If you currently have a thousand dollars to put into an investment, it’s likely that you’re taking several aspects into account as you search for the ideal stock. Different people prioritize various factors, with some leaning towards higher-risk growth stocks in pursuit of potential greater returns, while others seek out stable and value-oriented investments instead.

Not every growth stock is inherently risky, but typically, younger companies tend to offer greater growth potential. However, these young companies also carry some degree of risk. If you are comfortable with taking on a certain level of risk and are seeking a high-growth stock that could potentially yield significant returns, Dutch Bros (BROS) could be an ideal pick for you.

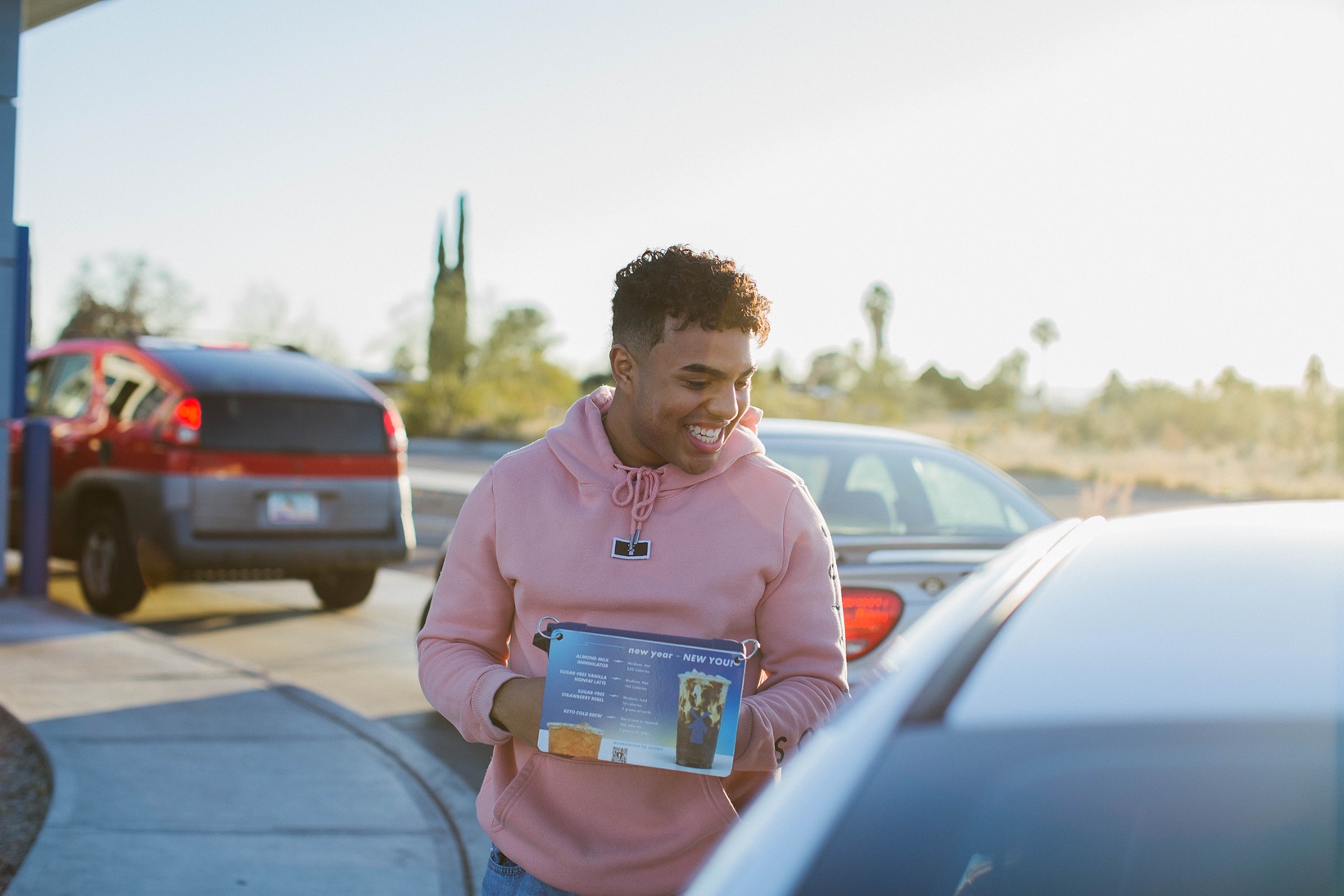

Fun and friendly coffee

Dutch Bros boasts a straightforward restaurant chain structure, yet sets itself apart by delivering an innovative twist on coffee. The brand offers exclusive drinks, particularly emphasizing cold concoctions, with customers often praising the personalized drink options they provide. In recent times, Dutch Bros has strategically planned its growth and adheres to modern trends such as speed and takeout services. Notably, the majority of their establishments are drive-thrus only.

As it grows, it’s attracting more and more satisfied customers who love its lively and welcoming atmosphere, and it’s consistently showing robust results, such as achieving profitability on a large scale.

In the first quarter of 2025, our revenue surged by 29% compared to the same period last year. This growth was fueled not only by a 4.7% rise in sales at established stores but also by a 1.3% increase in foot traffic. This suggests that customers are visiting our stores more often and more people are making purchases, rather than the growth being solely due to price hikes. Our net income soared from $16.2 million during the previous year’s first quarter to $22.5 million in Q1 of this year.

Just over four years since going public, the company has just surpassed 1,000 retail locations – nearly doubling its initial number – with a goal of adding at least 160 more this current year.

A shop on every corner

Management has expanded its potential market to include approximately 7,000 stores, which is nearly seven times the current store count. By the year 2029, they aim to operate around 2,029 stores, almost doubling again within four years. They anticipate a consistent annual revenue growth of about 20%, primarily fueled by a growth rate in the mid-teens for new stores and mid-single-digit growth for existing ones (comps).

