The S&P 500, that vast and curious beast, has been on an unexpected tear, gaining 24% and 23% respectively over 2023 and 2024. Even now, it strides toward another double-digit increase for the year. A few days ago, it even reached record heights, a triumph that serves as a testament to the current bull market’s endurance. But when one surveys the landscape, it is hard to avoid a faint sense of deja vu. Such rallies-though hopeful-are never entirely without their shadows.

Leading the charge are the growth stocks, those sprightly figures that have found their moment under the heady lights of artificial intelligence. Investors, caught in the excitement of this new technological dawn, have embraced the promises of AI with enthusiasm that borders on fervor. The projections are grand, the AI market to reach trillions by the early years of the next decade. And yet, beneath the surface of these predictions, one wonders whether all the promises will manifest as neatly as anticipated, or whether we shall see another grand scheme falter beneath the weight of its own ambition.

But let us not be too cynical, for there is much good news to be had. The Federal Reserve, with its gentle hand, has lowered interest rates. This is, after all, what the market needed: cheaper borrowing for companies and more disposable income for consumers, both of which help propel the growth of stocks. Indeed, the atmosphere is ripe with the scent of optimism. Yet, despite the merriment, there is a singular event that lingers-a rare occurrence that has only been witnessed thrice in the past 153 years-something that may not be as reassuring as it initially appears.

Tariffs: A Cloud on the Horizon

It was, of course, not all smooth sailing this year. Earlier, stocks dipped into the churning waters of uncertainty, driven by concerns over President Trump’s import tariff plans. A small flexing of policy here and there seemed to ease the market’s nerves, and investors resumed their cautious dance of optimism. Companies, with their customary resourcefulness, managed to weather the storm. And then, with a slight flicker of hope, the news came: AI growth and favorable monetary policy helped lift spirits further. To sweeten the deal, corporate earnings arrived stronger than expected. By the second quarter, 79% of S&P 500 companies surpassed revenue estimates, and over 80% exceeded earnings forecasts-figures far beyond historical averages.

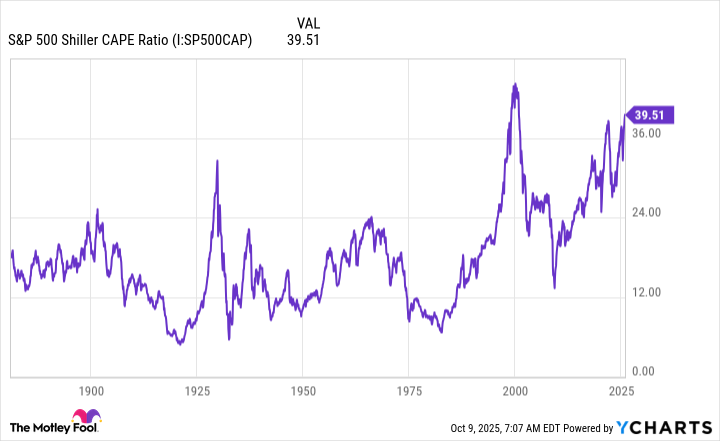

Indeed, the market rallied, pushing the S&P 500 to unprecedented heights. Yet here we arrive at a moment that, though historically rare, bears our full attention. For, as we look at the S&P 500 Shiller CAPE ratio, we notice something curious-something that speaks to the inherent tension between hope and reality. This ratio, which takes into account earnings over a decade, has crossed 36, a level reached only twice in 153 years. More alarmingly, it has now surpassed 39-a level not seen since the dot-com bubble of 1999, when it topped 44. One cannot help but wonder, how much of this enthusiasm is truly grounded, and how much is mere speculation?

What does this mean? In simpler terms, the market is expensive, and history, like a patient but somewhat melancholy old friend, tells us that when the market reaches such heights, declines inevitably follow. The past offers us cautionary tales: from December 1999 to December 2002, the S&P 500 lost more than 37%, and from December 2021 to December 2022, it fell 16%-all following similar valuation peaks.

The Silver Lining

Yet, all is not doom and gloom. For every ominous sign, there is a glimmer of hope-a lesson from the past that seems as immutable as time itself. History teaches us that even when markets are high, they are never truly beyond repair. A bull market will eventually cool, and a bear market will, in turn, recede. It is a cycle, as certain as the passage of the seasons. And though high valuations have often led to declines, they have also paved the way for rebounds-rising again, like the sun after a storm.

Thus, the key to navigating this moment is patience. If one invests with a steady hand, in companies that possess not only solid financial footing but also a clear sense of direction, the downturns of the market can become mere opportunities to buy at bargain prices. The market will move on-those who ride with it may find themselves better positioned in the long run, though the future remains as elusive as ever.

One can only hope that in this great theatre of markets and fortunes, the stage is not set for another disappointing act. But as always, the play goes on, as do the markets, each moment a chance to rewrite the narrative. 🌒

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Opendoor’s Stock Takes a Nose Dive (Again)

2025-10-13 02:38