- Rough day for Ethereum: $165 million in long ETH positions evaporate as ICO whale dumps 1,700 ETH worth $3.18M on Binance

- Despite its massive market cap, ETH’s network shows a decline in transaction activity, user growth, and revenue. Whoops!

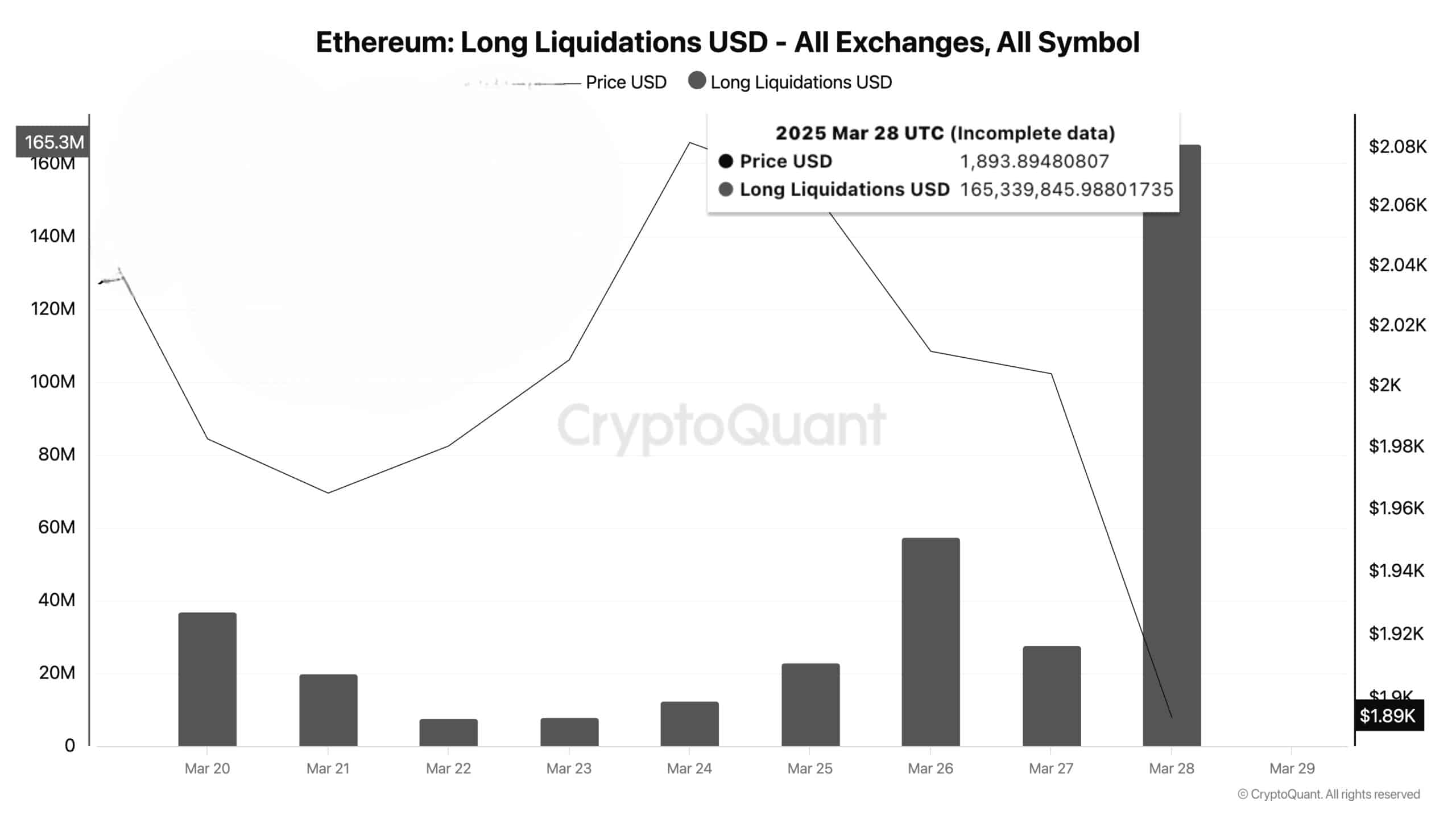

So, Ethereum [ETH] is having one of those “bad days”—you know, the kind where everything that can go wrong, does go wrong. A whopping $165 million in long positions just went up in smoke as traders who thought they had it all figured out watched in horror as ETH prices tumbled. And, as if that wasn’t enough, an ICO participant who hadn’t touched their coins in *seven years* just dropped a cool 1,700 ETH (worth $3.18 million) into Binance. Smooth move, right?

