The Surprising Rise of Bitcoin: Markets Go Wild! 🚀💰

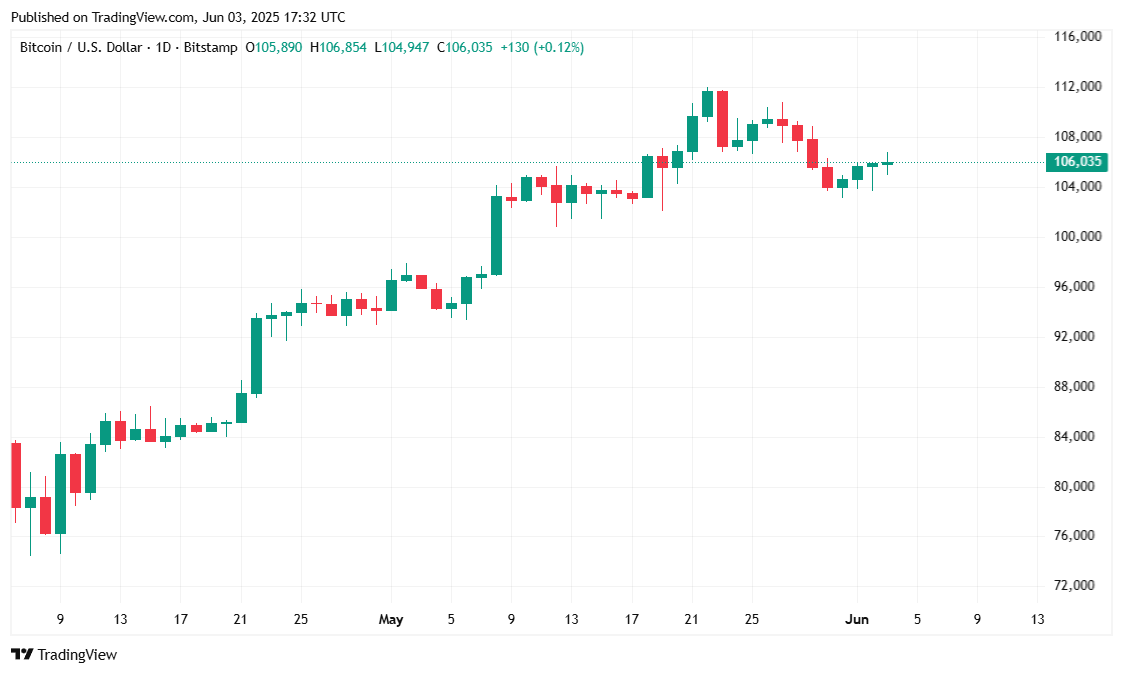

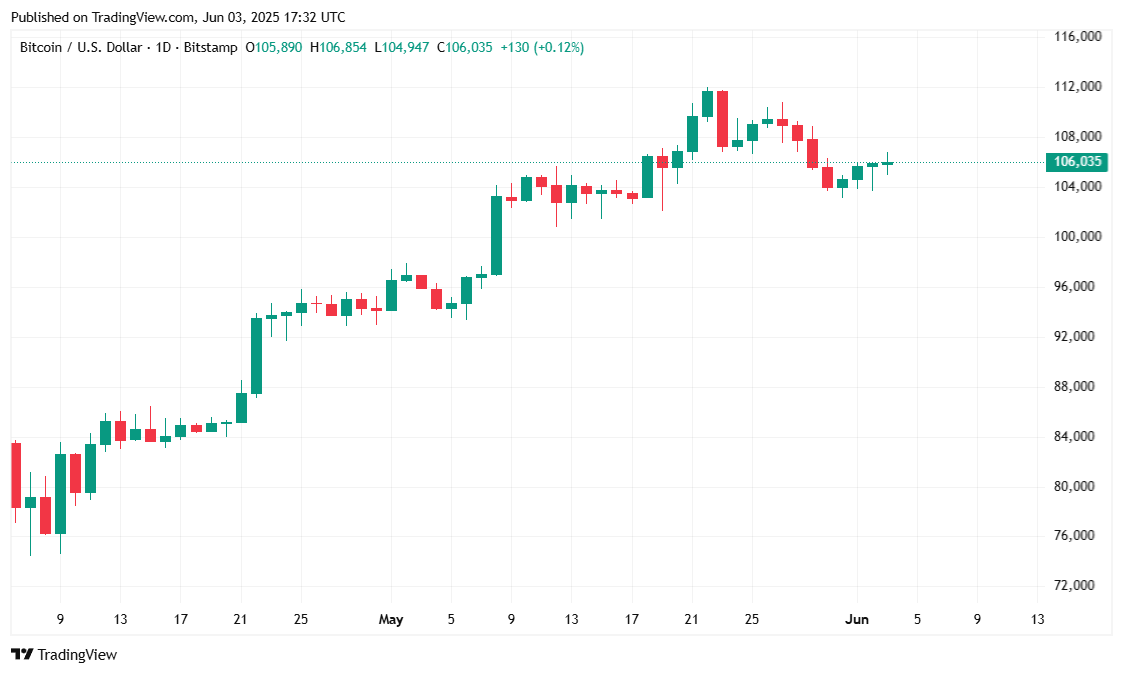

In what can only be described as a very expensive game of follow-the-leader, Bitcoin shot past $106,000 on Tuesday morning, because apparently, everyone woke up feeling like investing in digital gold. The stock market was doing its best impression of a cheerleader, and crypto threw a little party of its own, making a modest but spirited ascent.

