AST SpaceMobile, that wild-eyed dreamer of a company, has pulled off a breathtaking leap-from a paltry $2 a share in the absurd chaos of April 2024 to a staggering $45 per share as we drift into the fog of August 2025. But the real question digging at us like a festering itch is whether this satellite internet gamechanger is still sitting on the bargain bin of the investment world-just waiting to be plucked by the desperate hands of the hopeful.

Some would say, hell yes! Here’s a real thrill ride: despite still being stuck in the pre-revenue zone, AST SpaceMobile is preparing to drop a business plan that could displace the existing titans in satellite internet, like Starlink, and send Amazon’s Project Kuiper crashing down to Earth before it even breathes. Their bold innovation in direct-to-device connectivity could fire growth into overdrive, hypnotizing investors and crowning the revenue numbers with BILLIONS written in flashing neon.

So, is AST SpaceMobile stock a mystical once-in-a-generation opportunity? Ladies and gentlemen, grab your helmets; we’re about to find out.

The High Costs of Disruption

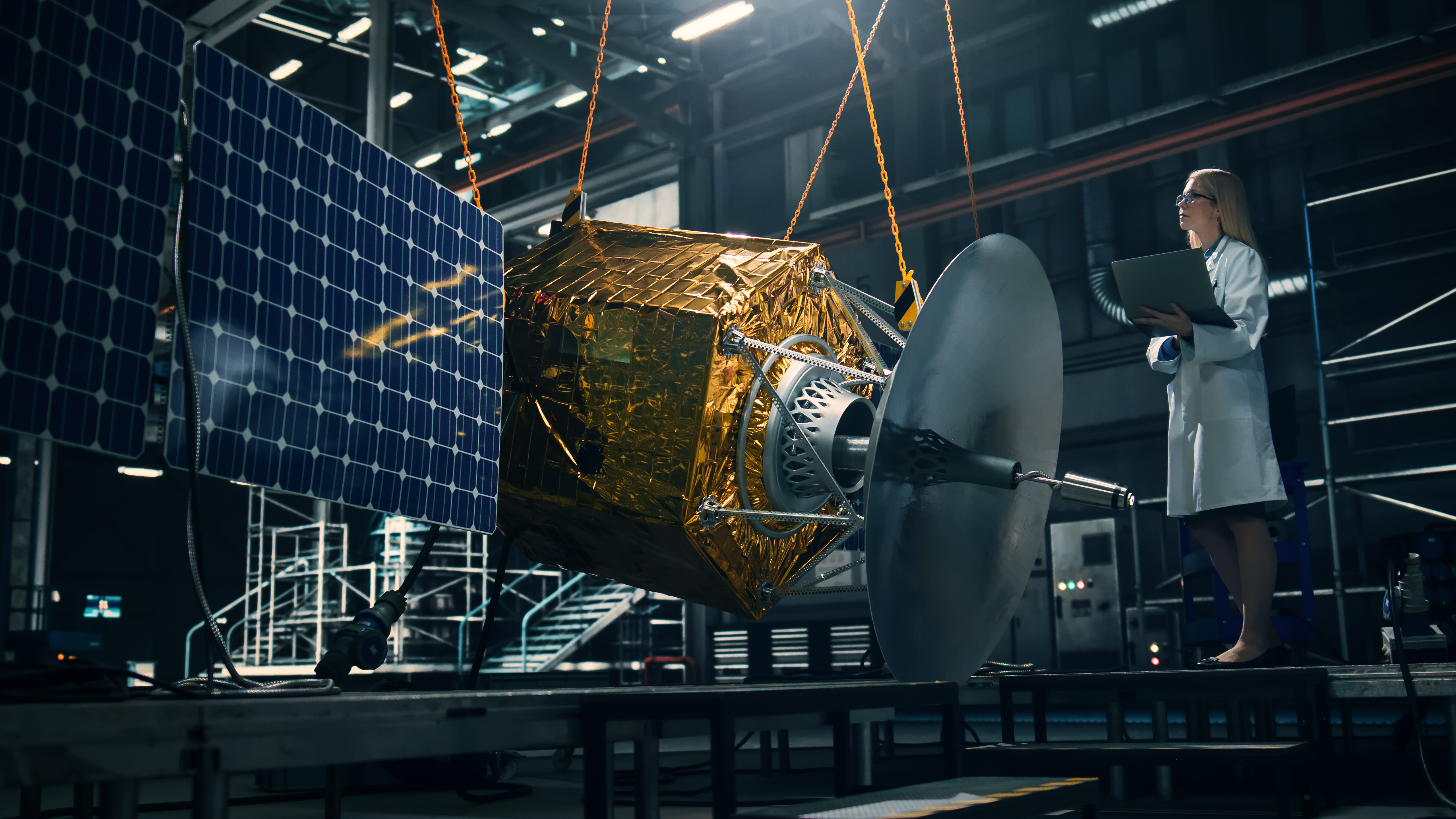

Crafting massive satellites that beam internet straight to smartphones-no wires, no cellular towers, no satellite terminals-is AST’s ticket to wringing out a cosmic shake-up in the satellite internet game. After years of caffeinated innovation and hard labor, the company has birthed these colossal machines and is now in cahoots with rocket-launchers to get them soaring through the void.

Management is dancing on the edge of their seat, plotting to hurl more of their magnificent creations into orbit soon. Six satellites are currently spinning around up there, but they’re aiming to throw between 45 and 60 into the ether by 2026. Their assembly line is humming, needing just the final kick to get them operational. Testing results have validated the possibility-speeds fast enough to stream video or natter on a video call from the ass end of nowhere, away from those pesky land-based towers.

But let’s face it: building a new satellite internet constellation isn’t akin to throwing some cash around at your local pub. A staggering $543 million has been obliterated on capital expenditures over the last year, resulting in virtually ZERO sales. As they ramp up this constellation, expect the burning of cash to hit white-hot levels. Thankfully, the management knows that this isn’t a children’s game; they’ve raised funds from all over the place, resulting in a hefty $1.5 billion sloshing around on their balance sheet, available to stoke the flames of growth.

Future Earnings: A Tricky Ploy

