Okay, so The Trade Desk. It’s one of those stocks that, a decade ago, would have funded my early retirement. Now? Let’s just say it’s a good reminder that even in digital advertising, gravity exists. Up 900% in ten years is a brag, obviously. But down nearly 80% from its peak? That’s less “disruption” and more “a really awkward office party.”

The market is currently doing that thing where it punishes growth stocks like they personally offended it. Which, honestly, some of them probably did with all the metaverse talk. But The Trade Desk isn’t some crypto-adjacent fantasy. It’s an ad platform. A really good one. And right now, it’s trading like it’s selling buggy whips. Which, in the digital age, is a truly impressive feat of market miscalculation.

The Ad Game Isn’t What It Used To Be

The Trade Desk helps companies put their ads in places people actually see them. Connected TVs, websites, podcasts…basically anywhere that isn’t a pop-up ad for discounted dentures. They’re a buy-side platform, which sounds incredibly fancy, but really just means they’re the middleman between the advertisers and the places that show ads. A very profitable middleman, until recently.

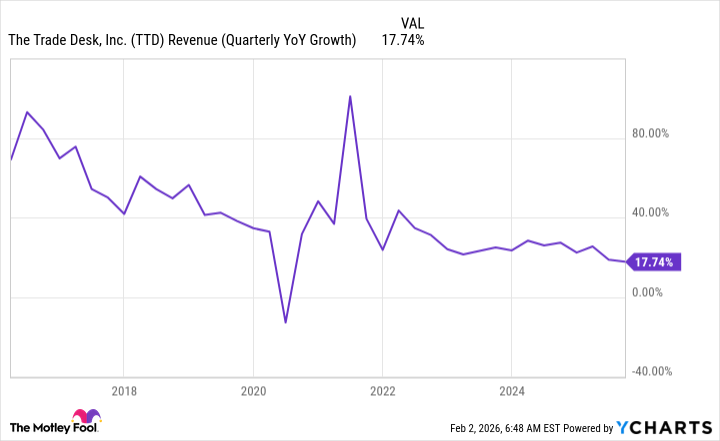

Their last quarter wasn’t a disaster. 18% revenue growth is still solid. Wall Street is projecting 16% for next year. That’s…fine. But the stock is acting like they accidentally launched a campaign for Nickelback. There’s a disconnect, people. A beautiful, potentially lucrative disconnect.

The problem? Competition, obviously. Everyone and their mother is getting into ad tech. And some clients are bringing things in-house, which is corporate-speak for “we decided to do it ourselves and probably regret it already.” But the biggest threat? Amazon. Because of course it’s Amazon. They control the eyeballs and the credit cards. It’s a bit like playing Monopoly against someone who owns Park Place, Boardwalk, and the bank.

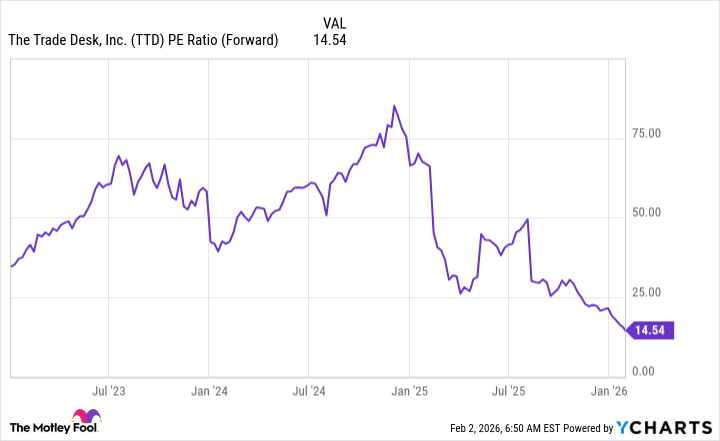

So, the ceiling has lowered. Expectations have been…adjusted. The stock is down. But here’s the thing: it’s trading at less than 15 times forward earnings. That’s practically giving it away. It’s like finding a designer handbag at a garage sale. You question the provenance, but you grab it anyway.

Look, the ad market is shifting. Programmatic advertising, connected TV…it’s all evolving. The Trade Desk isn’t immune to these changes, but they’re well-positioned to navigate them. They’re not Blockbuster trying to compete with Netflix. They’re more like…a really good streaming service adding another original show. It might not be the next Game of Thrones, but it’s still worth watching.

It’ll take time for the stock to recover. There’s no magic wand. But if you’re looking for a company with a solid business model, a reasonable valuation, and a chance to outperform the market, The Trade Desk is worth a look. Just don’t expect it to magically turn into a unicorn. It’s a workhorse. And sometimes, a good workhorse is exactly what you need.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-08 14:32