The business is taking various steps to expand beyond just establishing new retail outlets. For instance, they’ve introduced mobile ordering, which has proven effective. Currently, it contributes to about 10% of all orders and encourages membership sign-ups. Additionally, it boasts a high rate of repeat customers.

Dutch Bros is adapting their store designs according to the needs of each new location, offering both sit-in options and walk-up windows. They’re also innovating with their menu to increase revenue. A recent move includes incorporating more food items in their stores to boost customer engagement during morning hours and stimulate beverage sales at peak times.

Risk and valuation

Despite being established since 1997, Dutch Bros has only recently embarked on its domestic expansion and went public in 2021. Investing now implies trusting the company to meet its targets for store openings and comparable sales growth. The journey from a small coffee chain to a dominant player is still a long one.

Thus far, I’ve been relishing the thrill of making choices that bolster my self-assurance. In 2023, our esteemed founder-CEO gracefully handed over the reins to a seasoned executive, paving the way for our company to soar to new heights. Christine Barone has been instrumental in revamping the upper management, establishing a new operational hub, and redefining our real estate approach. These changes are impressive, yet it’s crucial to acknowledge that we’re currently in a phase of rapid growth, which means we’re heavily investing and not yet consistently generating free cash flow on a regular basis.

It’s crucial for every investor to take valuation into account as well. The stock of Dutch Bros is relatively expensive when looked at through the lens of its Price-to-Earnings (P/E) ratio, which stands at 160. This level is extremely high and could cause one to see stars, or experience nosebleeds. However, on a Price-to-Sales (P/S) basis, it appears more affordable, with a multiple of just 5 times its trailing-12-month sales.

For those with a taste for risk and a lengthy investment timeline, Dutch Bros may be an intriguing option. Given its continued growth trajectory, this company could maintain its strong performance and serve as a fantastic enhancement to a portfolio focused on growth.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2025-07-22 03:35