In the shadow of silicon peaks and data-center canyons, the world has carved a new frontier. Artificial intelligence, that restless firebrand, has scorched through boardrooms and balance sheets like a prairie fire. Yet amid the smoke, three titans stand-unyielding, weathered, and quietly humming with the promise of tomorrow. They are not the flashy prospectors of this gold rush but the blacksmiths and scribes of the silicon age, forging tools for a world that has yet to be built.

1. The Blacksmith of the Digital Frontier

Taiwan Semiconductor Manufacturing (TSMC) wears its anonymity like a well-worn coat. To the untrained eye, it is a factory of sand and fire, a place where raw elements are coaxed into the nervous systems of machines. But in the hush of its cleanrooms, where engineers toil like monks in a cathedral of circuitry, lies the beating heart of AI’s ascent. These chips-those tiny, unassuming slabs of silicon-are the loom on which the tapestry of machine learning is woven. Without them, even the most ambitious algorithms would wither like seedlings in a drought.

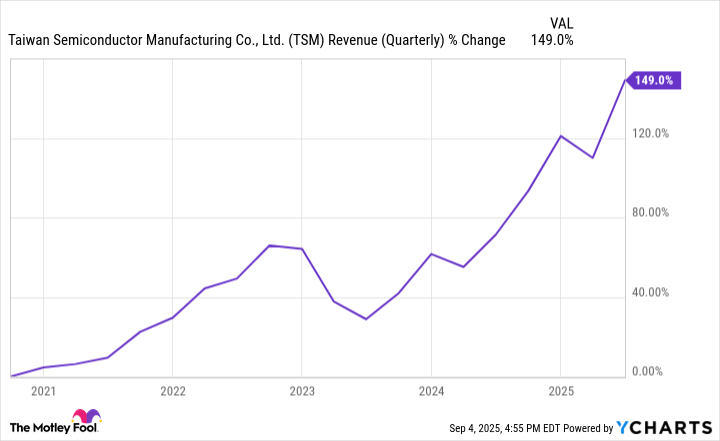

TSMC’s dominion over the foundry world is not a matter of pride but of necessity. Its 70% grip on global chip production is less a monopoly than a mandate of scale and precision. When AI demands the impossible-millions of calculations per second, the weight of the world crammed into a single wafer-it turns to TSMC. This year, the company’s high-performance computing segment swelled to 60% of revenue, a testament to the silent labor of its furnaces. And still, the demand grows. AI-related revenue is poised to double, a tide that no amount of geopolitical squabbles or supply chain storms can halt.

To hold TSMC is to hold a stake in the scaffolding of the future. It is not the flashy face of AI but the hands that build its bones. And in the long game of growth investing, the hands that build are often the ones that endure.

2. The Scribes of the Silicon Age

Alphabet (GOOGL) is a company of paradoxes. It is both scholar and merchant, a library of human knowledge and a marketplace of machine intelligence. In its labs, engineers scribble equations on whiteboards like alchemists seeking the philosopher’s stone. In its cloud, it hoards the data that fuels the engines of AI. Google Cloud, now Alphabet’s fastest-growing segment, is not merely a service but a lifeline for the next generation of machine minds. When Meta Platforms pledged $10 billion to anchor its AI ambitions in Google’s infrastructure, it was not a transaction but a covenant.

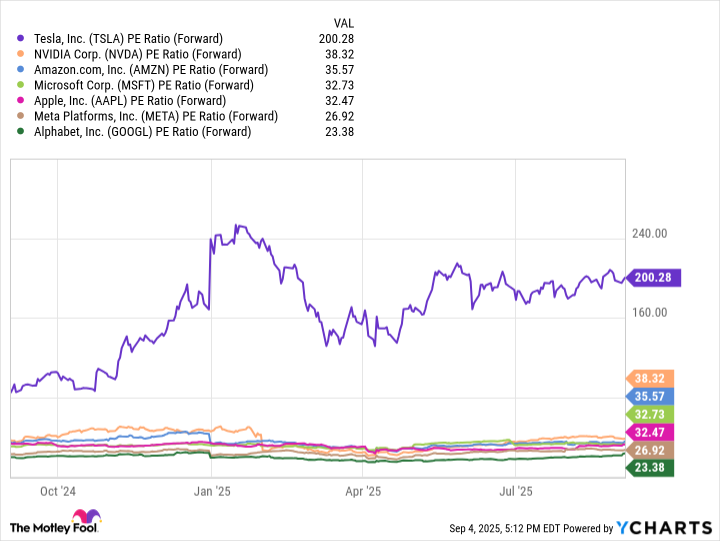

And yet, for all its might, Alphabet walks a tightrope. Its stock, trading at a fraction of its peers’ valuations, whispers of undervalued potential. The market, ever the impatient child, forgets that great inventions take root slowly. For the patient investor, this is not a flaw but an opportunity-a chance to buy the quill before the scribe writes the next chapter of the digital age.

3. The River That Nourishes the Land

Microsoft (MSFT) is the kind of company that makes its power look effortless. It is the river that carves canyons, the wind that carries the seeds of innovation. From the humming servers of Azure to the desks of Office users, Microsoft has woven itself into the sinews of modern life. Its partnership with OpenAI is not a gamble but a bridge-a direct line to the bleeding edge of AI, where theory meets the cold, hard ground of application.

What sets Microsoft apart is its ability to turn tides into tributaries. The AI enhancements in Excel, the neural networks embedded in Teams-these are not flashy parlor tricks but tools that make the invisible visible. And in the enterprise world, where contracts are measured in years and budgets in billions, Microsoft’s dominance is not a fortress but a fortress in motion. It is the quiet certainty of a company that knows its customers will not abandon it, even in the leanest seasons of the economy.

If I were to name one stock to hold until the stars grow cold, it would be Microsoft. Not for its stock price, but for its story-a story of relentless integration, of turning the abstract into the essential.

Investing is not the art of chasing sparks. It is the patience to hold the match until the kindling catches. These three-TSMC, Alphabet, Microsoft-are not just companies. They are the kindling of the next century. 🔥

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-09-10 17:45