The land of the chip, like any good farm, knows its seasons. There are years of bounty, when the silicon grows tall and promises much. Then come the lean times, the droughts when even the hardiest sprouts wither. But a change is coming, a shift in the winds that whispers of a new harvest. Those who understand the land, who read the signs, believe the next few years will be good ones, especially for those tending the right fields.

We’ve been watching this sector, the semiconductor country, for some time now. And it seems the iShares Semiconductor ETF (SOXX +0.19%) is positioned to reap a good yield in 2026.

A Prediction: The Semiconductor Fields Will Outperform in 2026 as AI Demands Grow

For a while now, these tiny slivers of silicon have been the heart of something new, something that promises to reshape the world – this thing they call artificial intelligence. It’s a strange sort of alchemy, turning sand into thought, and it demands a lot of these chips.

The past couple of years have been about building the roads, the foundations for this new world. Building the infrastructure. In 2026, it feels like that story will broaden. It won’t just be about building more, but about the things that are built with it. Cloud systems that think for themselves, machines that drive without hands, and data centers that hold the weight of all our information. Those building these things will need these chips, and that demand will spread.

All this – the cloud, the machines, the data – it all runs on semiconductors. And the building won’t stop for years. Billions will flow into this space, and while some will surely prosper, it won’t be just the usual names. It’s a good sign when the wealth spreads beyond a few dominant fields.

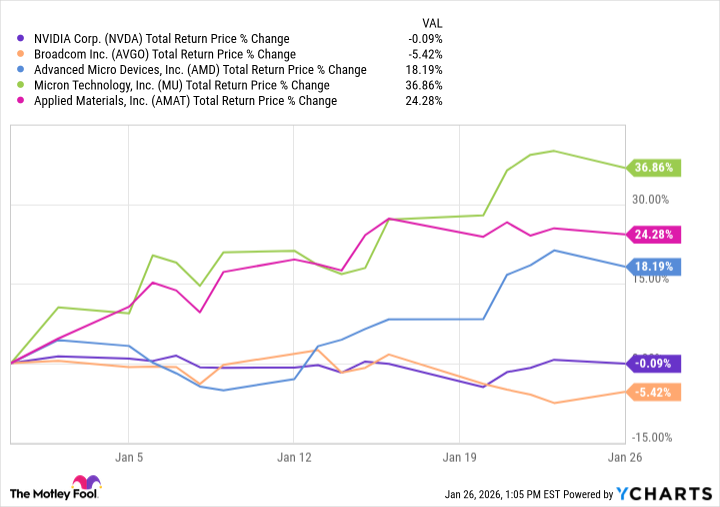

And so far, it has. Applied Materials (AMAT +1.36%), Micron Technology (MU +0.12%), and Advanced Micro Devices (AMD 0.22%) – all key holdings of the iShares Semiconductor ETF – have shown strength, gaining 18% or more this year (as of Jan. 26, 2026). It’s a hopeful sign, a broadening of the harvest.

That kind of spread, that breadth of growth, is what matters. It’s a sign that the land is healthy, that the harvest will be sustainable. And it suggests that the iShares Semiconductor ETF is well-positioned to deliver returns again in 2026. It’s not a promise, of course. The land is fickle, and the weather can change. But for those who understand the signs, the outlook is good.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-01-30 12:32