Over the past seven months, investing has been quite an exciting journey, filled with ups and downs. Back in mid-February, the widely recognized S&P 500 (^GSPC) reached a new record closing point. Similarly, both the renowned Dow Jones Industrial Average (^DJI) and the rapidly growing Nasdaq Composite (^IXIC) achieved their best closings in December.

Then the wheels fell off and heightened volatility kicked in.

In the first full trading week of April (from the market close on April 2 until the end of trading on April 4), the S&P 500 experienced its fifth-largest two-day percentage drop over a span of 75 years. Just under a week later, the S&P 500, Dow Jones, and Nasdaq Composite all recorded their largest single-day point increases in their individual histories.

It’s common for investors to look back at past events and statistics when the main indexes of the stock market show large fluctuations, as these might provide clues about possible directions in the performance of indices like the S&P 500, Dow Jones, or Nasdaq Composite. Although no indicator can predict the future with certainty, some correlations between events and statistics have a remarkable history of forecasting stock market returns.

It turns out that a recent accomplishment by the S&P 500 suggests a significant likelihood of stocks experiencing substantial growth in the next 12 months.

Heightened volatility may be the near-term norm for Wall Street

Before peering towards the future, it’s crucial to scrutinize the past and decipher the factors that have built a base for increased market turbulence in 2025.

It’s widely agreed that no single factor has influenced stock market fluctuations as much this year as President Donald Trump’s tariff and trade policies. On April 2, after markets closed, he announced a 10% global tariff and increased “reciprocal tariffs” on numerous countries with unfavorable trade balances towards the U.S. This announcement led to a 10.5% drop in the S&P 500 over the subsequent two trading days.

In about a week’s time, the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite saw unprecedented growth following a 90-day halt in increased reciprocal tariff rates. These same tariffs, which President Trump has once more put on hold for certain countries until August 1st, have now resumed their pause with adjustments.

1) The issue surrounding tariffs is two-pronged: Firstly, there’s a fear that tariffs could rekindle domestic inflation and strain trade ties with our allies. Secondly, the president and his team have been inconsistent in setting tariff dates and rates, which Wall Street finds problematic as they value predictability, yet are not receiving it from the current administration.

Investors have also been tasked with navigating one of the priciest stock market’s in history.

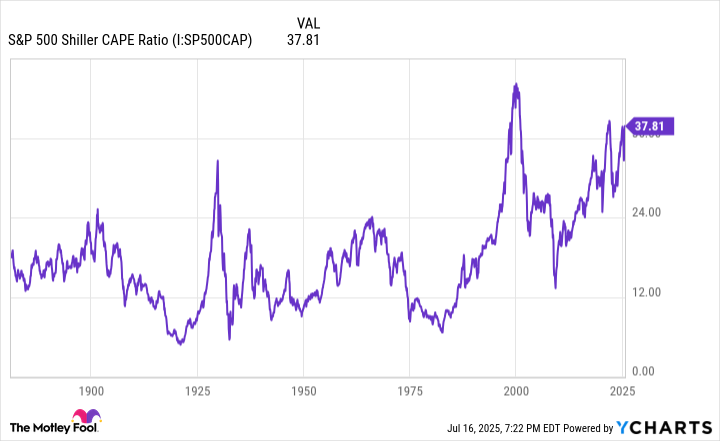

In December, the Shiller price-to-earnings (P/E) ratio for the S&P 500, also known as the cyclically adjusted P/E ratio or CAPE Ratio, reached a multiple of 38.89. This is one of the highest readings during a prolonged bull market when data goes back to January 1871. At the time of this writing on July 16, it remains above 38.

Expanding our perspective slightly, it’s important to note that over a span of 154 years, the Shiller P/E ratio has exceeded and maintained a level of 30 for two months or more on just six occasions – one of which is the current situation. Historically, each of the previous five instances led to the S&P 500, Dow Jones Industrial Average, and/or Nasdaq Composite Index dropping by at least 20% in value.

Another significant factor contributing to Wall Street’s instability is Moody’s decision to lower the United States’ credit grade from AAA to AA1. This makes the U.S. the third nation to lose its top credit rating, following this action by Moody’s.

As an ardent observer of our nation’s economic landscape, I can’t help but feel a pang of concern as we witness this downgrade in our economy’s rating. It’s like a friendly reminder that our ever-increasing national debt could potentially reach unsustainable levels someday. This is just another example of the uncertainty that’s been sneaking into the minds of investors, making us all pause and reflect on our financial future.

We just observed the S&P 500 do something exceptionally rare — and it bodes well for optimists

Given the increased unpredictability in the stock market throughout 2025, which may persist for some time, let’s revisit an extraordinary accomplishment of the S&P 500. From a historical perspective, this achievement suggests substantial growth potential in the stock market moving forward.

It isn’t unusual for investor feelings like anxiety and worry to surface when main Wall Street stock indexes plummet in value. However, an intriguing aspect of the stock market lies in the fact that some of the finest investment possibilities frequently emerge during times when situations appear their worst.

Earlier mentioned, the S&P 500 dropped by 10.5% from April 2 to April 4 and came very close to entering a bear market by the end of trading on April 8. On the other hand, the Nasdaq Composite officially entered a bear market on April 8, marking its first such instance since 2022.

Starting from April 9, all three main indexes experienced a significant surge and have continued to climb steadily. Remarkably, for just the sixth occasion since 1950, the extensive S&P 500 has recorded a rise of more than 25% over a three-month span.

Loading…

According to Ryan Detrick, Chief Market Strategist at Carson Group, the broadest index on Wall Street has experienced a significant increase of around 26% over the past three months. Predicting returns in the S&P 500 a month following such large increases can be unpredictable, but it’s clear that the S&P 500 has consistently performed well one year after these strong three-month gains.

After five occasions where the S&P 500 increased by at least 25% within a three-month span, the index typically rose an average of 21.4% one year later. On the contrary, the S&P 500 has yielded an average annualized return of 9.2% since 1950. To put it another way, during these infrequent periods of significant growth, the S&P 500 has historically seen its yearly return more than double its usual rate.

Detrick’s dataset indicates that investment cycles are not straightforward or predictable, but rather complex and often favor those who adopt a long-term optimistic approach.

In June 2023, researchers at Bespoke Investment Group analyzed the duration of each bull and bear market in the main index, starting from the onset of the Great Depression in September 1929. Their findings revealed stark contrasts.

While an average S&P 500 bear market usually lasts around 286 days or about 9.5 months over a span of nearly 94 years, a typical bull market tends to continue for around 3.5 times longer – approximately 1,011 days, which is roughly two years and nine months.

Despite any concerning drops in indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, such periods are typically brief in the grand scheme of things and often pave the way for some of the most lucrative investment chances on Wall Street.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-19 11:48