Artificial intelligence, that modern siren song, lures investors with promises of gold. BigBear.ai Holdings (BBAI), with its $2 billion market cap, floats among them—a vessel of fragile hope. Its mission: to furnish businesses with “AI-powered insights.” A phrase as hollow as a tin whistle, yet it hums with the same delirious charm as a summer twilight.

This week, the stock’s year-to-date ascent of 65% might be mistaken for a dance. But the music is faint, and the floorboards creak. Investors, like moths, cluster around its modest valuation, convinced the fireflies ahead will soon blaze into constellations. Yet earnings reports, those brittle parchment leaves, have seldom stirred the stock from its drowsy drift.

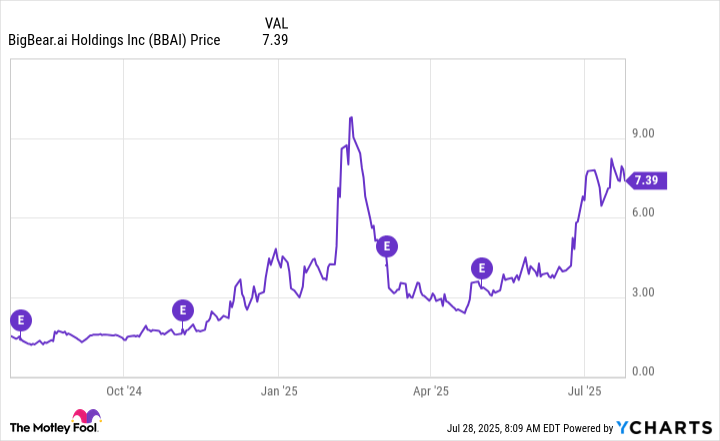

How BigBear.ai stock has done after earnings in the past year

Earnings season is a theater of vanities. BigBear.ai’s performances, lately, resemble a pianist who forgets the melody. Last May, it announced 5% sales growth and affirmed its forecast. The numbers, like a half-remembered dream, left little impression. The stock drifted downward afterward, as if the market had already written its epitaph in pencil.

Yet there was a curious twist: the stock doubled in the months following. Not from earnings, but from partnerships with airports and the U.S. Army—collaborations that smelled less of strategy and more of desperation. Investors, ever the optimists, clung to these scraps as if they were coupons for salvation.

The market may be looking for more signs of progress

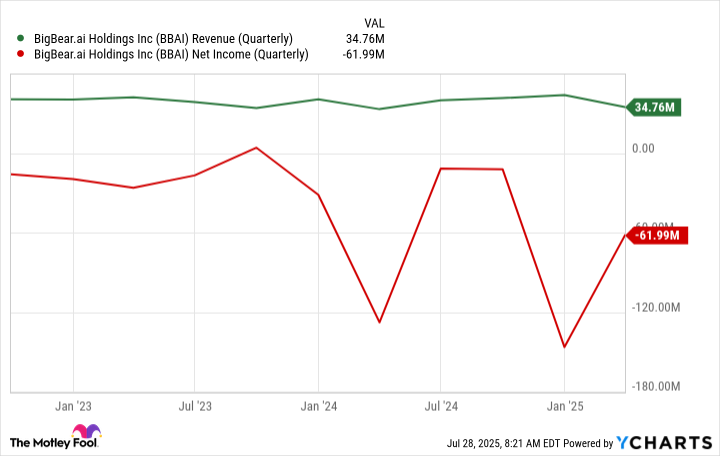

The company’s financials, however, remain a ledger of quiet despair. Losses swell like a tide, and profits linger as ghosts. In an age where AI startups bloom like weeds, BigBear.ai’s growth feels like a clockwork bird that flaps its wings but never takes flight. If the next quarter offers no respite—no whisper of margin improvement or guidance upgrades—the stock may yet return to its native soil of mediocrity.

Is BigBear.ai stock a buy before its next report?

I would not buy it today. The company’s margins are as thin as a beggar’s coin, and its sales, for all its press releases, remain a trickle. The market’s patience is a thread stretched near its breaking point. If you must act, do so before August 11—not out of faith, but out of habit. The stock may yet surprise, though surprises in this arena are often just the echo of a door slamming shut.

In the end, BigBear.ai is a story written in footnotes. Its potential is a horizon that recedes with every step. To watch it is to witness the slow, inevitable settling of dust. And so, we wait. As always, the market moves on, indifferent to our hopes, our calculations, our fragile, human need for meaning. 🌀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-31 02:56