The sudden liquidation of these long positions is a huge red flag for anyone hoping for a bullish comeback. If the market liquidity stays as high as it is, ETH’s price might just keep heading south, like a confused tourist at the wrong terminal.

These liquidations suggest the bullish momentum is about as strong as a wet napkin. So, don’t be surprised if entering with leverage seems like a bad idea for the near future. In fact, we might not even see ETH reach those critical support levels. The more it falls, the more everyone sells—and the downtrend just keeps going like an old car with a broken accelerator.

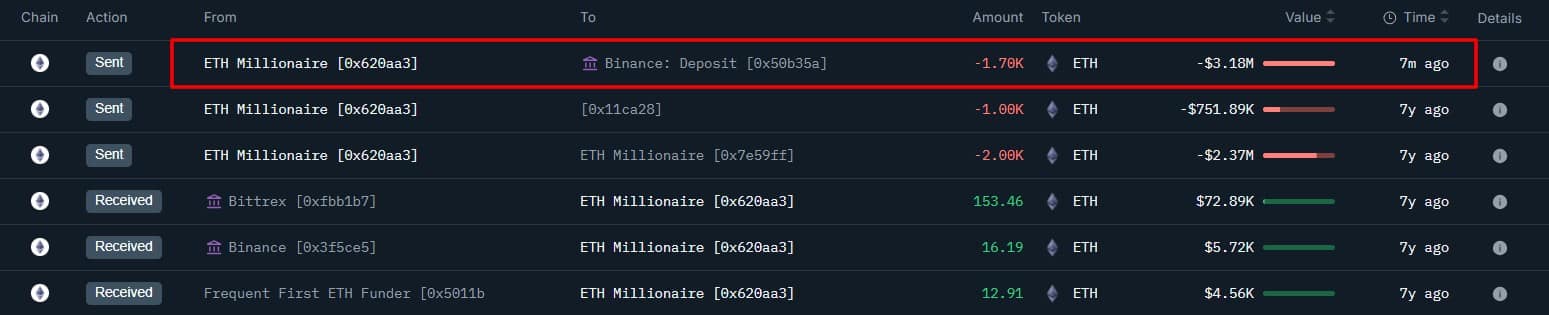

But wait, there’s more: An Ethereum ICO participant—remember those guys?—who’s been absolutely silent for seven years suddenly decides to move 1,700 ETH to Binance. Yes, you read that right. Seven years of no action, and now they’re throwing around millions like it’s Monopoly money. This has all the signs of “sell-side pressure” written all over it. Some people just can’t resist making a big splash when the market’s already drowning.

Let’s not forget the whales—those big fish in the crypto pond who can send the market into a frenzy just by moving their assets around. And guess what? They’re at it again, causing instability. It’s like a game of “guess what the whales are thinking,” and honestly, no one’s winning. If they do decide to sell, things could get even uglier for Ethereum.

On the other hand, if they’re just holding on for dear life, ETH’s price might stay mostly flat, which isn’t exactly a glowing endorsement for anyone hoping for massive gains.

