As someone who has been closely observing the crypto space for several years now, I find myself constantly amazed by the rapid evolution and diversity of blockchain networks. From my perspective, the metrics that capture user activity, such as daily active addresses, offer valuable insights into the real-world utility and accessibility of these networks.

Intriguingly, chains like Solana and TRON, which are leading in terms of daily active addresses, showcase an impressive level of engagement from their users—an aspect that I find particularly captivating. These networks demonstrate a strong connection with retail users, which is often overlooked when focusing on metrics such as Total Value Locked (TVL).

On the other hand, Ethereum‘s dominance in TVL reflects its maturity and financial depth in the decentralized finance (DeFi) space. As someone who has witnessed the rise of DeFi since its early days, I can attest to the transformative potential that this sector holds for the future of finance.

That being said, it’s essential to remember that no single metric can paint a complete picture of a blockchain network’s success. Just as you wouldn’t judge a book by its cover, we should be careful not to make hasty judgments about a network based on one particular statistic.

To put things into perspective, let’s consider this: just as I can’t resist a good novel with an intriguing plot and engaging characters, I find myself drawn to blockchain networks that offer innovative solutions, strong communities, and user-friendly interfaces—regardless of their position in the rankings.

In the end, it’s all about finding the right fit for you, much like how I discovered my favorite book genres over time through trial and error (and a few unfortunate missteps). So, keep exploring, keep learning, and who knows? You might just find your next favorite blockchain network along the way.

And as always, remember: never judge a chain by its TVL or daily active addresses alone—you might miss out on a hidden gem!

The development of blockchain technology calls for focusing on user involvement to evaluate the effectiveness of any particular network. One valuable indicator in this regard is referred to as daily active users (or addresses). This term signifies the unique number of blockchain accounts that engage in transactions daily, either by transferring or receiving assets. In essence, it offers a momentary glimpse into the number of individuals actively engaging with a blockchain at any point in time, serving as a dependable gauge for real-world application and appeal.

On December 27th, 2024, CryptoRank unveiled a chart showcasing the leading 10 blockchain platforms of the year, determined by their average daily active addresses. The data gathered from CryptoRank and Artemis.xyz reveals captivating patterns in blockchain adoption and sheds light on the platforms spearheading user interaction. In this analysis, we’ll examine the top three blockchains leading the charge, followed by brief summaries of the other networks in the top 10 list.

1. NEAR Protocol: 2.7 Million Daily Active Addresses (+766% YoY)

In 2024, the NEAR Protocol rose to prominence, with over 2.7 million daily active users. This represented an incredible 766% increase compared to the previous year, primarily due to its emphasis on scalability and accessible tools for developers. Notably, NEAR utilizes a cutting-edge sharding technology known as Nightshade, which breaks down the blockchain into smaller segments for easier management, thereby allowing for high transaction speeds at reduced costs. This efficiency has made NEAR a highly sought-after platform among developers building decentralized applications (dApps).

The swift acceptance of blockchain-centric games and social apps on the NEAR platform significantly boosted its success. These innovative applications drew in new users who were unaware of blockchain technology, enabling NEAR to construct a thriving and expanding community. Additionally, substantial financial backing from the NEAR Foundation for developer grants has further propelled the protocol’s rise, demonstrating its allure not only for users but also for builders.

2. Solana: 2.6 Million Daily Active Addresses (+702% YoY)

In 2024, Solana moved up to the second spot, boasting around 2.6 million daily active users and an astounding year-over-year growth of 702%. The network’s surge in popularity was primarily driven by its lively memecoin market, where platforms like Pump.fun witnessed high trading volumes. This bustling ecosystem attracted both retail and institutional investors, leading to a substantial increase in Solana’s usage statistics.

As a crypto investor, I’ve found myself drawn to Solana not just for memecoins, but also because of its lightning-fast, cost-effective infrastructure. This has made it an attractive choice for decentralized finance (DeFi) and non-fungible token (NFT) projects. The network has been a magnet for developers and users, who appreciate its efficiency, and as Solana demonstrated its scalability and reliability, institutional interest has grown. All these factors have solidified Solana’s position as one of the standout blockchains of the year.

3. TRON: 1.9 Million Daily Active Addresses (+20.3% YoY)

TRON ranked third among daily active addresses, totaling approximately 1.9 million, marking a consistent increase of around 20.3% compared to the same period last year. A significant factor contributing to this growth has been TRON’s leadership in handling stablecoin transactions, particularly those involving Tether (USDT). This platform’s appeal stems from its low transaction costs and rapid transfer speeds, making it an attractive choice for users looking for smooth, economical stablecoin transactions.

As a crypto investor, I’ve witnessed the significant impact TRON has made in the decentralized finance (DeFi) sector. It’s forged strategic partnerships with numerous global payment systems and financial institutions, carving out a robust presence in this domain. Although its growth may not have been as rapid as NEAR or Solana, TRON’s consistent performance and practical utility have solidified its position among the leading blockchains of 2024.

A Quick Look at the Rest of the Top 10

Below the first three, the other blockchains displayed a mix of unique advantages and difficulties.

On a day-to-day basis, BNB Chain recorded approximately one million active user addresses, representing a minor decrease of 4.8% compared to the same period last year. However, despite this dip, BNB Chain continues to be a significant center for Decentralized Finance (DeFi) and token trading, maintaining its relevance within the blockchain community.

