The chronicles of capital are replete with apparitions and vanishings, with valuations that swell like phantom tides and recede into the fog of speculation. Among these ephemeral entities, The Trade Desk (TTD 8.69%) presents a curious case. A recent entrant into the S&P 500, it has, in the span of a single cycle of seasons, experienced a decline of sixty-seven percent – a fall not unlike a stone dropped into a bottomless well. This, following a prior ascent that bordered on the unsustainable. The year commenced with a further diminution of twenty percent, a continuation of the downward spiral. One is reminded of the Kitab al-Kunuz, a lost treatise on the illusory nature of wealth, which posits that all fortune is merely a temporary configuration of shadows.

The Trade Desk occupies a peculiar niche within the labyrinthine world of adtech. Its platform functions as a sort of cartographer, matching the desires of advertisers with the latent inclinations of their potential audience. It operates, significantly, as an alternative to the established empires of Meta Platforms and Alphabet – those vast, self-contained universes where attention is both the currency and the commodity. To challenge such monoliths is to invite the scrutiny of forces beyond comprehension.

Despite this recent descent, the stock has, over its lifespan, outperformed the broader market – a fact which, in the grand calculus of finance, is akin to discovering a single, unblemished page within a decaying manuscript. The question, therefore, is not merely whether to acquire shares, but whether this ongoing decline is a harbinger of further misfortune, or a temporary aberration in the relentless march of market forces.

The Geometry of Decline

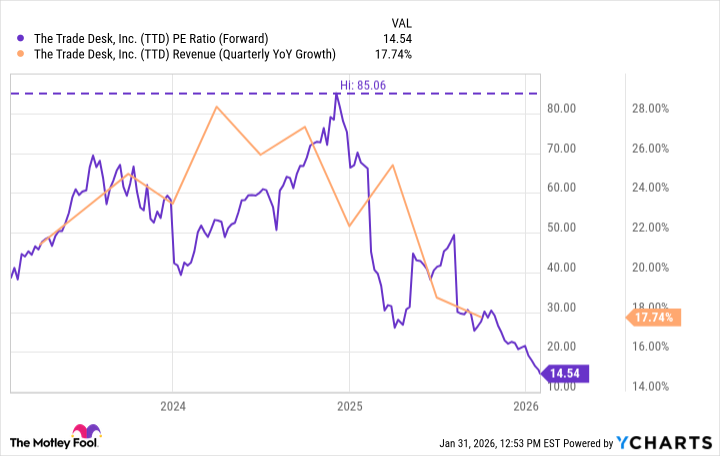

It is a fallacy to believe that such precipitous falls occur without cause. The Trade Desk, at its zenith, was burdened by a valuation that defied all reasonable expectation – a price-to-earnings ratio of eighty-five times forward estimates. Such heights are unsustainable, a fragile tower built upon the shifting sands of optimism. Its subsequent descent was, in a sense, inevitable – a correction of an artificial imbalance. One recalls the apocryphal words of the Alexandrian geometer, Hypatia, who argued that all extreme positions are inherently unstable.

Furthermore, the competitive landscape has undergone a subtle but significant transformation. Amazon, a titan in its own right, has emerged as a formidable contender in the realm of digital advertising, forging alliances with Netflix and launching a competing platform. The Trade Desk’s revenue growth has decelerated, a troubling sign for a growth stock of its caliber. This deceleration, while not catastrophic, suggests a tightening of the noose. The echoes of this competition reverberate through the market, a warning to those who seek to challenge the established order.

Recent internal turbulence – the abrupt dismissal of its chief financial officer – has further eroded confidence. Such events, while seemingly minor, can have a disproportionate impact on investor sentiment, like a single misplaced tile in a vast mosaic.

The Oscillating Pendulum

The current undervaluation, however, may present an opportunity. After a period of excessive exuberance, the stock appears remarkably cheap. The Trade Desk retains a strong reputation as an industry leader, having transitioned to Kokai, an advanced platform powered by artificial intelligence, in 2023. Analysts predict annual earnings growth of twenty percent over the next three to five years – a rate that, if realized, would justify a significantly higher valuation.

The current price-to-earnings ratio, hovering below fifteen times forward estimates, suggests a company on the verge of collapse. This is, of course, a misperception. The market, in its infinite wisdom (or folly), often overreacts to short-term fluctuations. A single strong quarterly report could trigger a rapid reassessment of the stock’s value. The Trade Desk, therefore, represents a compelling rebound candidate – a flickering flame in the darkness, worth considering for those who possess the patience to wait for the embers to ignite.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Zack Snyder Shares New Ben Affleck Batman Image: ‘No Question — This Man Is Batman’

2026-02-04 16:34