Now, the S&P 500. A curious concoction, isn’t it? Five hundred companies, all jostling for space like sweets in a jar. It’s America’s favourite, you see, because it’s got a bit of everything – the brainy boffins inventing whizzpoppers, the banks stuffed with other people’s fortunes, and all sorts of peculiar businesses in between. A right muddle, but a surprisingly sensible one.

For years and years – since 1957, can you believe it? – this index has been growing at a rate of 10.6% a year. Not bad, eh? Though last year it went a bit bonkers, shooting up 17.8% thanks to a new craze called ‘Artificial Intelligence’ – machines pretending to be clever. It’s had a bit of a wobble recently, but it’s still awfully close to its highest ever point. A bit like a wobbly jelly, really.

And then there’s the Vanguard S&P 500 ETF. A mouthful, I know. Think of it as a little box that holds all 500 companies, neatly arranged. It mimics the index, you see, so if the index goes up, the box goes up too. Now, some people try to guess when the market will go up or down. Utterly foolish, if you ask me. It’s like trying to predict which way a particularly grumpy snail will slither. So, should you jump in and buy this box right now? Let’s have a look.

A Fund for Folks of All Shapes and Sizes

Now, this S&P 500, while diverse, isn’t quite equal. The biggest companies have the loudest voices, you see. They weigh things down, so to speak. That’s why the ‘Information Technology’ sector – a place full of blinking lights and complicated wires – makes up a whopping 34.4% of the whole thing. Four giants – Nvidia, Apple, Microsoft, and Broadcom – are worth a staggering $12.7 trillion. Enough to buy a very large number of boiled sweets.

Here are the next five biggest slices of the pie, with a few of the characters inside:

| S&P 500 Sector | Weighting | Noteworthy Stocks |

|---|---|---|

| Financials | 13.4% | Berkshire Hathaway, JPMorgan Chase, Goldman Sachs |

| Communication Services | 10.6% | Alphabet, Meta Platforms, Netflix |

| Consumer Discretionary | 10.4% | Amazon, Tesla, Home Depot |

| Healthcare | 9.6% | Eli Lilly, Johnson & Johnson, AbbVie |

| Industrials | 8.2% | Caterpillar, Boeing, Deere & Company |

And then there are the others – the everyday staples, the energy providers, the utilities, the real estate folks, and the material suppliers. A perfectly sensible bunch, though not quite as flashy as the tech giants.

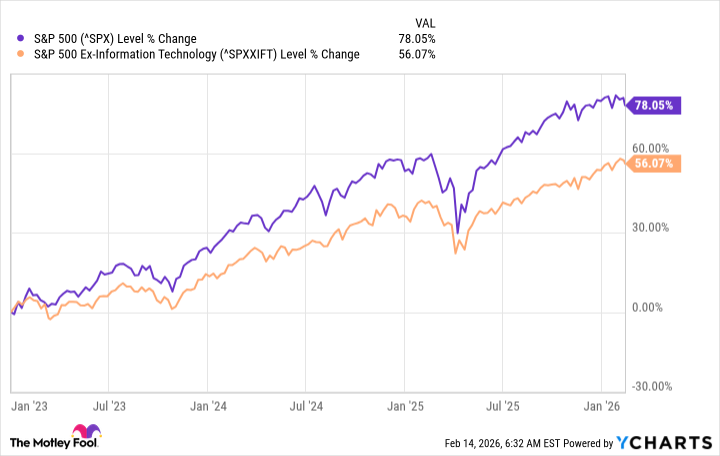

These AI stocks are the ones creating the most excitement at the moment. Companies like Alphabet, Meta, Amazon, and Tesla are all involved, though most of the really clever stuff is happening in that ‘Information Technology’ sector. Since the beginning of 2023, the S&P 500 has grown by 78% thanks to this AI boom. But if you take out that tech sector, it drops to just 56%. A rather significant difference, wouldn’t you agree?

So, the S&P 500 – and by extension, this Vanguard ETF – consistently gives you a good slice of the fastest-growing trends, while still spreading your pennies around a bit. A rather sensible strategy, if I do say so myself.

Should You Buy This Box Right Now?

History tells us there’s rarely a bad time to invest in the market. It’s bound to wobble and dip from time to time, but those who stick with it for the long haul usually do rather well. As I mentioned earlier, the S&P 500 has grown at 10.6% a year since 1957, and that’s after accounting for all the bumps and bruises along the way.

In fact, Capital Group tells us the S&P 500 dips by at least 5% once a year, on average. And bigger corrections – 10% or more – happen every couple of years. Even bear markets – when things fall by 20% or more – happen every six years or so. A bit like a grumpy giant having a bad day.

So, if you’ve been buying this ETF over the last seven decades, you’ve probably done rather well. And even if you’d bought at previous record highs, you’d still be sitting on a profit, even after a few dips and wobbles.

This Vanguard S&P 500 ETF is a simple way to get a piece of the S&P 500 pie, and it’s one of the cheapest funds available. The annual fee is just 0.03%, which means an investment of $10,000 would cost you a mere $3 a year. A pittance, really. So, if you’re planning to hold on for five years or more, there’s really no time like the present. Just remember, investing is a bit like gardening – you need to plant the seeds and then be patient. And sometimes, you get a lovely surprise.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2026-02-18 00:23