The year is 2026. Or, as some are beginning to whisper, the Year of the Algorithm. The great hyperscalers – those digital behemoths whose names we dare not speak lightly – are poised to spend a sum approaching seven hundred billion dollars. Not on philanthropy, mind you, but on the infrastructure of artificial intelligence. A paltry sum, perhaps, compared to the ambitions of these entities, but enough to make a provincial accountant weep with envy. Last year’s expenditure, a mere three hundred and ninety-four billion, now seems…quaint.

Naturally, investors, those restless spirits ever seeking a favorable wind, are circling like vultures. Two companies, Applied Materials and Applied Digital, appear to have caught the eye of the more discerning among them. Let us examine these contenders, though I confess, the very notion of “capitalizing” on such a monumental shift feels…unsettling. It smacks of attempting to sell indulgences in a digital cathedral.

Applied Materials: Polishing the Gears of Progress

Applied Materials, a manufacturer of semiconductor equipment, recently announced its first-quarter results. The stock, predictably, jumped – a modest eight percent. One might almost suspect a pre-ordained choreography. Revenue and earnings exceeded expectations, though one wonders what constitutes “expectation” in these days of manufactured optimism. The company’s CEO, Gary Dickerson, spoke of “unprecedented spending” on semiconductors. Unprecedented, of course, is a word much favored by those who wish to normalize the extraordinary.

The demand, it seems, is being driven by both foundries and memory manufacturers. Micron Technology and Taiwan Semiconductor Manufacturing, those titans of the microchip world, are expanding their capacity. One suspects they are not doing so out of altruism, but rather out of a primal fear of being left behind in this relentless race for computational dominance. Applied Materials, therefore, stands to benefit. A rather straightforward equation, really. The company anticipates an 18 percent earnings growth this year, escalating to 24 percent next year. A respectable trajectory, though one cannot help but wonder if such projections are based on solid ground or simply wishful thinking.

The hyperscalers’ seven hundred billion dollar expenditure suggests that Micron and TSMC may need to expand even further than anticipated. A rather predictable consequence, wouldn’t you say? This, in turn, should accelerate Applied Materials’ growth. One can almost see the gears turning, grinding out profits with ruthless efficiency. The stock has already gained 110 percent over the past year. A rather impressive feat, though one suspects the true price will be paid in some unforeseen currency.

Applied Digital: Building the Temples of the Algorithm

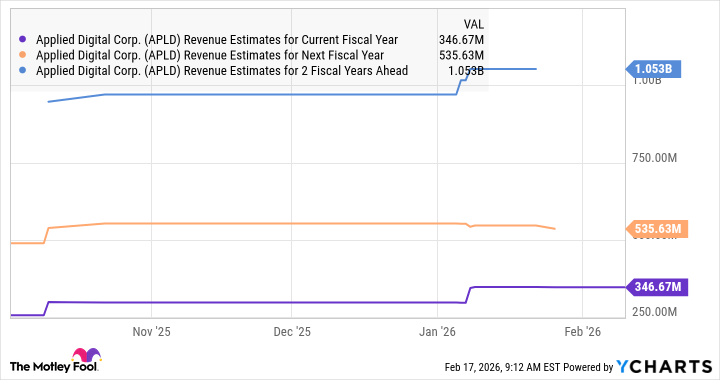

Applied Digital, a company dedicated to designing and operating AI data centers, is experiencing a veritable boom. The aggressive buildout of AI infrastructure is, unsurprisingly, fueling its growth. They construct data centers tailored to their clients’ needs, generating revenue from both the construction itself and the subsequent leasing of space. A rather simple business model, really. A digital landlord, if you will.

The company is currently building two data center campuses in North Dakota. A rather desolate location, one might think, but apparently ideal for housing the digital souls of the future. They have already secured potential lease revenue worth sixteen billion dollars over the next fifteen years. A considerable sum, though one wonders what guarantees are in place should the algorithms decide to relocate to a more hospitable climate. They are also in advanced discussions to build another three campuses, capable of generating nine hundred megawatts of power. A rather ambitious undertaking, requiring a level of energy consumption that would make a small nation blush.

According to CEO Wesley Cummins, inbound demand has increased meaningfully. Another hyperscaler is showing interest. The usual dance of capital, with promises whispered and contracts signed. One can almost smell the sulfur.

Having secured two hyperscale leases in the region, inbound demand has increased meaningfully. As a result, we are in advanced discussions with another investment-grade hyperscaler across multiple regions, including additional locations in the Dakotas and select Southern U.S. markets.

One should not be surprised to see Applied Digital break ground on even more campuses this year. The hyperscalers’ spending spree is, after all, a rather potent catalyst. The new campuses should bring in more fit-out revenue and improve the company’s revenue pipeline. A rather predictable outcome, really.

Investors will have to pay almost thirty-three times sales to buy Applied Digital stock. A rather steep price, one might think, but justified by the company’s stunning growth rate, robust lease pipeline, and potential to add more data center sites. A rather circular argument, really. But in these days of algorithmic madness, logic often takes a backseat to momentum.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-20 14:42