In the vast and impersonal machinery of modern commerce, where brands rise and fall like fleeting shadows, Lululemon Athletica (LULU) now finds itself ensnared in a legal labyrinth against Costco Wholesale (COST). This is no mere squabble over retail space; it is a contest of principles, a struggle for the soul of a brand that has long prided itself on exclusivity and craftsmanship.

The stock of Lululemon, once buoyant with the optimism of growth, has plummeted nearly 50% this year-a grim testament to faltering confidence among investors. Its challenges are manifold: sluggish expansion, an uncertain foothold in China, and now, the specter of imitation goods sold under the austere roofs of Costco warehouses. At these valuations, unseen since 2020, one must ask whether Lululemon represents a bargain or a mirage-a seductive illusion leading only to deeper entrapment.

What hangs in the balance, perhaps more than any quarterly earnings report, is the very essence of what Lululemon claims to embody.

A Litigation That Tests the Fabric of Identity

Lululemon accuses Costco of peddling “dupes”-cheap imitations that not only mimic its designs but also appropriate its lexicon of color names, such as “Tidewater Teal.” To Lululemon, these are not trivial details but vital threads woven into the tapestry of its identity. The lawsuit alleges intellectual theft, a crime not merely against property but against the spirit of creation itself.

If Costco prevails, it will deal a grievous blow to Lululemon’s fragile ambitions. In an era when consumers tighten their belts, drawn inexorably toward bargains, the allure of affordable substitutes could unravel the premium pricing upon which Lululemon depends. Imagine the indignity: garments bearing resemblance to Lululemon’s wares, priced at fractions of their cost, stacked indifferently alongside bulk paper towels and discount electronics.

Such a scenario would force Lululemon to slash prices, eroding margins and tarnishing the aura of exclusivity that sustains its appeal. It would be akin to watching a cathedral crumble beneath the weight of its own aspirations.

The Erosion of Growth: A Stark Reality

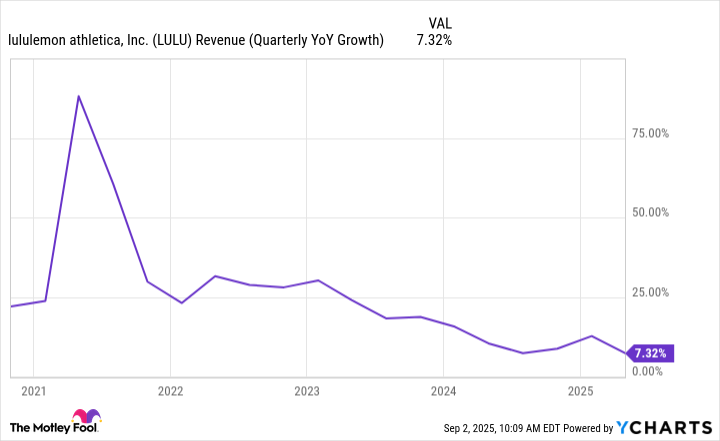

Once celebrated for its meteoric ascent, Lululemon now limps along with single-digit growth rates-a far cry from the heady days when annual increases exceeded 20%. The decline is not merely numerical; it reflects a deeper malaise, a loss of momentum that threatens to render the company irrelevant.

Compounding this peril is the looming uncertainty of tariffs tied to China-a nation both a critical market and a source of supply for Lululemon. Should Costco succeed in flooding the market with lookalike products, the erosion of Lululemon’s growth trajectory may accelerate, leaving behind a husk of its former self.

Why Prudence Demands Caution

To invest in Lululemon today is to wager on the resilience of a brand besieged by forces beyond its control. Its intellectual property, once a fortress of distinction, now stands vulnerable to the encroachments of cheaper alternatives. If consumers abandon loyalty for expediency, opting for imitation over authenticity, the future becomes bleak indeed.

Though the stock appears deceptively inexpensive, trading at a price-to-earnings ratio of approximately 14, the risks loom large. Investors must weigh the likelihood of triumph in the courtroom against the probability of continued stagnation. Will shoppers cling to the intangible value of Lululemon’s name, or will they succumb to the siren call of lower prices?

For now, the scales tip toward caution. Unless Lululemon can reclaim its narrative-through victory in litigation or resurgence in demand-it remains a venture fraught with peril. And so, I counsel abstention, lest we find ourselves complicit in the slow unraveling of a once-proud enterprise. 🧵

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-04 12:15