It seems the US economy is doing its best impression of a sinking ship, and in the lifeboat? Bitcoin. Major companies are already jumping aboard, and who can blame them? The dollar’s about as stable as a house of cards in a hurricane. 🌪️💸

Nic Puckrin, a crypto analyst who’s seen enough of this to know what’s coming next, sat down (virtually) with BeInCrypto to share his thoughts on how this is all going to play out. Spoiler alert: Bitcoin wins. 🏆

Could a US Recession Actually Help Bitcoin? (Yes, You Read That Right)

Not too long ago, the fear of the US economy plunging into a recession seemed like something from the ‘not today’ file. The Atlanta Fed released some optimistic GDP numbers, tariffs took a step back, and people were casually sipping their lattes, thinking all was fine. ☕📈

But wait – it’s 2025, and the economy is clearly a bit of a drama queen. Two critical indicators of economic health have suddenly gone from “meh” to “uh-oh,” showing trouble for the dollar and a big ol’ green light for Bitcoin. 🚦

These two harbingers of doom (or at least, uncomfortable uncertainty) are the OECD’s Economic Outlook and the ADP’s jobs report. The latter one reveals that private sector hiring is at its lowest point in over two years, which got President Trump all fired up, pressuring Jerome Powell to lower interest rates. 💼🔻

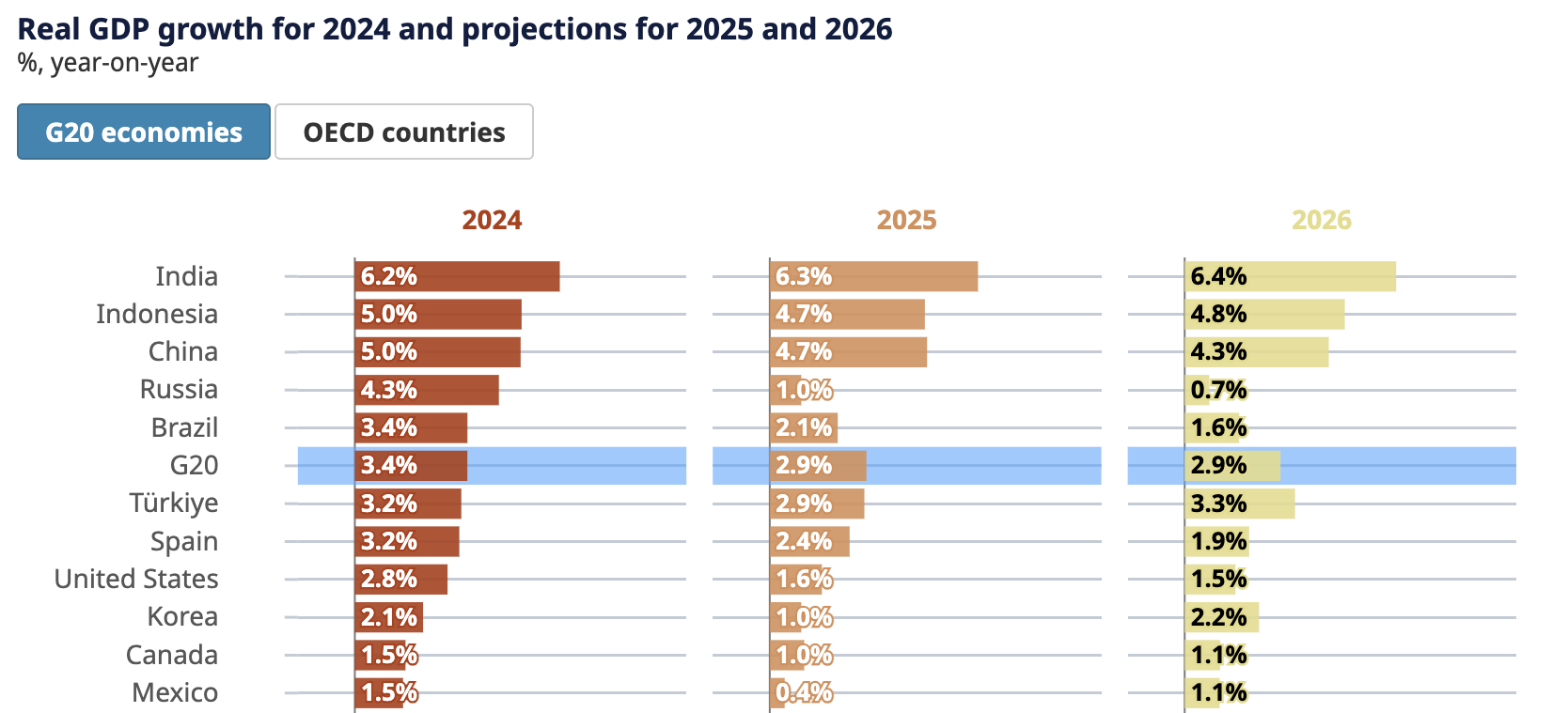

Meanwhile, the OECD didn’t mince words. They’ve officially downgraded the US GDP growth from 2.8% in 2024 to a dismal 1.6% in 2025, and then it keeps on falling. Their report practically has “incoming recession” stamped in big red letters. 😱

And just to make things extra interesting, there’s talk of new tariffs on the EU and more tech sanctions against China. Because why not add fuel to the fire, right? 🔥

So, Nic Puckrin weighed in on how this chaos could *actually* work out in Bitcoin’s favor:

“The OECD has just put a number on one of investors’ biggest fears about the US – its growth outlook, which it now predicts will be lackluster at best over the next two years. If the US dollar was still clinging to hopes of a rebound before this, the OECD’s damning report has finally sounded its death knell,” Puckrin said, clearly holding back tears of joy. 🥳

He also pointed out a few other fun facts, like the US dollar index (DXY) plummeting 9.3% year-to-date. And Morgan Stanley? They predict another 9% drop next year. How’s that for a wild ride? 🎢

Now, here’s the kicker: Bitcoin, that magical digital currency, is acting less like an unpredictable rollercoaster and more like a surprisingly calm boat in the storm. 🛶 And guess what? US companies are noticing. Corporate bigwigs like MicroStrategy are throwing in major investments, and there’s a flood of ETF inflows showing us that something is clearly afoot.

JPMorgan, ever the opportunist, even launched a new service for institutional clients to get a little more crypto exposure. The data is piling up, and it’s clear: Bitcoin is getting its time in the spotlight. 💡

“Companies are practically tripping over themselves to stash their cash in Bitcoin. As the US dollar keeps losing value, more and more investors are going to scramble to secure their assets. Bitcoin has been holding steady above $100,000 for over 20 days now, and it’s looking like the new safe haven,” Puckrin added. 🛡️💰

However, and this is important, just because corporations are gobbling up Bitcoin doesn’t mean it’s all sunshine and rainbows for the average person or the decentralized finance (DeFi) ecosystem. But hey, at least the price of Bitcoin is going up, so there’s that. 📈

All things considered, this demand is going to keep pushing Bitcoin’s value higher, and investors who saw the writing on the wall early might just find themselves with some nice, juicy returns. 🍎 As the recession looms (or is it already here?), those with Bitcoin in their pocket might be the ones laughing all the way to the bank. 🏦

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- 30 Best Couple/Wife Swap Movies You Need to See

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-06-05 00:06