The Trade Desk (NASDAQ:TTD) once epitomized the archetype of a high-flying tech stock. By December 2024, its valuation multiples had reached stratospheric heights-134 times free cash flow and 30 times sales-positioning it as a benchmark for disruptive growth narratives. For context, these metrics rendered even Nvidia’s (NASDAQ:NVDA) 62x free cash flow multiple relatively “affordable” in market parlance.

However, the intervening months have rewritten this narrative.

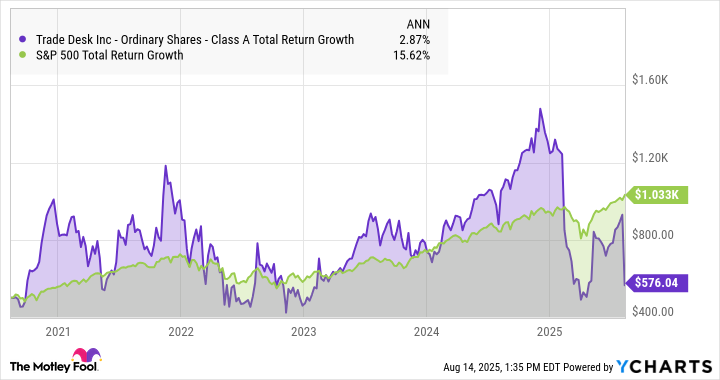

Recent quarterly reports, while technically robust, were accompanied by tempered forward guidance that triggered a reassessment of risk-reward dynamics. The subsequent market reaction erased multi-year gains, reducing a $500 investment in 2019 to a mere $576 as of 2024:

Contrast this with the S&P 500 (^GSPC), which delivered a 15.6% compound annual growth rate over the same period, dwarfing The Trade Desk’s 2.9% return. This divergence underscores the perils of overvalued growth stocks during macroeconomic recalibrations.

Revisiting Valuation Multiples

The current valuation landscape presents a more measured opportunity. Free cash flow multiples have contracted to 33x, while sales multiples stand at 9x-levels that, while still elevated for a growth stock, suggest a narrowing gap to peers. Notably, a hypothetical doubling of the share price would still leave The Trade Desk trailing Nvidia’s 62x free cash flow multiple.

These metrics remain consistent with the firm’s positioning in the programmatic advertising sector. While not a “bargain basement” investment, the valuation reflects a business operating in a $40 billion TAM with demonstrated scalability:

Key factors to monitor include:

- Execution against 14% revenue growth guidance in Q3 2024

- Persistent macroeconomic pressures on digital ad spend

- Regulatory developments in data privacy frameworks

The 2025 price correction has recalibrated risk parameters without negating the company’s strategic moat. Investors must now weigh near-term volatility against long-term growth potential in an industry undergoing structural transformation. The market’s patience with high-multiple narratives may yet return, but for now, capital allocation demands a more discerning lens. 📉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-15 21:47