In the grand theater of human ambition, where fortunes rise and fall like tides under a tempestuous moon, there exists a peculiar creature: BigBear.ai. Its stock-ticker symbol BBAI-has danced to the tune of chaos, ascending by a staggering 337% over the past year, only to stumble into an abyss of despair in recent weeks, losing 31% of its value within a single month. Oh, how swiftly the market transforms hope into dread, salvation into ruin!

On August 11, the company unveiled its second-quarter results, a grim confession that left investors clutching at their chests as though struck by some invisible dagger. Not only did it miss Wall Street’s expectations, but it also revised downward its 2025 guidance-a move akin to admitting defeat in the face of insurmountable odds. And yet, amidst this turmoil lies a paradoxical truth: BigBear.ai operates within the burgeoning artificial intelligence (AI) software market, a domain destined for exponential growth. The question looms heavy with existential weight: Is this decline merely a prelude to redemption, or is it the beginning of a descent into oblivion?

A Market Pregnant with Promise, Yet Fraught with Peril

BigBear.ai offers tools that promise mastery over data, granting its clients the power to peer into the labyrinthine corridors of decision-making. These AI-powered solutions find application in realms as varied as cybersecurity, healthcare, academia, and border security. It is here, amid the hum of algorithms and the glow of monitors, that humanity wrestles with its own reflection-a reflection distorted by both progress and hubris.

The numbers speak of boundless opportunity. By 2028, the global AI software market is projected to swell from $28 billion in 2023 to a staggering $153 billion-an ascent so vertiginous it seems almost divine. Yet, what of BigBear.ai itself? Here lies the tragedy. For while the world races ahead, the company stumbles, its revenue growth languishing, its ambitions confined to federal contracts whose whims are as unpredictable as the wind.

Consider its rival, Palantir Technologies, which strides confidently through this same landscape. In the first half of 2025, Palantir’s revenues surged by 44%, buoyed by a commercial customer base expanding faster than the stars in the night sky. Meanwhile, BigBear.ai clings to government contracts, its Q2 revenue plunging 18% year-over-year due to the vagaries of Army spending. How cruelly ironic, then, that a company built upon the premise of predictive intelligence should fail to foresee the capriciousness of its largest client.

The Burden of Choice: To Adapt or Perish

CEO Kevin McAleenan, a man burdened by the weight of leadership, acknowledges the narrowness of BigBear.ai’s pipeline. “It was clear to me,” he confessed during the company’s latest conference call, “that our reliance on a few large contracts was unsustainable.” Thus, he speaks of broadening horizons, of venturing into new markets, of seeking prime contracts abroad. But such transformations take time-a commodity the market rarely affords.

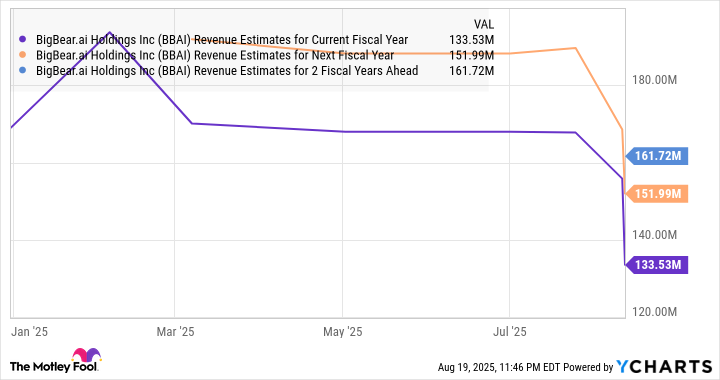

Analysts, those modern-day augurs interpreting entrails of data, have tempered their forecasts for BigBear.ai. Revenue projections for 2026 and 2027 suggest stagnation rather than triumph. The stock, trading at 10 times sales, may grow cheaper still, a relic discarded by those who demand immediate gratification. And yet, beneath this veneer of despair glimmers a faint light-a chance for reinvention, for redemption.

To invest in BigBear.ai now is to wager not on its present struggles but on its potential metamorphosis. Should the company succeed in diversifying its clientele and penetrating untapped markets, it may yet defy the cynicism of analysts and the fickleness of fate. But beware, dear investor, for such gambles require patience, faith, and perhaps a touch of madness. After all, is not every act of speculation a leap into the unknown, a cry against the void? 🌌

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-08-22 18:59