It transpired, as I posited, that Coca-Cola proved the more resilient investment than Procter & Gamble in the year recently passed, 2025. A gain of 12.3% for the former, contrasted with a decline of 14.5% for the latter – a disparity not merely of numbers, but of currents shifting beneath the surface of the market. One observed, with a certain quiet satisfaction, the vindication of a considered judgment.

The performance of Coca-Cola was all the more noteworthy given the peculiar languor that afflicted the consumer staples sector as a whole. While the broader S&P 500 ascended with a vigor of 16.4%, this sector, burdened by its own weight of tradition, could only muster a decline of 1.2%. A curious spectacle, this divergence, revealing the subtle preferences of the investing public.

Let us then consider the reasons for this outcome, and, more importantly, discern which dividend-paying stock promises the greater rewards for the year now unfolding, 2026.

The Familiar Recipe

When one surveys the landscape of reliable income generation, Coca-Cola and Procter & Gamble stand as venerable institutions, pillars of a bygone era. Coca-Cola, boasting 63 consecutive years of dividend increases, and Procter & Gamble, with a still more impressive 69 years, represent a lineage of consistent reward – a rarity in these volatile times. They are, one might say, the landed gentry of the stock market.

Both companies possess supply chains of remarkable efficiency and brands recognized across the globe. Coca-Cola’s network of bottling partners allows it to maintain healthy margins, a delicate balance of production and distribution. The corporation itself concentrates on syrups and concentrates, leaving the complexities of packaging and delivery to its affiliates. This arrangement allows for a flexibility that shields it, to a degree, from localized economic downturns.

Procter & Gamble, similarly, benefits from its scale, its global partnerships, and a portfolio of brands that dominate their respective categories. High margins, in both instances, translate to greater earnings and, consequently, the capacity to sustain dividend growth. A simple equation, yet one that underpins enduring prosperity.

The Concentration of Essence

Despite their superficial similarities, these two enterprises differ in their approach to capital allocation. Coca-Cola, in recent years, has favored acquisition, absorbing brands like BodyArmor, Fairlife, Topo Chico, and Costa Coffee to diversify beyond its traditional sodas. Procter & Gamble, on the other hand, has preferred to nurture its existing portfolio through innovation and marketing – a more conservative, perhaps more provincial, strategy.

Coca-Cola, despite these additions, remains heavily reliant on its flagship Coca-Cola brand, which accounts for 42% of U.S. unit case volume and 48% internationally. Procter & Gamble boasts a wider array of core brands – Gillette, Tide, Pampers, Crest, Dawn, Olay, Febreze, Bounty, and Charmin – yet lacks that singular, dominating presence.

Diversification, of course, can be a strength. However, in recent times, Coca-Cola’s concentration on a few key brands has proven advantageous, allowing it to absorb rising costs and pass them on to consumers with greater ease than Procter & Gamble. A subtle advantage, perhaps, but one that has yielded tangible results.

For the full year 2025, Coca-Cola anticipates non-GAAP organic revenue growth of 5% to 6%. Procter & Gamble, by contrast, achieved only 2% organic sales growth in its fiscal year ending June 30, 2025, and projects a range of 0% to 4% for the year ahead. A telling contrast, indicative of differing trajectories.

Value and the Passing Seasons

As we entered 2025, Coca-Cola possessed a clear advantage in terms of value, bolstered by its robust margins. Throughout the year, the company demonstrated an admirable ability to maintain, and even slightly increase, volume while exercising commendable pricing power.

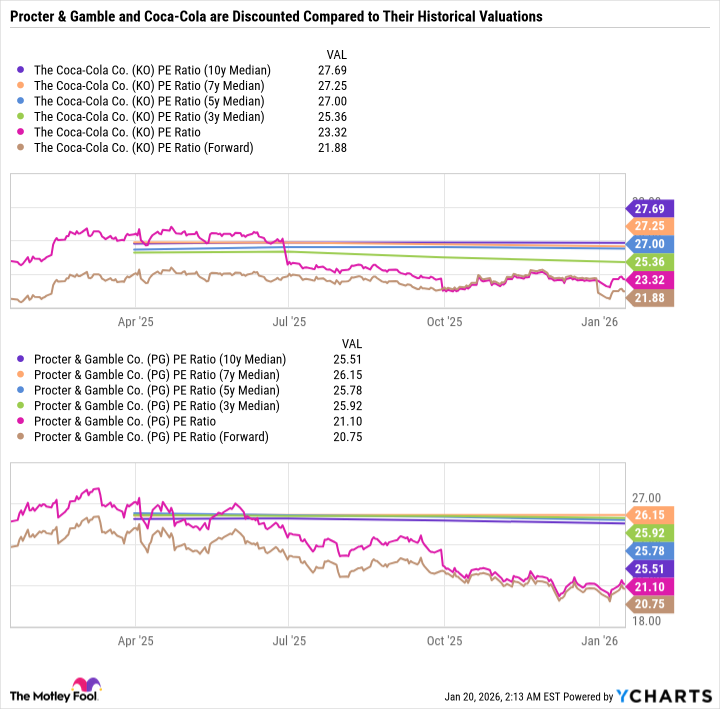

The landscape has shifted for 2026. Procter & Gamble now appears to offer the more compelling value proposition. Yet, both companies are currently trading below their historical valuations, as reflected in both price-to-earnings and forward P/E ratios. However, given the deceleration of earnings from both, a degree of caution is warranted. The market, it seems, has already begun to account for this.

Following Procter & Gamble’s recent decline and Coca-Cola’s modest gain, both stocks represent solid buys for 2026, particularly for income investors seeking to enhance their passive income streams. A prudent course, in a world beset by uncertainty. One might even say, a necessary one.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 06:23