The market breathes, you see. It swells with hope, then contracts with fear. Lately, that breath has been ragged. Folks are talking of shadows lengthening, of a chill in the air. Thirty-eight and a half percent still hold to a hopeful view, clinging to the belief that the coming months will be kind. But nearly the same number – a little over thirty-eight percent – feel a tightening in the gut, a sense that the ground might soon give way. It’s a familiar story, this dance between optimism and dread.

Will the fields lie fallow in ’26? Nobody can say with certainty. The land yields what it will, and the market is much the same. But downturns are as natural as the seasons. A wise farmer doesn’t ignore the storm clouds; he prepares for them. And a careful investor, a man who seeks the steady yield, does the same. There’s one thing, above all, to consider when the winds begin to howl.

Keeping a Clear Head

When the market trembles, the impulse is to pause, to pull back, to wait for the shaking to stop. It seems sensible enough. But sense, like a good plow, requires careful handling. It can be costly to simply stand idle.

The market is a restless creature, always shifting, always testing. Trying to time its movements is a fool’s errand. Even the so-called experts, those who claim to read the signs, are often left guessing. A month, a year… these are mere blinks in the life of the market. To sell at the wrong moment is to lock in loss, to surrender a portion of what you’ve worked to gather.

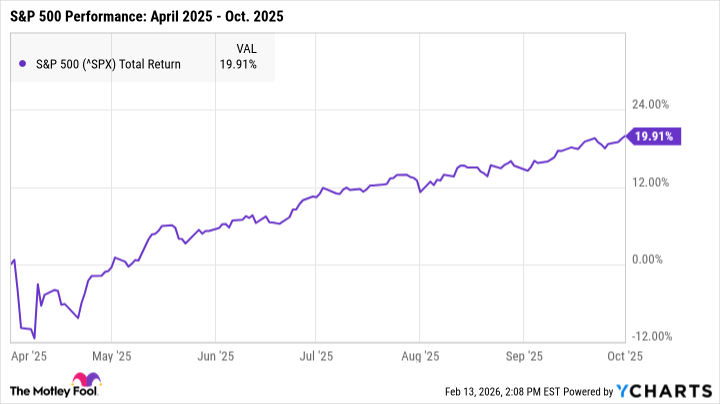

Take, for instance, the spring of ’25. Prices dipped, a shadow of tariffs falling across the land. Many feared a long winter, a deep recession. It would have seemed prudent to sell, to safeguard what little remained. But the land, it surprised them. The market rebounded, almost immediately. The S&P 500 (^GSPC +0.05%) climbed, a stubborn vine reaching for the sun, gaining nearly twenty percent before the leaves began to turn.

Not every fallow period yields such a quick harvest. The land is fickle. But panic-selling is a dangerous game. It’s like abandoning your fields at the first sign of drought, hoping to find richer soil elsewhere. More often than not, you’ll find only dust.

To sell in a moment of fear is to sell low. And to buy back in later, when prices have risen, is to pay a higher price for the same yield. It’s a cycle of loss, a slow erosion of wealth.

Protecting Your Harvest

The best defense, when the storm gathers, is to remain planted. To stay invested, no matter the weather. It’s not about chasing quick gains, but about weathering the seasons. Your portfolio may lose value, its surface appearance diminished, but as long as you hold firm, as long as you wait for the sun to return, you will be restored.

Loss comes only when you surrender. When you sell in fear, you make the loss real. But if you remain steadfast, if you trust in the long-term yield, you will be rewarded.

The key is to choose strong seeds. To invest in companies with deep roots, companies that can withstand the harshest conditions. Even the strongest trees can be bent by the wind, but they will not break. A portfolio built on solid foundations is more likely to survive even the most severe downturns, to yield a harvest year after year.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-15 20:22