Yesterday, the cryptocurrency Polygon (MATIC) had 855,000 daily active users, representing a strong 139% increase compared to the same period last year. As a scaling solution for the Ethereum blockchain, Polygon is gaining popularity among gaming, NFT, and DeFi projects, further cementing its importance within the Ethereum network’s ecosystem.

“Coinbase’s Layer 2 solution, known as Base, saw a daily active address count of 655,000. This represents an impressive 2,098% increase compared to the same period last year. The close connection with Ethereum and Coinbase’s user-friendly interface have been key factors in its rapid adoption.

Sui saw impressive results, boasting a remarkable 519,000 daily active addresses, representing a staggering 908% rise compared to the same period last year. This phenomenal growth can be linked to its cutting-edge programming language and rapidly growing network of decentralized applications (dApps).

In simpler terms, it’s worth noting that Bitcoin, the globally recognized blockchain network, saw approximately 496,000 daily active users, a drop of 19% compared to the same period last year. Despite Bitcoin leading the market in terms of total value, this decrease in active users suggests that priorities among its user base may be shifting.

In 2024, The Open Network (TON), the blockchain linked to Telegram, saw an extraordinary expansion, as daily active addresses skyrocketed by a staggering 5,185% to hit 414,000. This phenomenal growth was driven by TON’s integration with Telegram, which allowed it to capitalize on the messaging platform’s immense user base, thereby significantly increasing its adoption.

As an analyst, I’m delighted to report that Arbitrum, a prominent Ethereum Layer 2 solution, has seen a staggering year-on-year increase of 180% in daily active addresses, reaching a significant milestone of 413,000. This growth underscores the platform’s impressive ability to scale Ethereum applications without compromising on low fees and high throughput. Arbitrum’s contributions have solidified its position as a vital player within the broader Ethereum ecosystem.

Comparing Activity with Total Value Locked: A Broader Perspective

A different perspective for assessing blockchain environments is Total Value Locked (TVL), a figure representing the overall dollar worth of assets secured within decentralized finance (DeFi) platforms on a given blockchain. TVL indicates the amount of money users have invested in DeFi services like lending, staking, and liquidity provision. In contrast to daily active addresses, which highlight user engagement, TVL offers insights into the financial robustness and development stage of a blockchain’s DeFi sector.

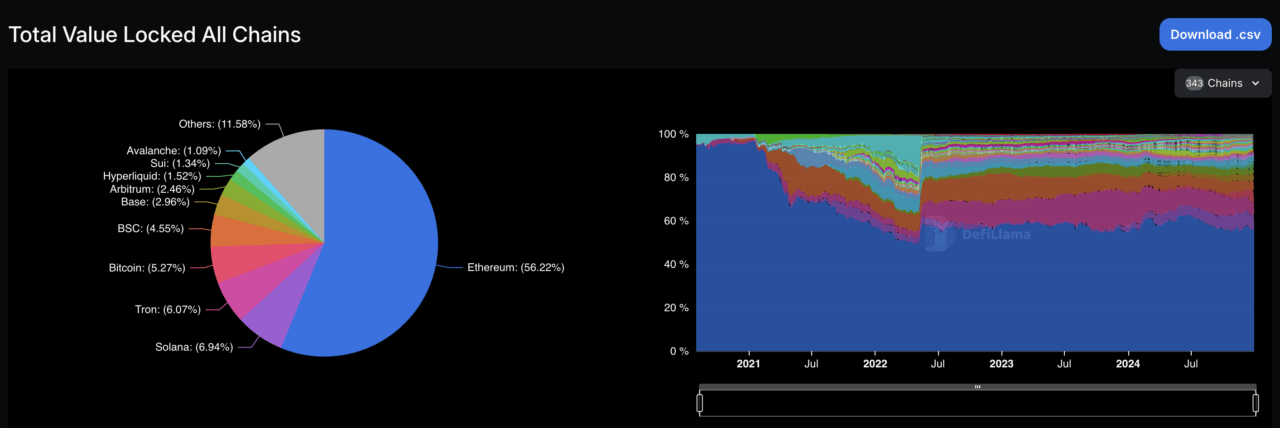

According to DeFiLlama’s data, as of December 30, 2024, Ethereum dominates other blockchains with a staggering 56.22% share of the total value locked (TVL) across all chains.

The strength of Ethereum comes from its robust Decentralized Finance (DeFi) infrastructure, boasting the widest variety and most sophisticated collection of decentralized applications. This is thanks to its early adoption and a powerful developer community. Yet, while Ethereum dominates in terms of Total Value Locked (TVL), it falls short when it comes to daily active addresses, where it doesn’t take the lead position. This discrepancy underscores the distinct characteristics of these metrics: TVL measures the amount of capital tied up in protocols, typically involving fewer but larger transactions, whereas daily active addresses focus on the regularity of user engagement, often associated with smaller, retail-oriented activities.

Despite ranking second and third in terms of daily active addresses, Solana and TRON occupy relatively smaller positions when it comes to Total Value Locked (TVL). Specifically, Solana holds approximately 6.94% of the total TVL, while TRON accounts for about 6.07%. This means that Ethereum still maintains a larger TVL share compared to these two platforms.

The difference between Total Value Locked (TVL) and daily active addresses in the blockchain world underscores the various capabilities each network brings to the table. For instance, Ethereum shines in its financial fluidity and support for high-value applications, whereas networks such as Solana and TRON flourish in terms of user interaction and transaction volume. Taken together, these indicators offer a more complex view of the blockchain ecosystem, demonstrating that a single metric does not fully encompass a network’s popularity and practicality.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-30 13:45