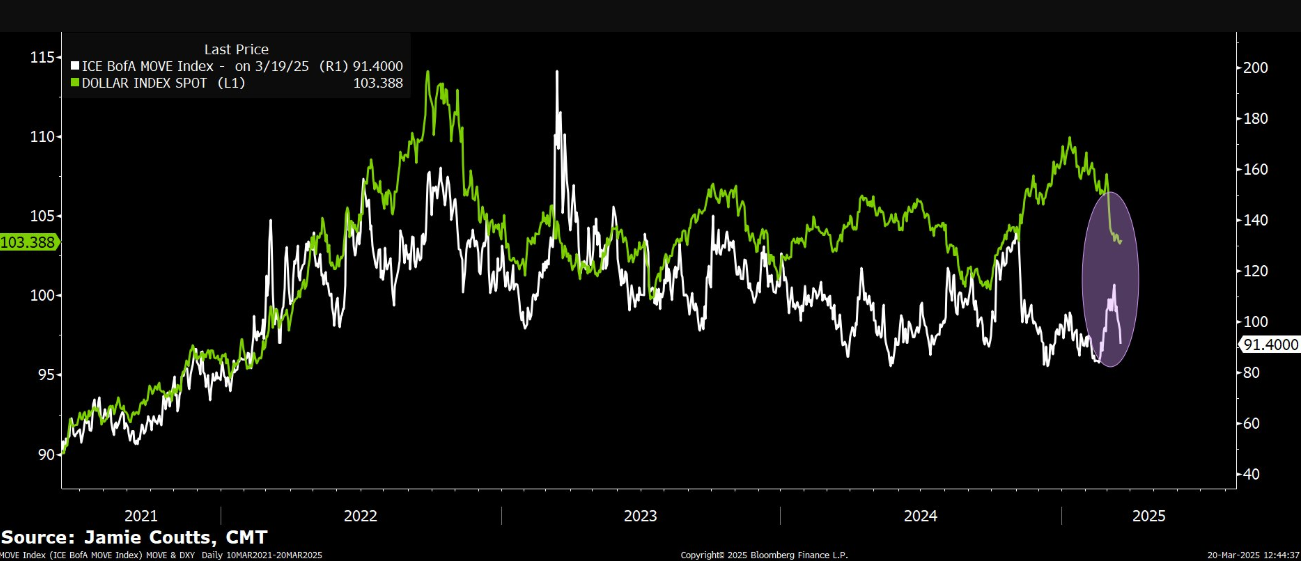

Over in the land of serious business, Real Vision’s chief crypto analyst, Jamie Coutts, a digital oracle for the masses, weighed in on the debacle. In a rather spirited post on X (Twitter), he suggested that quantitative tightening (QT) might as well be declared deceased, for the foreseeable future.

Coutts points out a delightful drop in Treasury yield volatility, conspiring with the DXY’s downturn to paint a rosy picture of future Bitcoin prospects, or at least a well-staged propaganda piece.

“After last night, QT is effectively dead (for some time). Treasury volatility has backed right off and is now mirroring the decline in DXY from earlier this month. This is all extremely liquidity-positive,” Coutts asserted, because who doesn’t love a bit of liquidity?

Yet not all glimmering knights in analyst-tinted armor share the same glowing sentiment. Analyst Benjamin Cowen insists QT is still trudging along, albeit at a leisurely pace.

“QT is not ‘basically over’ on April 1st. They still have $35 billion per month coming off from mortgage-backed securities. They just slowed QT from $60 billion per month to $40 billion per month,” Cowen cautioned, probably while twirling a pencil in thought.

Bitcoin and the Dollar: Will it Ever be a Match?

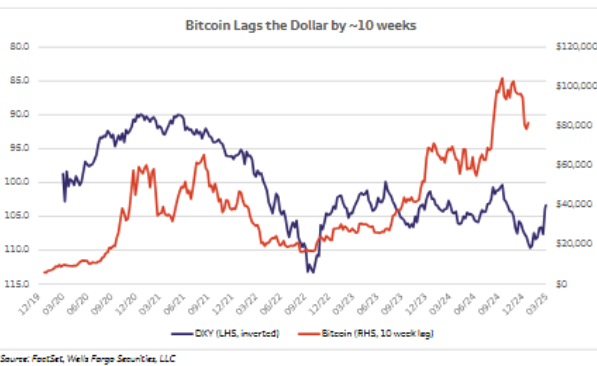

Leading us into this wild hypothesis, Mathew Sigel, VanEck’s whimsical Head of Digital Assets Research, pointed out Bitcoin’s tendency to stalk the DXY monthly drama with a 10-week delayed reaction. Could it be that our beloved Bitcoin’s tempestuous pricing is merely playing catch-up with the erstwhile robust dollar that now lies in defeat?

If patterns hold like a cat to a sunbeam, we might just be poised for a Bitcoin renaissance, all thanks to the DXY’s recent descend into the abyss.

Meanwhile, BitMEX co-founder Arthur Hayes chuckles cautiously, recognizing that while QT is easing, he questions whether fiscal movements in the EU—spurred by military spending and armed with freshly printed euros—could overshadow the shenanigans in the US.

“Will the re-arming of the EU paid for with printed EUR overwhelm the near-term negative fiscal impulse of the US? That’s the big macro question. If yes, correction over. If no, hold on to your butts,” Hayes quipped, as if relishing the turbulent times.

Hayes jests that perhaps Bitcoin’s slip down to $77,000 might have been a false bottom. But, be cautioned: traditional markets may yet have more pummeling in store, a storm cloud that might rain on our crypto parade.

Thus, the post-FOMC atmosphere bathes us in mixed signals for Bitcoin. On one hand, lower DXY, less Treasury volatility, and sluggish QT whisper sweet nothings of increasing liquidity—historically, quite a boon for BTC. But on the other hand, ominous macroeconomic drama, rising corporate bond spreads, and the potential for chaotic instability lurk, ready to strike at a moment’s notice.

With Bitcoin’s historic lagging behind DXY movements, the coming days beckon with the ominous allure of a delayed rally. Political climate and global liquidity conditions remain the ever-watchful sentinels, dictating Bitcoin’s next major frolic on the markets.

As of now, BeInCrypto data reports BTC was basking at $85,832. A gasp-worthy gain of nearly 4% over the past 24 hours—oh, how thrilling!

Read More

2025-03-20 11:31