In the grand theatre of finance, where fortunes are written and rewritten with the flourish of a trader’s pen, the stock market has long played the role of Prospero – conjuring tempests and calm seas with equal indifference. Yet even this sorcerer’s apprenticeship has its limits, as history’s grimoire reveals in ink both indelible and ironic.

Five months past, when the Thespian-in-Chief recited his tariff-laden soliloquy, the market’s three musketeers – the S&P 500 (^GSPC), Nasdaq Composite (^IXIC), and Dow Jones Industrial Average (^DJI) – executed a pirouette so dramatic it would make Nijinsky envious. The S&P 500, that most temperamental of performers, delivered its fifth-steepest two-day decline since the age of tailfins and transistor radios, while the Nasdaq stumbled into its first bear market since the days of disco.

Yet Wall Street’s heart, like Wilde’s Dorian Gray, remains eternally youthful in its capacity for reinvention. Since the presidential decree of a 90-day tariff truce on April 9, the indices have pirouetted back to life, breaking records with the exuberance of debutantes at their first ball. But let us not forget: all gilded ages cast long shadows.

The Market’s Narcissus Complex: A Reflection in Valuation

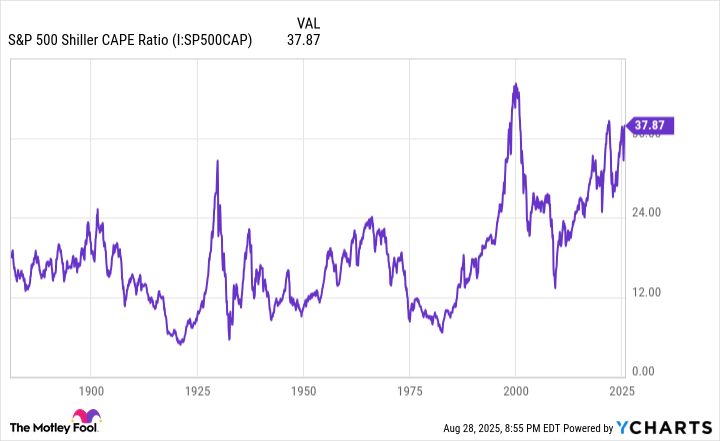

One must approach historical precedent with the caution of a gentleman handling a Fabergé egg – exquisite, but liable to shatter under scrutiny. The Shiller P/E ratio, that most perspicacious of mirrors, currently reflects a visage both magnificent and monstrous.

This cyclically adjusted price-to-earnings ratio – which peers through the frosted glass of ten-year inflation-adjusted earnings – now stands at 39.18. The S&P 500 (^GSPC) may have crossed 6,500 with the bravado of a Victorian explorer, but the numbers whisper darker truths. Only twice in 154 years has this metric worn a more expensive crown:

- The opening act of 2022, when the ratio briefly donned 40 like a borrowed tiara

- December 1999, where 44.19 gleamed like Midas’ final folly

The aftermath? The dot-com bubble claimed 49% of the S&P’s value and 78% of Nasdaq’s glory, while 2022’s bear market devoured a quarter of portfolios with the indifference of a hungry crocodile in a Darwinian essay.

When the Shiller P/E exceeds 30 for two months’ duration, it becomes the Cassandra of financial metrics – always right, never believed. Each of the five previous occurrences ended in corrections ranging from 20% to 89%, a mathematical ballet of destruction.

The Alchemy of Patience: Turning Time into Treasure

Yet to judge the market by its peccadilloes is to miss the grand opera of capitalism. While the Shiller P/E may portend short-term storms, the long game reveals a different stratagem. Since the war-torn days of 1945, America has weathered twelve recessions – each averaging ten months, none exceeding eighteen. Economic expansions, meanwhile, have paraded for five years on average, with two grand affairs surpassing the decade mark.

Loading…

–

The statisticians at Bespoke Investment Group recently revealed that S&P bear markets (those 20%+ declines) average 286 days – a fleeting indisposition. But bull markets, ah! They linger like a fine claret, averaging 1,011 days of liquid gold. And over twenty-year periods? The index has never, not once, delivered negative returns with dividends included. The market, that most unreliable of lovers, remains a faithful companion to those who measure time in decades rather than days.

In this grand pantomime of valuations and volatility, one truth emerges with Wildean clarity: The market’s greatest tragedy is its investors’ impatience. To those who would dance through the decades, the music never truly stops. 🎭

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-08-31 10:12