Once those satellites start tapping into the ether, AST SpaceMobile is poised to crank the revenue faucet wide open. How? By teaming up with telecommunication giants like AT&T and Verizon, along with their cohorts in other realms. With these connections, AST SpaceMobile targets a staggering 3 billion souls, existing smartphone users, with its audacious add-on service promising uninterrupted internet access in the wilderness.

This explosive partnership allows the company to predict-a wild shot in the dark-that revenue could crank up to a dizzying $50 to $75 million almost instantly in the latter half of this year, assuming the service hits the States like a runaway train. By 2026, expect this service to stretch its limbs both across America and into the UK, Canada, and Japan, pushing revenue into the stratosphere-hundreds of millions of dollars, perhaps? There are military contracts too, giving an extra layer of intrigue and volatility to their financial escapades.

Tracing the lines of potential profit here is like trying to read tea leaves in a hurricane; with revenues currently flirting near zero, we’re all just guessing. Suppose 10 million adventurous customers latch onto this service from their telecommunication partners-at a tantalizing $10 a month-that’s a breathtaking $1.2 billion floating around, not to mention a few government contracts that might pile on another $300 million. Even if they share a good chunk of that with the mobile moguls, we’re still talking about a tidy berth of $500 million to $1 billion clattering into AST SpaceMobile’s coffers, setting the stage for net profits and cash flow within the next five, wild years.

Buy, But Beware the Chaos

Now, here comes the caveat, dear investor-because when it comes to sending satellites into the abyss, things rarely go as planned. Just this week, the Indian Space Research Organization (ISRO) opted to delay the launch of an AST SpaceMobile satellite, bumping it to the first quarter of 2026. Delays can bleed cash like a sandpaper cut, compelling the company to seek fresh funding.

Still, let’s not kid ourselves; even if AST SpaceMobile sticks the landing, calling its valuation reasonable would be an outright fairy tale. With a market cap of $16 billion draped over a zero-revenue canvas, even a rosy forecast of net earnings hitting $500 million in five years translates into a punchy price-to-earnings ratio (P/E) of 32-still absurdly high compared to the average bear on the stock market.

Adding it all together, we find ourselves gazing at an exhilarating disruptor in the satellite internet biz, a true thrill ride. But let’s not get ahead of ourselves; this stock has dashed far ahead, making it a no-go for prudent investors today. Time to sit back, light a smoke, and watch the fireworks from a safe distance. 🔭

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-24 13:12