It is a truth universally acknowledged that a bull market will invariably flatter itself. For years, the whispers on Wall Street – nay, the shouts – have centred upon technology, growth stocks, and the rather vulgar spectacle of the ‘Magnificent Seven.’ Even Bitcoin, that digital phantom, enjoyed a fleeting moment of adoration. One might have assumed such enthusiasms would continue indefinitely, but alas, markets, like reputations, are built on sand.

The year 2026, it seems, has arrived to administer a gentle, yet pointed, correction. These once-favoured darlings now languish, and the S&P 500, that index of respectable mediocrity, barely manages a polite cough. But observe, if you will, a curious phenomenon: sectors previously dismissed as…provincial…are beginning to flourish. It’s a rather delightful irony, wouldn’t you agree?

Cyclicals and defensive stocks, those paragons of prudence, have performed admirably. Materials, once the domain of the utterly uninspired, have enjoyed a renaissance, rising a respectable 14%. Industrials, solid and dependable, have gained 9%. And even consumer staples – the very embodiment of bourgeois contentment – have crept upwards by nearly 12%. Yet, none of these modest successes compare to the truly astonishing performance of a sector many had consigned to the annals of history.

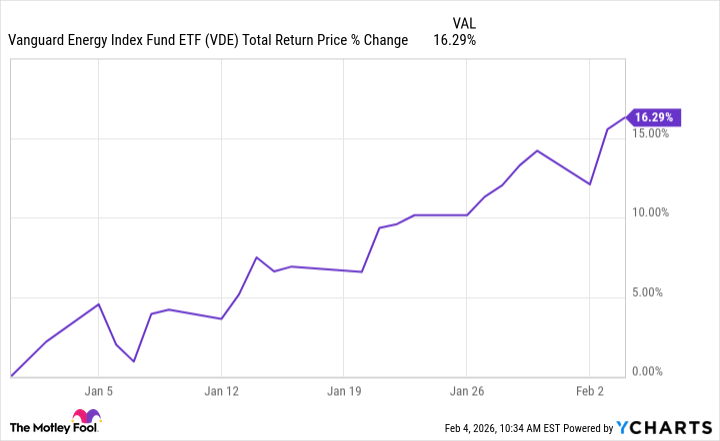

The Vanguard Energy ETF (VDE +0.91%) has ascended, not with a roar, but with a quiet, almost aristocratic, confidence, posting an impressive gain of 16% this year. It’s a rather startling spectacle, isn’t it? To see the mundane – oil, gas, the very fuel of modernity – outperforming the glittering promises of the digital age.

The reasons, my dear reader, are, as always, multifaceted. Investors, it appears, are experiencing a crisis of enthusiasm. The relentless pursuit of risk has waned, replaced by a cautious, almost melancholic, pragmatism. OPEC+, that cartel of calculated restraint, continues to exert its influence. But the true catalyst, I suspect, lies elsewhere.

Geopolitical tensions, those tiresome intrusions of reality, are at play. Tariffs and trade disputes threaten to unravel the delicate fabric of the global supply chain. As nations retreat into protectionism, energy prices, predictably, ascend. It’s a rather predictable outcome, really. A shortage, artificially created, always benefits those who control the supply. One might even say it’s the most reliable principle in the world. The tendency of energy stocks to thrive amidst chaos is, of course, well-documented. To be surprised by it would be to misunderstand the very nature of human folly. It is, I daresay, a lesson we are destined to relearn, again and again.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-10 14:02