The S&P 500 (^GSPC +0.88%) recently scaled a new peak, and the air hums with optimism-though one might suspect the market’s cheer is as fickle as a Soviet bureaucrat’s promise. A recent survey by the American Association of Individual Investors reveals that over 44% of U.S. investors fancy themselves bulls, a term that, in investing, means “I’ve forgotten what fear feels like.”

As 2026 looms, it is prudent to inspect one’s portfolio with the scrutiny of a man checking his pockets before a revolution. While strategies vary like the weather, one maneuver stands out: the art of not panicking when the market behaves like a capricious lover.

The virtue of persistence

Some investors, spooked by record prices, retreat like phlegmatic monks. Yet waiting for a “better time” is a gamble as perilous as betting on a horse named “Maybe.” The market, after all, is a fickle mistress. One day she grins, the next she weeps-and no oracle can predict her moods.

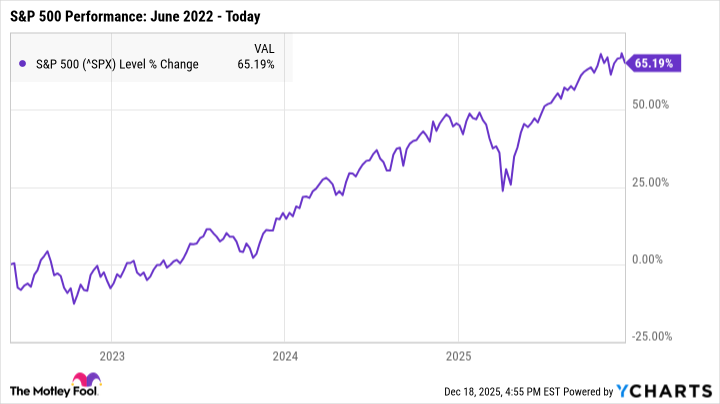

Consider the 2022 prophecy from Deutsche Bank: “A near-100% chance of recession!” By 2023, the S&P 500 had soared 16%. By now, it’s up 65%. Those who fled in fear? They missed the feast, while the bold dined on gains.

To abandon the market mid-2022 was to trade a golden goose for a feather. Consistency, dear reader, is the unspoken secret of the wealthy: invest regularly, regardless of the market’s antics. For in time, the tide returns, and the patient reaps the harvest.

The long game: a tale of resilience

Markets, like empires, eventually falter. Yet those who endure the storm emerge with their coffers intact. Take the 2007-2009 crash: a decade later, the S&P 500 had surged 80%. Even the most ill-timed investment, if rooted in solid ground, can bloom into fortune.

The key? Choose wisely. Stocks with shaky foundations will crumble, while those with robust legs will dance through the storm. Now is the hour to audit your holdings-sell the duds, cling to the champions.

The future is a riddle, but the solution lies in steadfastness. Invest in quality, stay the course, and let time be your ally. For in the grand chessboard of finance, the best move is often the simplest: to keep playing.

And so, dear reader, we part with a single truth: the market’s whims are eternal, but so too is the reward for those who dare to outlast them. 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2025-12-20 16:02