Stocks Climb, Bitcoin Follows

Bitcoin decided to join the party, climbing like a caffeinated squirrel up to $106,813.58, as stocks and other crypto bits and bobs enjoyed their own little rally. Tech stocks led the charge—because what’s better than some shiny gadgets and software to make everyone feel bullish? Plus, a tiny uptick in job openings had market pundits breathlessly claiming all is well, or at least better than last week. The Bureau of Labor Statistics managed to report 7.4 million openings, a smidge more than previously, with arts, entertainment, logging (yes, logging—who knew that was still a thing?), and mining industries hogging the spotlight.

The crypto market overall was up almost 2%, reaching a staggering $3.34 trillion market cap. The venerable S&P 500, Nasdaq, and Dow jonesed their way up slightly, just enough to keep things interesting. Interestingly, Bitcoin’s relationship with good old Wall Street has been easing — down from 80% correlation to an agreeable 54%, as if they’re trying to be friends after years of awkwardness.

“Stocks up and so are long-dated treasuries, which takes out two FUD narratives at once,” said Bloomberg’s Eric Balchunas, probably while sipping his third coffee. (FUD stands for fear, uncertainty, doubt—dangerous stuff, like bad gym advice.) The bond yields are meandering a bit, with the 30-year slightly dipping and the 10-year nudging upward, creating a slightly confusing dance where bonds seem to be doing the jitterbug while stocks look on bemused.

This all amounts to a mixed bag of market sentiment—think of it as a slightly confused but mildly hopeful grandma trying to decide if she should buy more bonds or just stick to crocheting. Not as panicked as a few weeks ago when debt fears sent everything into a tailspin, but definitely not the calmest waters either.

Market Metrics at a Glance

Bitcoin’s current price is around $106,015—up about 1.5% in a day, but still down over 3% for the week, so the market is twirling its mustache and saying, “Well, maybe, maybe not.” This narrow range of $104,100 to $106,813 hints at cautious optimism or maybe traders just too tired to make bold moves.

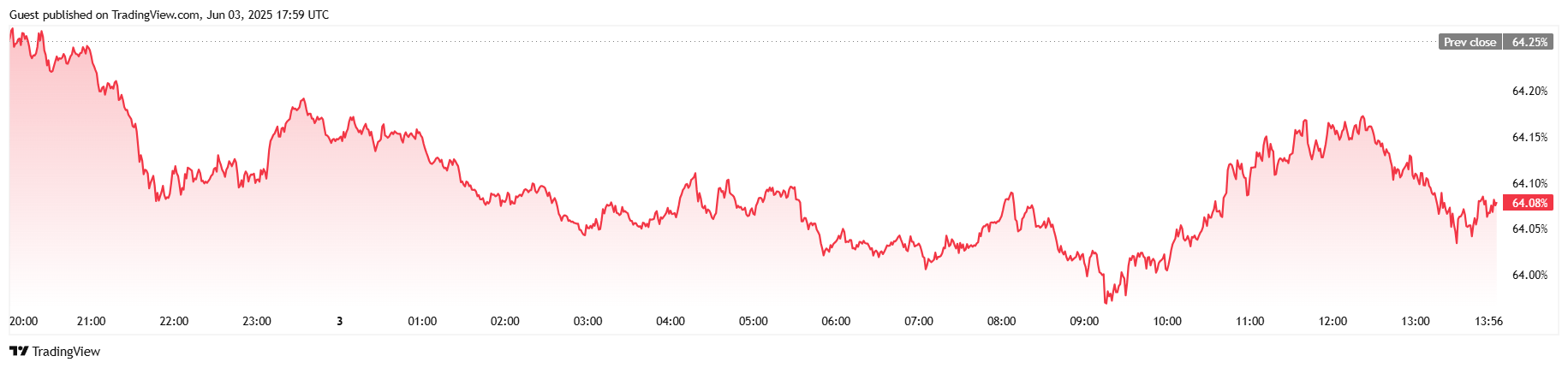

Trading volumes have gone up a tiny bit—by about 6.5%—because everyone loves a potential breakout, or perhaps just an excuse to justify that third coffee. Market cap nudged up by 1.5%, reaching $2.1 trillion, but Bitcoin’s hold on its throne (dominance) eased slightly to 64%, as if to say, “Hey, there are other crypto kiddos in town.”

The derivatives saga continues: open contracts dipped just a tiny bit, but liquidations—like folks running out of patience or realizing they bet the wrong way—shot up to almost 2.5 million, mostly from traders holding onto long positions. Short liquidations? Barely a blip, like a whisper in a noisy room.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-06-03 21:30