The year has unfolded with a certain…restraint, at least for the broader indices. The S&P 500 and Nasdaq Composite, while not exhibiting outright decline, have merely lingered at the threshold of progress. Yet, beneath this placid surface, the software sector stirs with a disquieting restlessness. The iShares Expanded Tech-Software ETF, a barometer of this particular realm, has yielded a decline of some twenty percent – a fall not easily dismissed, like a late autumn leaf severed from its branch.

One is compelled to inquire into the currents responsible for this downturn. Is this a moment for prudent acquisition, a chance to gather value from a temporary chill? Or does the artificial intelligence trade, so recently lauded, now reveal itself as a fragile bloom, susceptible to the first frost?

The Weight of Infrastructure

Over the past three years, the great cloud hyperscalers – Microsoft, Alphabet, and Amazon – have poured forth capital at a rate that would have astonished even the most lavish of Tsarist landowners. Billions have flowed into the construction of data centers, a modern equivalent of building grand estates, fueled by the insatiable demand for GPUs and networking equipment.

Wall Street, initially tolerant of this expenditure – viewing it as a necessary prelude to the monetization of AI-powered services – now appears to be reassessing the equation. The pace of investment continues to accelerate, with forecasts suggesting a cumulative spend exceeding half a trillion dollars in the coming year. One begins to wonder if this relentless expansion is sustainable, if the returns will truly justify the outlay. The landscape, so promising, feels burdened by its own ambitions.

The Illusion of Value

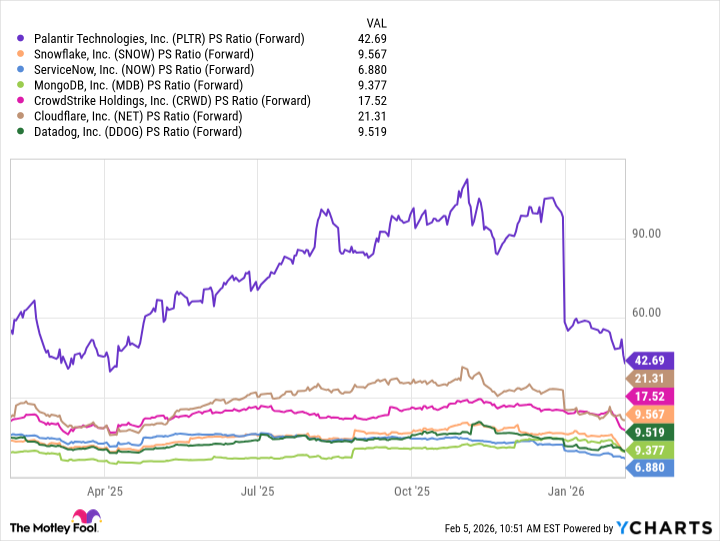

Software-as-a-service companies have long enjoyed elevated valuation multiples, a privilege earned through the recurring nature of their revenue and the substantial margins they command. Investors, eager to secure a share in future growth, have willingly paid a premium. But even within this realm, certain valuations strain credulity.

Palantir Technologies, a specialist in data mining, stands apart, a solitary figure in a crowded field. Even after the recent correction, its forward price-to-sales ratio remains roughly double that of its nearest competitor. This discrepancy places the company under immense pressure, demanding an almost impossible level of performance each quarter. It is a precarious position, akin to a tightrope walker above a chasm, with little margin for error.

One cannot help but observe a certain…vanity in these elevated expectations. The market demands perfection, forgetting that even the most promising ventures are subject to the vagaries of fortune.

The Shadow of Disruption

There is a growing apprehension that the traditional SaaS model may be threatened by the rise of large language models. These models, developed by Anthropic and OpenAI, possess the capacity to integrate with existing enterprise software platforms, augmenting their capabilities in unforeseen ways.

The potential benefit lies in the ability to connect these models to vast volumes of data, enabling them to analyze information and derive solutions with unprecedented efficiency. But this also raises the specter of disruption, a challenge to the established order. It is as if a new generation, armed with novel tools, is poised to inherit the landscape.

A Season for Prudence

In times of market correction, growth stocks are invariably the first to feel the chill. This is a natural consequence of risk aversion, a retreat to safer havens.

While concerns surrounding infrastructure budgets and valuations are not without merit, a discerning investor recognizes that many of these companies possess inherent resilience. They have built diversified ecosystems, capable of weathering difficult economic periods. Moreover, the best companies will adapt to the challenges posed by large language models, integrating them into their existing offerings rather than allowing them to cannibalize their businesses.

Thus, a measured approach to software stocks appears warranted. One should favor established leaders with proven track records, rather than speculative ventures with uncertain futures. The landscape may be turbulent, but the foundations of enduring value remain.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-11 21:02