![]()

For three years past, the markets have known a feverish bloom, a prosperity not seen in a decade, fueled by this… artificial intelligence. It is a curious thing, this ambition to create a mind from metal and sand, and even more curious how readily men abandon prudence in its pursuit. The indices have risen, yes, but one wonders if they climb towards genuine progress, or merely towards a reckoning. The technology and infrastructure sectors, naturally, have been the most favored, gorging themselves on the spoils of this new age. And at the heart of it all, unseen by many, lies a quiet power, a foundry where the dreams of Silicon Valley are forged.

One speaks, of course, of the semiconductor. These minuscule wafers, these slices of purified earth, are the very foundation upon which these digital minds are built. Without them, the algorithms remain but phantom thoughts, incapable of manifesting in the world. And those who control the flow of these essential components hold a sway that rivals kings of old. Investors, with a restlessness peculiar to their kind, flock to the familiar names – Nvidia, Advanced Micro Devices, Broadcom – each a glittering beacon promising untold riches. But true discernment, it seems, lies in recognizing the less obvious forces at play.

It is the seller of pick and shovel, as the Americans say, who often prospers most in a gold rush. While others chase the glittering promise of the next breakthrough GPU, one must consider the company that makes the GPUs, the one that truly holds the keys to this burgeoning realm. Taiwan Semiconductor Manufacturing, or TSMC as it is known, is not merely a manufacturer; it is the silent architect of the AI revolution. Let us examine, then, the reasons why a careful investor might find more enduring value in this unassuming giant than in the more celebrated names.

Is This Euphoria Sustainable? The Lessons of History

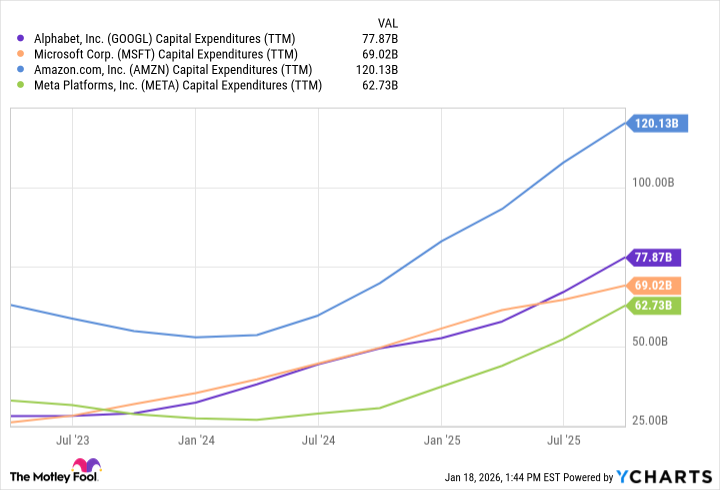

There are those among us, the ever-present chorus of pessimists, who see in this relentless ascent the echoes of past manias. They speak of the late 1990s, of the dot-com bubble, and warn of a similar fate for artificial intelligence. They point to the accelerating investments by the hyperscalers – the vast data centers, the insatiable demand for chips – as evidence of a speculative frenzy. And there is a certain logic to their concerns. The human heart, alas, is easily seduced by novelty, and prone to overestimation. But to judge the health of this new technology solely by the pronouncements of Nvidia, a company that naturally benefits from its success, is to view the landscape through a distorted lens.

If one truly wishes to understand whether this is a genuine revolution or merely a fleeting bubble, one must look beyond the surface and examine the foundations upon which it is built. And it is in the earnings reports of TSMC that one finds a more honest and nuanced assessment. For it is TSMC that bears the weight of this ambition, that feels the true pressure of demand, and that ultimately determines whether these digital dreams can be realized.

The Silent Engine of Progress: Why Taiwan Semi May Dominate the Decade

TSMC is, quite simply, the largest chip manufacturer in the world. Its foundries, sprawling complexes of precision and innovation, are the crucible in which the most advanced semiconductors are forged. It manufactures the GPUs for Nvidia, the accelerators for AMD, the custom chips for Broadcom, and the high-bandwidth memory for Micron. Consider this: the very companies driving the AI revolution – Microsoft, Alphabet, Amazon, Meta, Oracle – all rely on TSMC to produce the chips that power their ambitions. It is TSMC, therefore, that sits at the heart of this virtuous cycle, the silent engine driving the semiconductor supercycle. A humbling position for a company so little known to the general public.

The recent earnings report for the fourth quarter was, to put it mildly, remarkable. A revenue increase of 25% year over year, a gross margin of 62% – figures that speak volumes about the company’s strength and efficiency. These are not merely numbers on a page; they are indicators of a fundamental shift in the landscape, a testament to the enduring demand for advanced semiconductors. The hyperscalers are investing heavily, yes, but they are doing so because they believe in the long-term potential of AI. And TSMC, with its ability to deliver both quality and quantity, is uniquely positioned to benefit from this trend. The CEO, C.C. Wei, speaks of further expansion, of new facilities contributing to growth in the coming years. A measured ambition, befitting a man who understands the weight of responsibility.

It is this dynamic that sets the stage for long-term growth, a catalyst that will propel TSMC forward for years to come. The secular tailwinds are strong, the infrastructure era is upon us, and TSMC is poised to ride the wave. One cannot help but wonder, however, whether this relentless pursuit of technological advancement is truly in the best interests of humanity. But such philosophical musings are best left for another time.

The Chorus of Approval: Wall Street’s Bullish Outlook

Of the eighteen analysts who cover Taiwan Semi, seventeen rate the stock a buy or its equivalent. A remarkable consensus, one rarely seen in the volatile world of finance. The average price target is $408, implying a 19% upside from the recent closing price. Simon Coles of Barclays has even raised his target to $450, following the impressive earnings report. But to focus solely on short-term gains is to miss the larger picture. The true value of TSMC lies not in its immediate prospects, but in its long-term potential. It is a company poised for explosive growth, a silent giant that will shape the future of technology for decades to come. A compelling investment, indeed, for those with the patience and foresight to recognize its true worth.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 04:32