As the final days of the calendar slip quietly away, the S&P 500 dances near a lofty perch-six thousand eight hundred and thirty-nine, or thereabouts-a number that glints like a polished stone, tempting yet somehow distant from the ground beneath. For three years now, an underlying hum-artificial intelligence-has carried the market forward, whispering promises of progress that may yet prove as fragile as a winter’s frost.

In the dim-lit corridors of investment, many cast their eager gaze upon the shimmering ascent, hopeful that the year ahead-2026-will mirror previous triumphs. Yet beneath that veneer of optimism, a lesser-known indicator stirs-a spectral warning whispering from the shadows, repeating a refrain that history etched deep into its ledger.

Will the markets falter and fall in the shadow of their own hubris? A question that haunts those who look beyond the gleam of the present and glimpse into the murky mirror of the past. The answer, as always, remains elusive, cloaked in the mist of what might come.

When the Wall Street echoes become faint, what do they truly say?

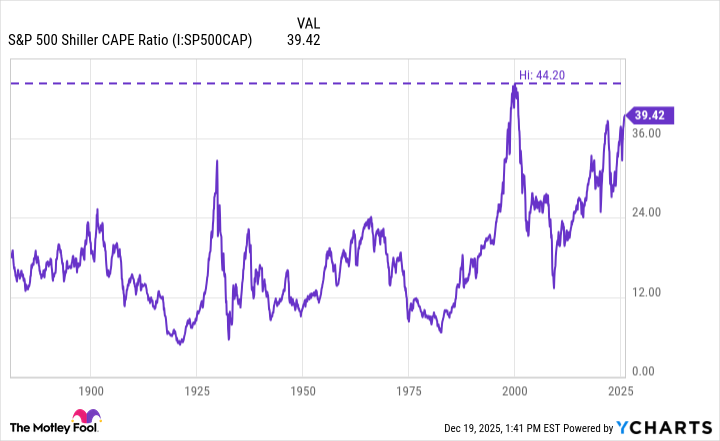

Analysts mutter about values-multiples, ratios, and projections-words that echo like distant thunder, more frequent and less meaningful the further from the ground they drift. The broader landscape often calls for simplicity, a glance at the S&P 500 Shiller CAPE ratio-a measure of inflation-adjusted earnings stretched across a decade, now resting near a level once seen in the late 1920s and again at the dawn of the millennium.

This faintly ominous graph-perhaps no more than a mirror held up to the markets-reminds us that the ratios of yesteryear, when lofty, presaged downfall. As the ratio approached its current perch, the echoes of the past tell tales of crashes-catastrophes that threw whole epochs into disarray. The late 1920s crumbled into the Great Depression; the year 2000 unraveled the dot-com fantasy, leaving behind less than the promises once made.

The specter’s shadow cast forward, into 2026

If history’s lessons are to be trusted-an endeavor often tinged with wistfulness-the trajectory suggests a reversal. The high peaks-those inflated ratios-often herald a downturn, if not a collapse. Stocks have, on occasion, resembled fragile castles of sand, promising much but barely holding their form when the tide begins to turn.

Yet, beneath this somber prognosis lies a peculiar reality: the sharp rise over the past few years owes much to the titans of technology-companies whose missions once seemed as boundless as their stock prices, yet whose results often lag behind the dreams they sell. Nvidia, Alphabet, Amazon, Microsoft, Broadcom, Meta, Apple-these names have monetized and capitalized on generative AI, transforming aspiration into profit, or so it appears.

Nevertheless, the duration of market reversals remains an enigma. Recessions-like weather-come and go differently each time, sometimes lingering in the shadows for years, sometimes passing swiftly, leaving little trace of their passage. The market’s breath is uneven, and patience-an undervalued virtue-is perhaps all that remains.

Despite the uncertainty, a truth endures unwavering-a kind of quiet conviction. Investing in the S&P 500 over the long haul has historically been akin to planting a small seed and waiting patiently as it grows. Over nearly a century, an average annual gain of around 7% has woven a tapestry of modest success, often under the guise of a quiet, unassuming market. Even if the calendar’s pages turn to a year of turmoil, the fundamental principle endures: patience and persistence often outshine fleeting panic.

In the end, the market’s unceasing march is a reminder that life, with all its unfulfilled promises, persists beyond the warnings and the warnings’ silence. Markets will rise or fall, as they always do, but the true investor’s task is to observe quietly, to buy even as the shadows lengthen, and to accept that perhaps some stories are best left unfolding in the soft, indifferent dusk of time.🌙

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- The Weight of Choice: Chipotle and Dutch Bros

2025-12-23 23:54