In the hallowed recesses of speculative investment, where the future is less a destination than an illusion perpetuated by probabilities, there lies the enigmatic figure of SoundHound AI, a company poised at the intersection of the known and the unknowable. The claim is bold: a humble $10,000, invested in this curious enterprise, could swell into $100,000 within a span of years that, like the future itself, might elude our grasp.

One might be tempted to dismiss such assertions, as the philosopher dismisses the mirage of infinity. Yet, as with all speculative ventures, the labyrinth of possibility is not without its seductive appeal. We are, after all, living in an age when the promise of artificial intelligence has become the new gold rush-an arena where fortunes are forged in the crucible of innovation. In such a world, the question is not merely whether SoundHound can fulfill its promises, but whether it is the right labyrinth to enter at all.

The company, not a pioneer in the strictest sense but a competent heir to the legacy of digital assistants, has crafted its niche by blending the commonplace-audio recognition-with the esoteric-generative AI. It is not the innovation itself that confounds the onlooker, but rather the manner in which it outpaces its human counterparts. Take, for example, the menial task of drive-thru order taking, where SoundHound’s technology can seemingly outperform the limited faculties of human employees.

Yet the true value of SoundHound lies not in its present capabilities but in the vastness of the labyrinth it seeks to map. Its reach has expanded, like the threads of an ancient myth, into automotive, healthcare, retail, and financial services. In its second-quarter earnings report, the company revealed that seven of the world’s top ten financial institutions had entered into its fold. Four of these, like pilgrims returning to a holy site, have expanded their commitments. One might, in this context, draw parallels to a secret society, where the terms of engagement are as much about trust as they are about technology.

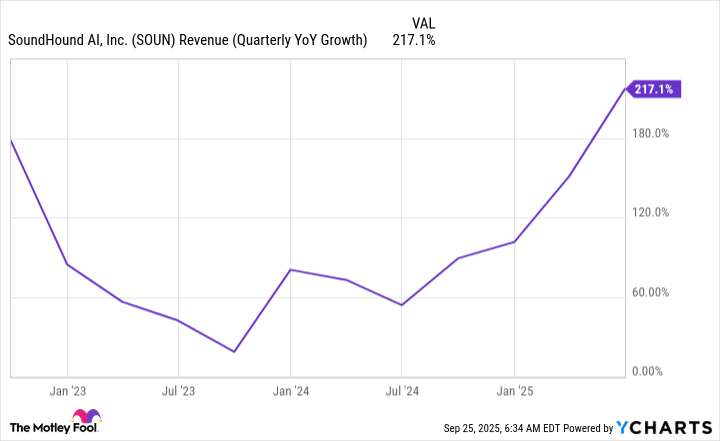

In the arcane halls of finance, there is a curious fascination with growth-a fascination that borders on the metaphysical. And SoundHound, with its staggering 217% year-over-year revenue increase, beckons the investor with the promise of exponential ascension. Yet, like a young scholar exploring the vast expanse of a forgotten library, one must note that the company remains small, its revenues under $50 million per quarter. This affords it the nimbleness to grow at an extraordinary pace, an advantage akin to a secret door that might, at any moment, open into an entirely new chamber.

The Organic Growth Enigma

And yet, we must acknowledge the tension that resides within SoundHound’s impressive growth figures. There is an old maxim in the halls of finance: “Acquisition is but the shadow of true growth.” SoundHound has bolstered its prospects through acquisitions, inflating its growth like a temporary enchantment, one that cannot last forever. The key question, then, is the “organic growth rate,” that elusive metric by which a company’s true nature is revealed, undistorted by external forces.

In a recent conference call, the company’s leadership, scholars in their own right, projected that the organic growth rate might exceed 50% in the years ahead. A figure of this magnitude, one might argue, carries with it the weight of an ancient prophecy. If realized, this growth could propel SoundHound into the realm of the truly exceptional, where the fruits of an initial investment could multiply in ways one might call alchemical.

Should SoundHound’s revenue trajectory mirror that of its stock, the speculative journey of a $10,000 investment might indeed yield $100,000. In a mere six years, the investor could find themselves in possession of a treasure that was once the stuff of fables. But such promises are precarious, like stepping stones across a vast river. The market’s ceaseless currents and the inevitable rise of competitors may yet render these projections more myth than reality.

Thus, the wise investor-if we may borrow a term from ancient philosophers-must balance risk with reason. Like the great navigators of old, one must plot a course through the turbulent seas of uncertainty, with an eye toward long-term horizons, even as the immediate future remains a fog. For if SoundHound succeeds in its ascent, even a modest investment of 1% to 2% of one’s portfolio could yield extraordinary returns. But the path is fraught with danger, and there are no guarantees in this labyrinth of investment.

The future, like all things, is written in the ink of probability. As such, the possibility that SoundHound could emerge as a monumental winner is not one I would dismiss lightly. In the end, time will reveal whether this company’s story is one of triumph or tragedy, but the curious investor, much like the scholar perusing ancient texts, may find themselves drawn to the riddle all the same.

🌀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-04 12:02