Ah, the Fed Governor, wise as ever, seems to have seen a vision! And what vision do you ask? A rather curious one at that-stout stablecoins prancing around the global finance playground, potentially tinkering with the Fed’s dear interest rates.

In the quaint realm of finance, where majestic theories often lead to the unassuming concrete walls of banking, Governor Miran appears to have embarked on an intriguing fantasy. These-these dollar-sterilized stablecoins-have caught quite the buzz. And why not? They disguise themselves as digital tokens, likened to stampeding bulls with the U.S. dollar as their majestic flag.

As they flood into the unwitting hands of people across the world-mostly in lands where the banking system is as labyrinthine as the U.S. Senate-the Fed is cautiously whispering that perhaps a reassessment of the “neutral” long-term interest rate is in order. Imagine that, a debtless democratization of dollarized denizens!

Admittedly, and at this juncture I offer you a playful chuckle, stablecoins have been adopted in realms where banking access is as clouded as last summer’s fog by the Volga-a place, my dear reader, where local currencies dance like marionettes in the tempest of inflation!

With some statutory flourish this year, the GENIUS Act (graciously, of course) rolled out a floodlit red carpet for U.S.-based stablecoin issuers, compelling these purveyors to keep their reserves as unassailable as an impenetrable fortress of safe and liquid dollar assets. Ah, how credibility does bloom in such regulated gardens!

The Grand Waltz of Dollar Access

The stablecoin, that dancer par excellence, has now found its tune in emerging economies-a symphony of blockchain music playing across borders, where the vigilant financial sentinels dare not tread. What a delightful carnival they are henceforth hosting!

Indeed, while appetite for these tokens might originate from beyond Uncle Sam’s garden rather than within it, they promise the thrill of transacting in the land of the free for those languishing under rigid financial barricades. And the finesse of this digital dance shall even drive more patronage to the ever-so-bountiful U.S. Treasury markets!

Introducing: A New Knight of Interest Rates

Miran extended a nod to the era of the “global saving glut,” conjuring memories of when illustrious foreigners, bedazzled by dollar allure, channeled funds into American investment havens. Might these stablecoins then, like a quiet giant in the lush Gorkhys-Eurasian forests, subtly reroute rivers of international capital back to U.S. Treasury riches?

With estimates suggesting they could bloat to the colossi of $1 to $3 trillion by 2030, it’s no secret: this growth might nudge the pursuit of the “normal” interest rate to a slightly undignified bow, lower today than ever anticipated.

The Current Market: A Spirited Ballet

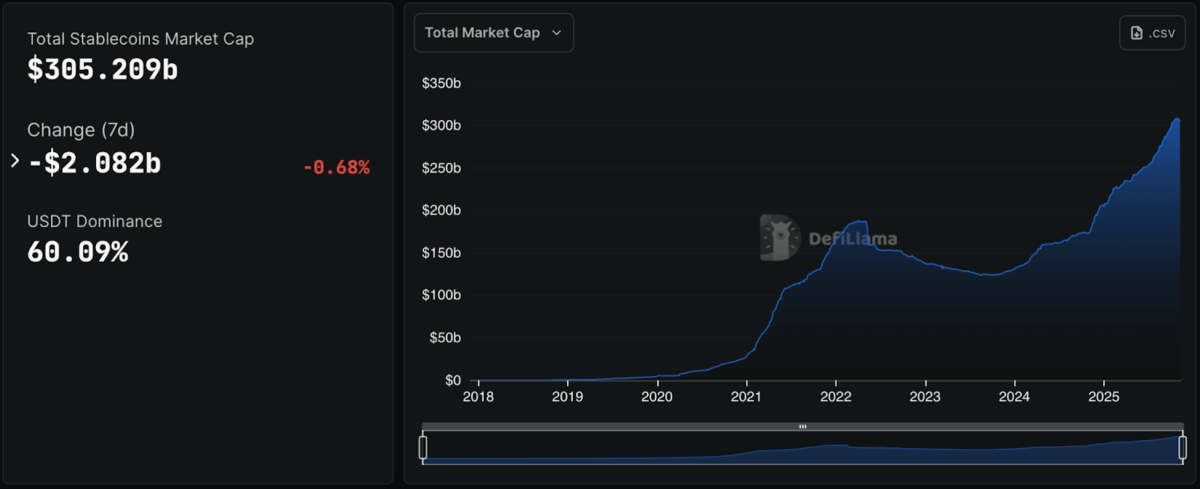

The stablecoin gallant, wears its crown regally with a valuation approaching $305.2 billion. Tether, as though in an eternal chase, holds the majority of this majestic horde. Ever since the Great Crypto Boom of yesteryear, the stablecoin’s chronicle has been one of turbulent passions-ups, downs, and sweeping crescendos.

Such tokens persist in their faithful service across markets, decentralized finance, and cross-border payment operas. Amidst these rhapsodic turns, they emerge from mere crypto dalliance to being forces shaper of monetary sovereignty. How delightful this not-so-distant future where stablecoins have woven themselves into the fabric of international finance!

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-11-10 10:14