As an analyst with a background in global economics, I find the current trend of the U.S. dollar’s strength against major currencies intriguing yet concerning. The NYT article sheds light on the underlying factors driving this phenomenon – expectations about Federal Reserve interest rate decisions and persistent inflation.

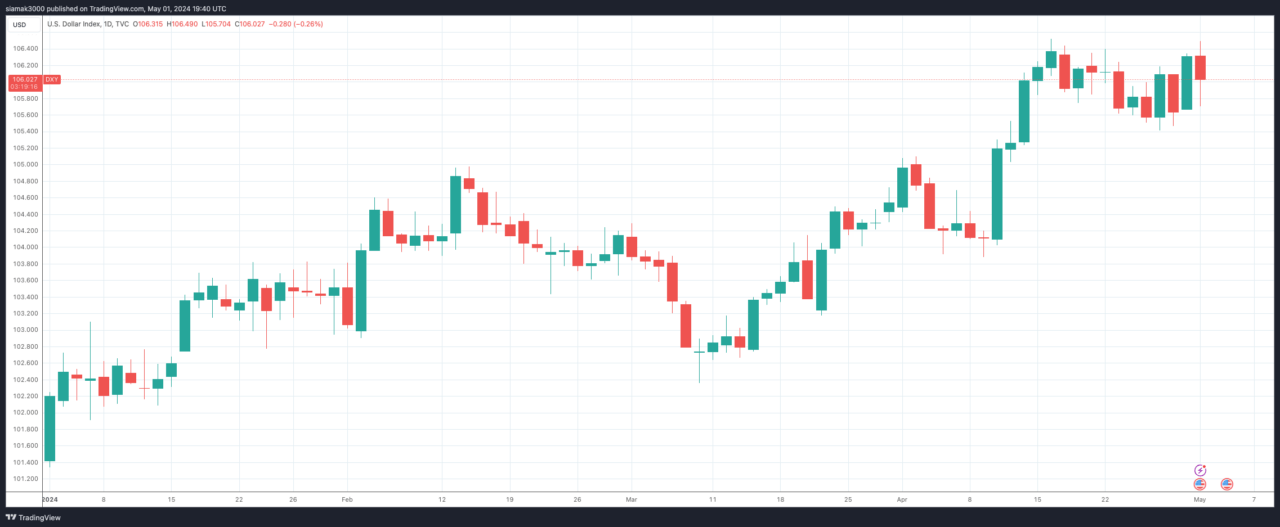

As a crypto investor, I’ve been closely monitoring the currency markets and, according to my observation, the US dollar has been on a roll this year. An article in The New York Times by Joe Rennison and Karl Russell sheds light on this trend, mentioning that about two-thirds of the 150+ currencies Bloomberg tracks have weakened against the greenback. This is primarily due to anticipation surrounding the Federal Reserve’s interest rate decisions.

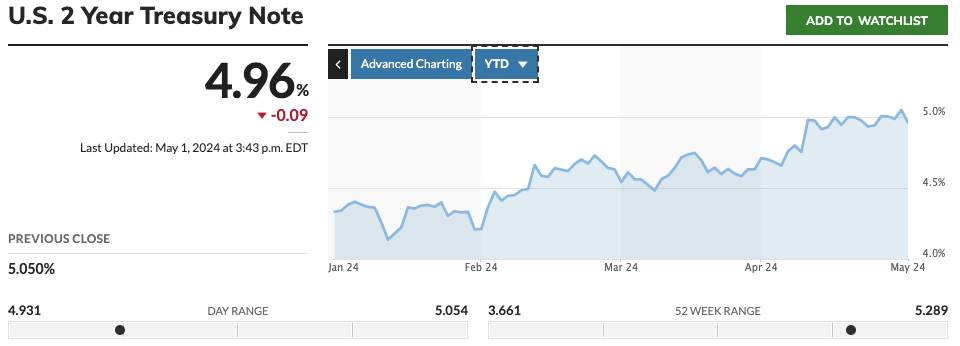

From a researcher’s perspective, the article reveals that elevated Federal Reserve interest rates aim to quell persistent inflation. Consequently, these rates have increased the allure of American assets for investors globally. Subsequently, a significant influx of capital has headed towards the United States. This financial movement generates ripples that reach policymakers, politicians, and everyday people across cities such as Brussels, Beijing, Toronto, and Tokyo.

As an analyst, I would interpret The Times’ article as follows: I notice that a robust dollar brings about significant repercussions. Abroad, this can lead to heightened inflation and increased interest expenses for countries that have borrowed in dollars. On the bright side, it could also present advantages for foreign firms exporting goods to the U.S. Nevertheless, American businesses selling overseas might face challenges, which could potentially widen our country’s trade deficit.

As a researcher examining the influence of the dollar’s strength based on The New York Times report, I would rephrase it as follows:

As an analyst, I would highlight that Asia has experienced significant impact from the robust US dollar. Notably, the Japanese yen and South Korean won have touched their lowest levels in years. The Times further brings up China’s decision to let the yuan depreciate, fueling concerns regarding the resilience of its economy.

As a financial analyst, I’d say based on the New York Times piece, European policymakers are pondering the idea of reducing interest rates. However, it’s crucial for them to keep in mind the possible repercussions on the euro’s exchange rate against the dollar. The article likewise mentions that central banks in South Korea, Thailand, and Indonesia face similar predicaments.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2024-05-01 23:04