Ah, the stock market! The place where fortunes are made, lost, and occasionally, forgotten about entirely. When we talk about making money in this strange, glittering universe of shares and stocks, everyone seems to focus on one thing: stock price appreciation. It’s straightforward, right? You buy a stock at a particular price, wait for it to go up, and then sell it to someone else at a higher price. Simple as making a cup of tea, provided you don’t overcomplicate it by questioning the price of tea leaves, the nature of your kettle, or why tea even exists in the first place.

However, there’s another, often overlooked way to make money from stocks. It’s almost as though someone decided that simply making your money grow faster wasn’t nearly enough and invented dividends. Yes, dividends, those delicious little morsels of guaranteed income that occasionally drop from the heavens of corporate profits. They arrive quarterly (or monthly, depending on the company’s inclination) and are a wonderful buffer, much like a second blanket when the stock market gets a bit too chilly. And, unlike stock price fluctuations, dividends are reliably dependable, like your grandmother’s knitting.

So, if you find yourself looking to add some high-quality dividend ETFs to your portfolio, consider the Schwab U.S. Dividend Equity ETF (SCHD). With just a modest $1,000 investment, you could set the stage for financial growth that’s as gradual as a sloth climbing a tree (but, you know, less sticky and far more rewarding over time).

SCHD’s Criteria: Where Quality Meets the Unlikely

Let’s pause for a moment and acknowledge something crucial here: not every dividend stock is as sweet as it seems. In fact, some stocks with sky-high dividend yields can be traps, leading you into the murky waters of “yield traps,” where the dividend is high only because the stock has plummeted faster than a stone dropped off a cliff (and probably for equally mysterious reasons). The key here is to invest in companies that actually have something going for them beyond a misleading dividend yield.

Enter SCHD. This ETF tracks the Dow Jones U.S. Dividend 100 Index, which means it’s somewhat picky about its members. You can’t just waltz in wearing a cheap suit and expecting to get invited to the party. To qualify for inclusion, companies must have:

- A balance sheet that doesn’t look like it was written on a napkin

- Consistent cash flow that would make even the most miserly accountant nod in approval

- At least 10 years of steady dividend payouts (a truly impressive feat in an age where most things are lucky to last 10 days)

- Strong profitability metrics-return on equity that makes you think, “Ah yes, these people know what they’re doing.”

This means you don’t have to spend endless nights poring over financial reports and wondering if you’ve missed something obvious (like a massive unpaid fine for space travel violations). You can rest assured that these companies have met a stringent set of criteria, and are likely doing better than your average office printer when it comes to efficiency.

Some of the dividend giants that make their home in SCHD include Coca-Cola, Altria, PepsiCo, Target, and Kimberly Clark. These are the titans of the business world, the dividend kings who’ve been increasing their payouts for decades. They’ve been doing this long enough to make the idea of investing in them feel more like joining a stable, well-run club, rather than gambling at an alien casino in the middle of a solar flare.

The Dazzling Power of a Sustainable Dividend Yield

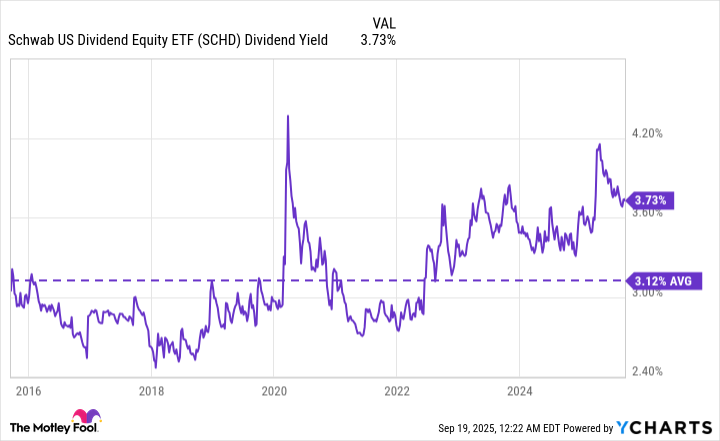

Now, let’s talk about dividends. More specifically, let’s talk about the yield, which is the percentage of your investment you get back in the form of income. The dividend yield is not static. It’s a bit like a garden; it changes with the seasons. But the good news here is that SCHD has a pretty solid yield, currently sitting at a very respectable 3.7%. This is above its 3.1% average over the past decade, and roughly three times the paltry offering from the S&P 500. It’s a bit like comparing a three-course meal to a sad little cracker.

If you were to invest $1,000 today, you’d get about $37 annually. Now, I know what you’re thinking: “That’s not exactly going to fund my yacht.” True, it’s not the stuff of early retirement dreams, but consider this: if you reinvest your dividends through a Dividend Reinvestment Plan (DRIP), you could soon find yourself in a position where that modest $37 begins to snowball. Your broker takes those dividends, buys more shares of SCHD for you, and the compounding effect starts to make its presence felt. It’s like planting a seed in your financial garden and watching it turn into a money tree (with the occasional visit from a squirrel, but we’ll gloss over that for now).

And, let’s not forget, SCHD has upped its payout by more than 160% in the last decade, which is a bit like someone giving you a raise every year, but with fewer awkward office meetings.

Explosive Stock Price Growth? Don’t Hold Your Breath

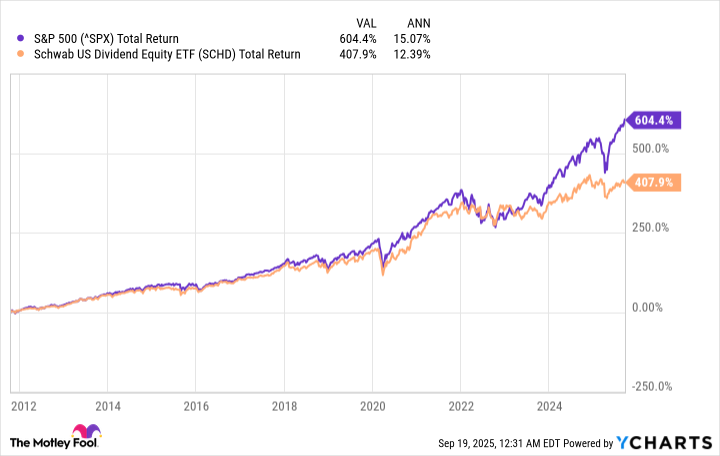

One thing to keep in mind: if you’re expecting your investment to explode in value faster than a firecracker on New Year’s Eve, you might be disappointed. Since its debut in October 2011, SCHD has underperformed the S&P 500, averaging annual total returns of 12.4% versus the S&P’s 15%. This, however, is not to be sniffed at. A 12% annual return is still pretty solid, especially when you’re not riding a rollercoaster of stock price gyrations.

If we were to assume that SCHD continues to deliver around 12% annually (which, by the way, is not guaranteed), your $1,000 investment today could grow to a rather splendid $9,600 over 20 years. And if you throw in an additional $100 each month, you’re looking at a neat $96,000. All with a ridiculously low 0.06% expense ratio-essentially the financial equivalent of having a quiet dinner in a restaurant where they don’t add an extra 15% charge for “service” when you’ve already done most of the work yourself.

So, there you have it: a modest, steady, and-dare I say-underrated way to grow your wealth in a way that doesn’t involve frantically checking stock prices every five minutes. Patience, dear investor, is a virtue, and in this case, it’s also highly profitable.

Now, if you’ll excuse me, I have a kettle to put on. 🍵

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-09-23 18:02