For investors who prioritize dividends and aim to boost their portfolio’s earnings significantly, it’s worthwhile to thoroughly examine Universal Health Realty Income Trust (UHT). This investment boasts a substantial 7.4% dividend yield and an impressive history of consistent dividend growth. While this dividend stock might not suit every income-focused investor, it could be the most strategic dividend stock to purchase at present for a specific group of investors.

What makes a dividend stock attractive?

Among the initial aspects income-focused investors scrutinize is the dividend yield. Notably, Universal Health Realty Income Trust boasts an impressive 7.4% dividend yield. To provide some context for comparison:

1. The average dividend yield of S&P 500 companies is approximately 1.9%.

2. The average yield on a 10-year U.S. Treasury bond is around 3%.

So, when considering Universal Health Realty Income Trust’s high dividend yield, it’s essential to compare it with these benchmarks to better understand its potential value for income investors.

The S&P 500 (^GSPC) offers a small yield of approximately 1.3%. In comparison, the average healthcare stock yields around 1.8%, while the typical real estate investment trust (REIT) provides a yield of about 4.1%. Therefore, it’s quite evident that Universal Health Realty stands out in terms of its higher yield.

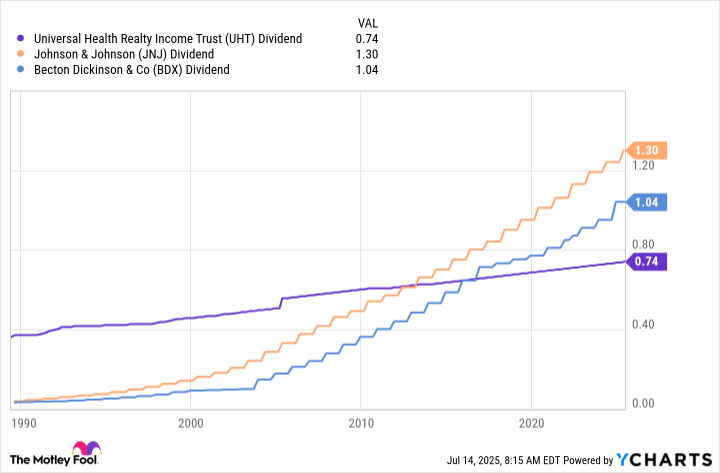

When evaluating both yield and reliability is important. For instance, two of the most dependable dividend-dispensing healthcare stocks are Johnson & Johnson (JNJ), boasting 63 years of uninterrupted annual dividend increases, followed by Becton, Dickinson (BDX) with 53 years. However, these companies, being Dividend Kings, have an elite status that Universal Health Realty does not possess. Despite this, Johnson & Johnson’s yield is 3.4%, while Becton, Dickinson’s yield is slightly lower at 2.4%.

For over four decades, Universal Health Realty has consistently increased its annual dividends. This is quite an impressive track record, though it hasn’t reached the status of a Dividend King yet, considering its high yield in the real estate investment trust sector. With a $1,000 investment, you would approximately receive 24 shares of this healthcare-oriented REIT.

Universal Health Realty Trust is for income right now

Observing from this vantage point, Universal Health Realty Trust appears quite alluring with its robust dividend history and impressive yield, reminiscent of items on a discount rack. However, it’s crucial to note that the appeal doesn’t stem from promising dividend growth – a factor that hasn’t traditionally been a major draw in this case.

The graph shows that Johnson & Johnson (JNJ) and Becton, Dickinson have experienced much faster dividend growth than Universal Health Realty Trust. However, instead of focusing on rapid dividend expansion, Universal Health Realty Trust aims for steady, reliable growth. It seems this company is more like a slow and consistent tortoise rather than a swift hare, and it’s likely to remain that way.

The second major point investors should be aware of involves Universal Health Realty Trust. This REIT is managed externally by Universal Health Services (UHS), its largest tenant, which raises questions about potential conflicts of interest. However, UHS’s 40-year history of gradual and consistent dividend growth hints at their strategies in this area.

This version maintains the original meaning but uses more natural, easy-to-read language to convey the information.

More attractive than it was, not for all, but smart for some

Before the coronavirus outbreak, Universal Health Realty’s dividend was quite low at around 2.1%. This indicated that investors may have had overly high expectations for the REIT due to its slow dividend growth. However, with the current yield standing at 7.4%, this healthcare stock now appears much more appealing.

Not every dividend investor might find it suitable due to the company’s management structure and slow dividend growth. Dividend growth investors would benefit more from companies like Johnson & Johnson or Becton, Dickinson. However, if your aim is to earn as much income as possible from your portfolio right away, and you’re seeking a healthcare investment, Universal Health Realty Trust could be an excellent fit for your portfolio, whether you have $1,000 or $10,000 to invest.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-20 11:36