Max Pain and Network Woes: Ethereum’s New Normal

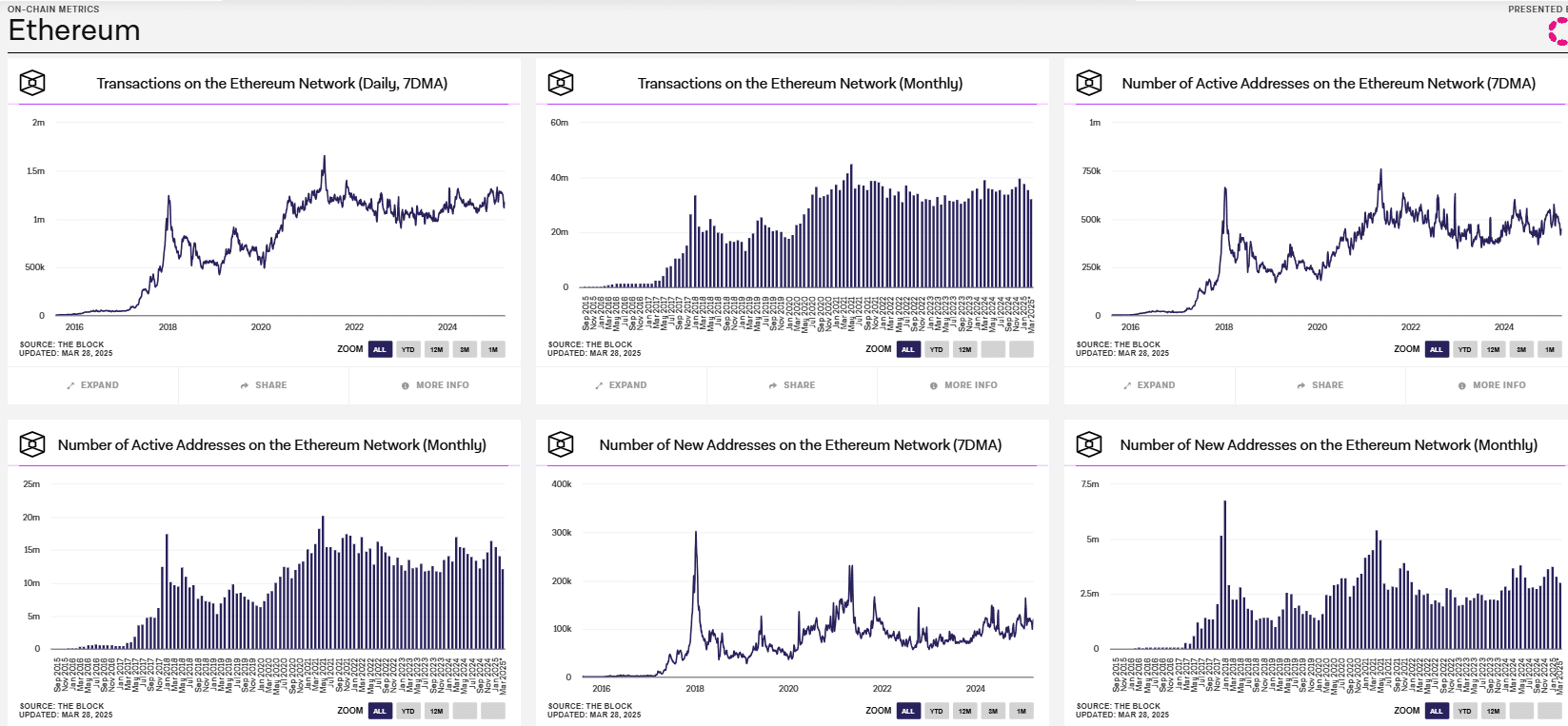

At this point, the Ethereum blockchain has all the excitement of a Monday morning commute. The number of daily transactions? A stale 1M, barely moving. The user engagement? A slow slide into irrelevance, with active addresses staying comfortably under 750k. Even though Ethereum’s monthly active addresses top 10M, the overall trend is heading in the wrong direction.

Looking at the new Ethereum network addresses, it’s hard not to notice the drop in numbers—under 100k for the 7-day moving average. Not quite the “booming” growth everyone was hoping for. And let’s not even talk about the 2.5M new addresses created last month. Meh. The market’s just not impressed anymore.

Oh, and did I mention that ETH just broke through its “max pain” price of $2,200? Historically, this has been the level that held things up. But now? It’s like that one bridge in every disaster movie—the one that was supposed to be sturdy but gave way when you least expected it.

If you’re wondering what this all means… well, don’t expect fireworks. More downside is likely, folks. Buckle up.

Is Ethereum a Smart Investment or Just a Really Fancy Utility Network?

Right now, Ethereum seems to be operating more like a giant public utility than the next big thing in investment. The evidence is hard to ignore: the network’s user growth is stalling, transaction operations are sluggish, and the market’s been doing some serious soul-searching about Ethereum’s future.

So, what does this mean for investors? Well, if you’re expecting Ethereum to be the next big asset to fill your pockets, you might want to temper those expectations. With stagnating adoption rates, liquidations happening left and right, and whales offloading their holdings, the appeal of ETH as an investment is…let’s just say it’s *dwindling*.

In short, Ethereum’s market environment is as clear as mud. And if you’re looking for clarity, good luck with that.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-03-30 02:19